Home > Wednesday Wisdoms: Newsletter > Start September Strong

Jump to Section:

Start September Strong: 4 Actionable Tasks + BONUS

These 4 actionable tasks to start September strong!

Bonus Section: Forming A* Habits

Wilko administration explained - store closures, job losses and closing down sales

Summary:

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

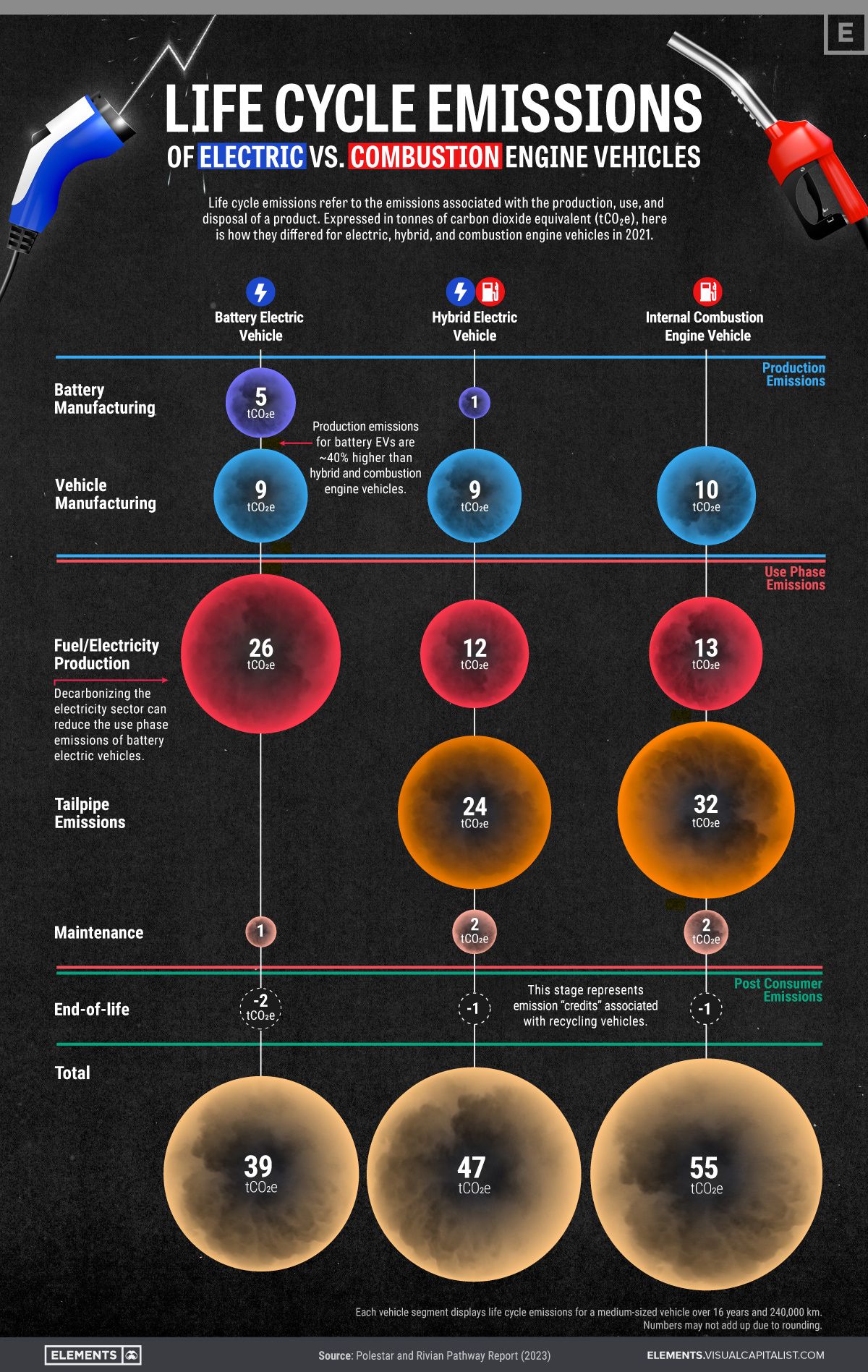

Life cycle emissions of Electric vs. Combustion Engine Vehicles

The transportation sector, heavily dependent on fossil fuels, was responsible for 37% of 2021's CO2 emissions. A study using Polestar and Rivian’s Pathway Report compared the life cycle emissions of battery electric vehicles (BEVs), hybrids, and internal combustion engine (ICE) vehicles, revealing that BEVs have the lowest total emissions at 39 tCO2e, compared to hybrids' 47 tCO2e and ICE vehicles' 55 tCO2e over a 16-year use phase. However, BEVs have higher production emissions due to battery manufacturing, with electricity production being their most emission-intensive phase. Decarbonizing electricity and recycling vehicle components can further reduce emissions, emphasizing BEVs' potential in a carbon-neutral future, provided battery production becomes more sustainable and cleaner energy sources are embraced.

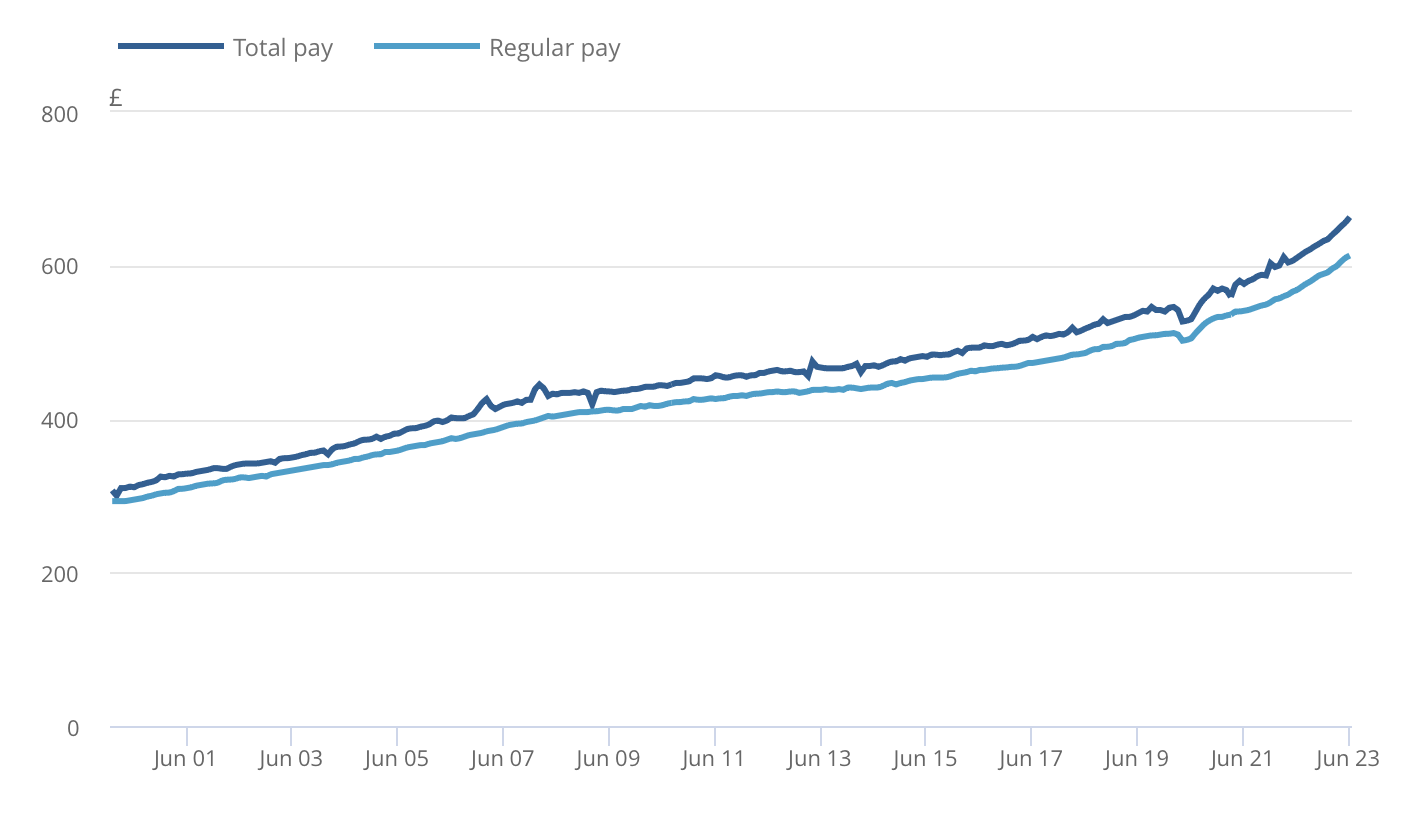

Chart of the Week

This week's chart of the week dives into the intricate dynamics of wage growth, capturing the pulse of the UK's economic health. Between April and June 2023, we witnessed the highest annual growth rate for regular pay since 2001. This period also saw a significant surge in total pay growth, influenced by one-off NHS bonus payments. Adjustments for inflation provide further depth to these figures, revealing the true purchasing power of workers. Join us as we unpack the nuances of these crucial economic indicators.

Between April and June 2023, regular pay saw an annual growth of 7.8%, marking the highest rate since records began in 2001. Including bonuses, total pay growth was 8.2% – the largest increase outside the coronavirus pandemic period, although this was influenced by a one-time NHS bonus payment in June 2023. When adjusted for inflation using the CPIH, total pay increased by 0.5% annually, and regular pay grew by 0.1%. AWE data for the latest month is provisional, with May 2023 experiencing significant revisions due to updated or late data, a trend expected to continue for June 2023, especially in light of the NHS pay deals and the annual seasonal adjustment review.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie