Home > Wednesday Wisdoms: Newsletter > The Second Year of A-Level Economics: Preparing for the Challenge

Jump to Section:

The Second Year of A-Level Economics: Preparing for the Challenge

1) Grab Your Support Mechanism

2) Review, Review, Review

3) Keep Up with the Real World

4) Practice Exam Questions

5) Consistency is Key

UK economy 'close to stalling' in July as high interest rates hit firms

Summary:

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Write your awesome label here.

A report from Goldman Sachs predicts a significant shift in the global economic landscape over the next few decades. By 2050, China is projected to be the largest economy, followed by the U.S., India, and Indonesia, with Asia commanding a larger share of the global GDP. Remarkably, Indonesia is expected to become the fourth biggest economy, surpassing Brazil and Russia as the largest emerging market.

By 2075, the economic landscape will further evolve, with Nigeria, Pakistan, and Egypt breaking into the top 10 due to their rapid population growth. Meanwhile, European economies are expected to decline in their rankings. Lastly, China, India, and the U.S. are anticipated to have similar GDPs, suggesting a new balance of global economic power.

By 2075, the economic landscape will further evolve, with Nigeria, Pakistan, and Egypt breaking into the top 10 due to their rapid population growth. Meanwhile, European economies are expected to decline in their rankings. Lastly, China, India, and the U.S. are anticipated to have similar GDPs, suggesting a new balance of global economic power.

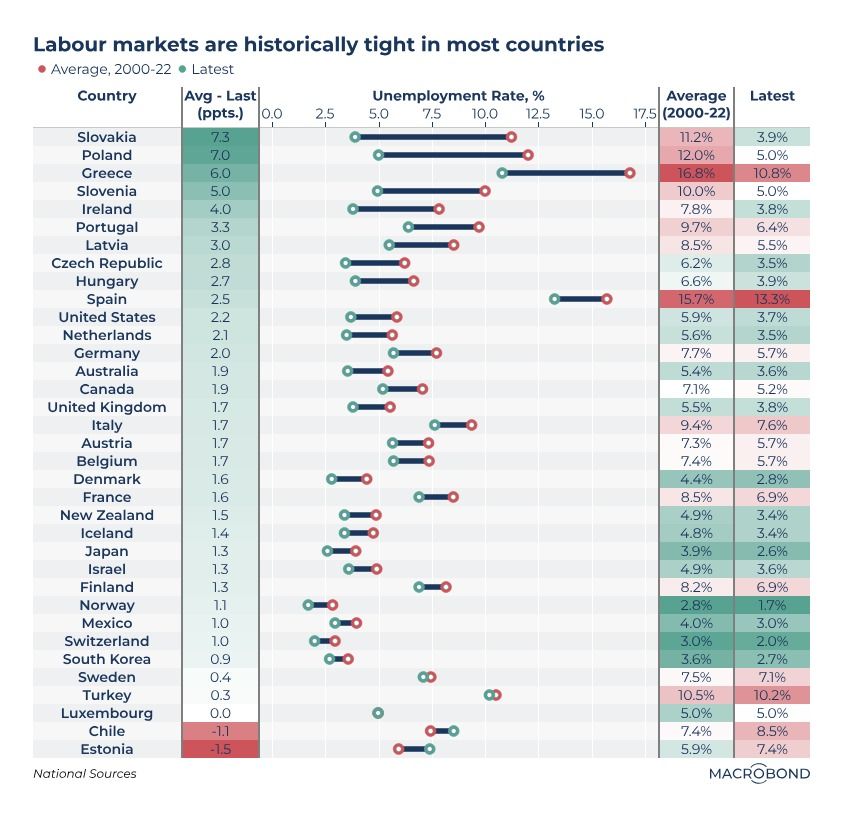

Chart of the Week

This week's chart of the week highlights the tighter labour markets in southern and eastern Europe, leading the OECD countries, with Slovakia showing a remarkable 7.3 percentage point reduction in unemployment. Inflation-wise, Switzerland has become the first country to return to old-normal inflation targets of around 2%.

The US industrial policy is triggering a construction boom, compensating for a downturn in homebuilding. Meanwhile, the gold price is evaluated against historic norms, and economic theories suggesting an overreaction to the recent yuan weakness in China are explored. Finally, the analysis tracks the performance of the S&P 500 after previous Fed tightening cycles ended, with the dotcom bust being the only time stocks fell.

The US industrial policy is triggering a construction boom, compensating for a downturn in homebuilding. Meanwhile, the gold price is evaluated against historic norms, and economic theories suggesting an overreaction to the recent yuan weakness in China are explored. Finally, the analysis tracks the performance of the S&P 500 after previous Fed tightening cycles ended, with the dotcom bust being the only time stocks fell.

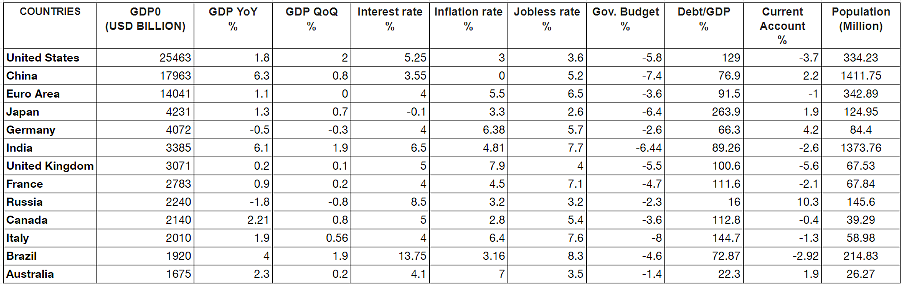

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie