Home > Wednesday Wisdoms: Newsletter > Ace Your A-Level Economics: The Power of Prioritising Points

Jump to Section:

Ace Your A-Level Economics: The Power of Prioritising Points

Is the economy facing another energy price shock?

Summary

Possible A Level Economics 25 Marker Question

Infographic of the Week

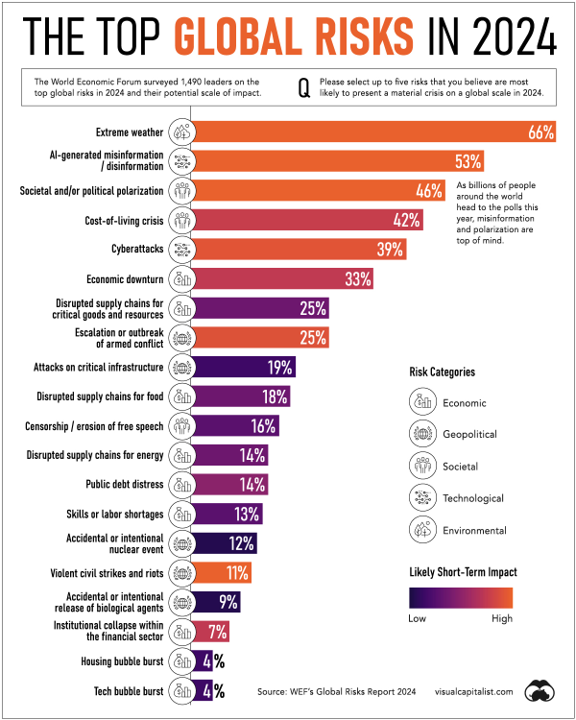

Navigating 2024's Perilous Global Risk Landscape

As we approach 2024, the world faces a diverse array of significant risks. According to the World Economic Forum's survey of global leaders, extreme weather, driven by record global temperatures, tops the list of threats, potentially causing irreversible environmental damage by the 2030s. Misinformation and disinformation emerge as the second most significant risk, with the potential to exacerbate societal polarization and undermine trust in global elections across major countries like the U.S., Russia, and India. This threat is compounded by technological advancements in AI-generated content. Economic challenges, including a cost-of-living crisis, and geopolitical tensions in the Middle East, which might escalate into broader regional conflicts, add to the complexity of these risks. Looking further into 2034, environmental concerns are predicted to dominate, while technological risks like AI's destabilizing potential and cyber insecurity will continue to be significant concerns, highlighting the need for global preparedness and resilience against these multifaceted challenges.

Chart of the Week

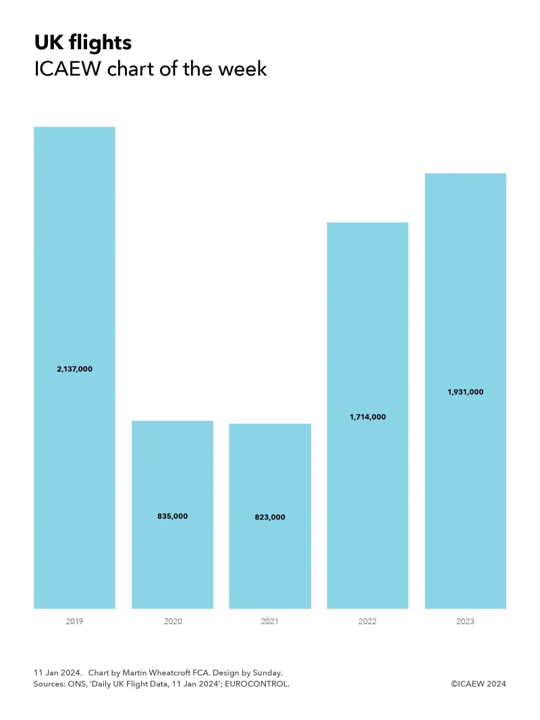

UK Air Travel: A Slow Ascent from Pandemic Turbulence

The UK's aviation sector has experienced notable fluctuations over the past five years, as reflected in the number of flights departing and arriving from its airports. Data from the Office for National Statistics shows a steep decline from 2,137,000 flights in 2019 to 835,000 in 2020, gradually recovering to 1,931,000 in 2023, which is still only 90% of pre-pandemic levels. This shortfall is attributed to changes in business travel patterns, with increased reliance on video conferencing, corporate carbon reduction efforts, and cost-saving measures reducing the need for business trips. Consequently, airlines have been adapting by focusing on higher seat utilisation, targeting leisure travelers with premium offerings, and shifting towards budget carrier models. With a 9% increase in flights in the latter half of 2023 compared to 2022, the industry remains hopeful for continued recovery and growth into 2024.

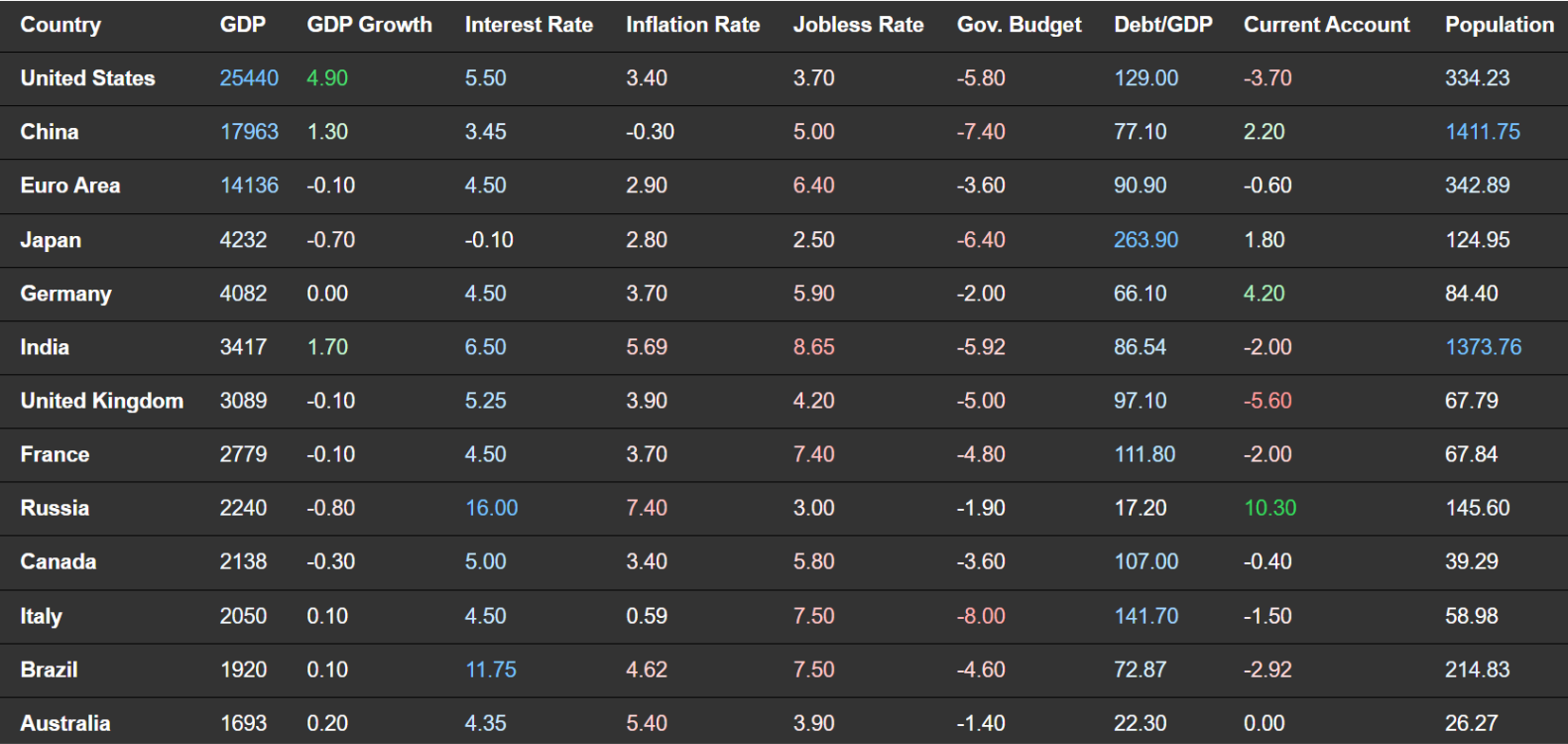

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie