Home > Edgenie Sunday Schroll: Newsletter > 📉 Are We Heading for a Stock Market Crash? 🧐

Jump to Section:

📉 Are We Heading for a Stock Market Crash? 🧐

Bank of England lowers rates to 5% in first cut since 2020

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Top 10 Emerging Technologies of 2024

Emerging technologies in 2024 have the potential to reshape industries, enhance economic efficiency, and address global challenges. According to the World Economic Forum, the top technologies include AI for scientific discovery, privacy-enhancing technologies, and reconfigurable intelligent surfaces. These innovations promise advancements in healthcare, secure data use, and next-generation wireless communication. Sustainable solutions like carbon-capturing microbes and elastocalorics address environmental concerns by reducing CO₂ and improving energy efficiency. Technologies such as high altitude platform stations and integrated sensing systems are set to revolutionise connectivity and monitoring. Collectively, these technologies highlight the significant impact of AI and sustainability-driven innovations on society's future.

Chart of the Week

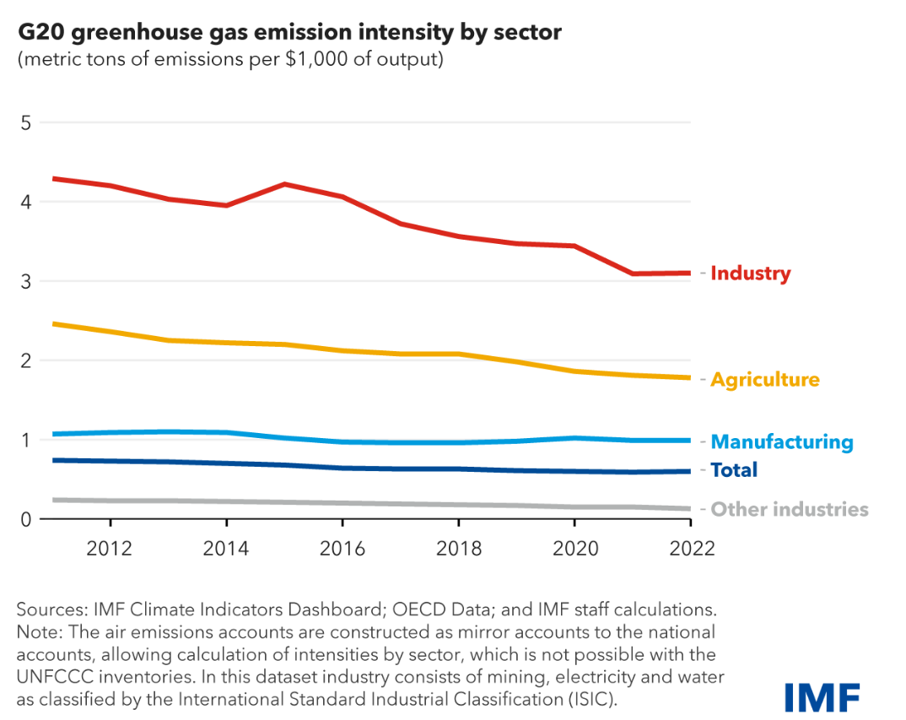

Trends in Emission Reductions and Data Gaps in the G20

Recent data show promising reductions in emission intensities within the agricultural and industrial sectors, which account for over 75 percent of all G20 emissions. This suggests that cleaner technologies and energy efficiency improvements are effective. However, despite these declines, the pace of emission reduction is insufficient to decouple economic growth from emissions to meet climate goals. The 2023 IPCC report indicates a need for a 43 percent reduction in global greenhouse gas emissions by 2030 to limit global warming to 1.5 degrees Celsius. Significant data gaps persist, impeding effective management and decision-making, highlighting the necessity for more granular data. The G20 Data Gaps Initiative aims to provide comprehensive emissions data, including emissions transferred outside the G20, to better align economic policies with sustainability goals.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie