Home > Wednesday Wisdoms: Newsletter > Are You Predicted an A or A* in A-Level Economics?

Jump to Section:

Are You Predicted an A or A* in A-Level Economics?

'Vote of confidence': UK hails $37 billion of foreign investment

Summary

Possible A Level Economics 25 Marker Question

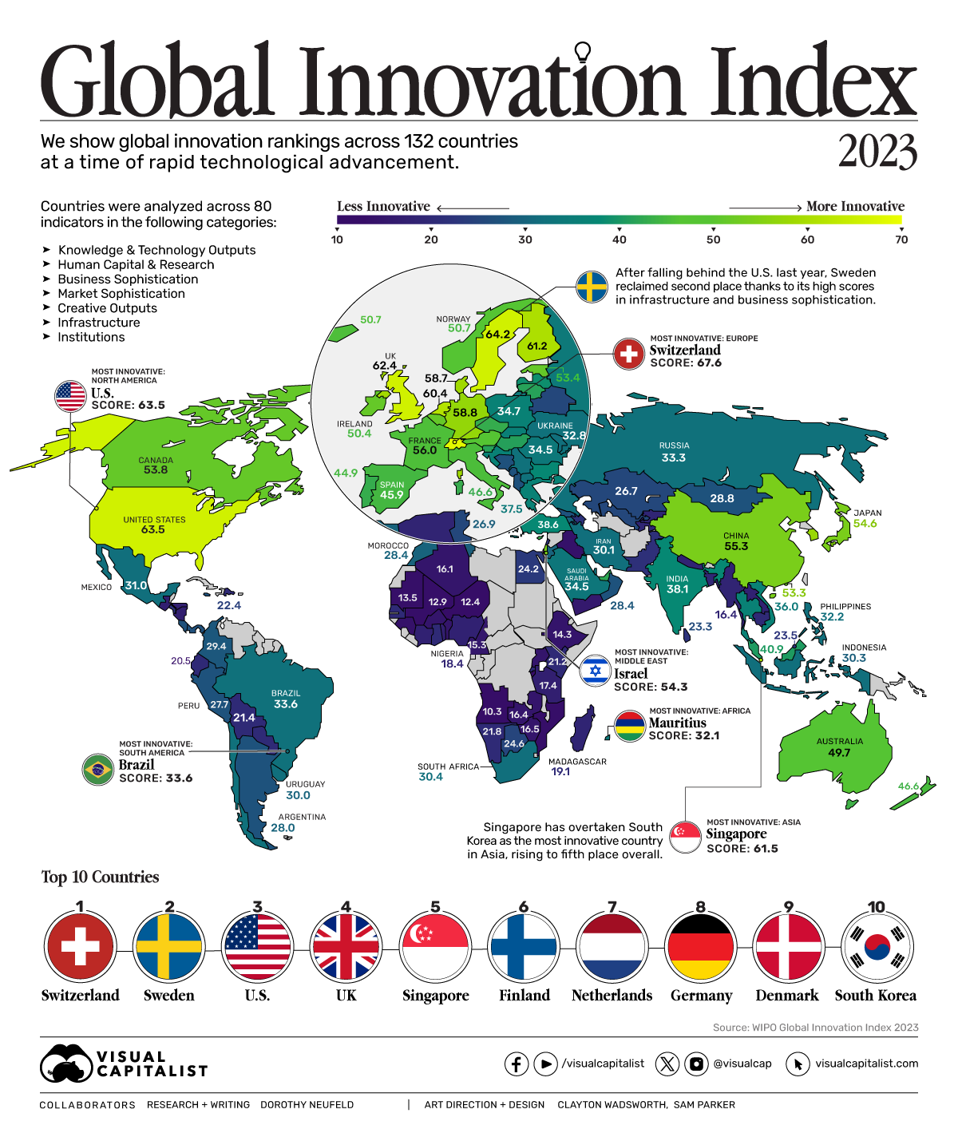

Infographic of the Week

Global Innovation Leaders in 2023: Spotlight on Countries and Tech Clusters

In 2023, Switzerland leads as the world’s most innovative country for the 13th year, according to the Global Innovation Index (GII) by the World Intellectual Property Organization, with a score of 67.6. Sweden (64.2) surpasses the U.S. (63.5) for second place, excelling in business sophistication and research talent. The UK (62.4) and Singapore (61.5), ranking fourth and fifth, stand out for their research institutions and government effectiveness in innovation. The GII measures innovation using seven pillars and 80 indicators, like patent applications, venture capital, and knowledge-intensive employment. Notable tech clusters such as Cambridge in the UK and San Jose-San Francisco in the U.S. significantly contribute to innovation, with companies like ARM and Google leading in patents and research. Brazil and Mauritius top their respective regions, while Cambridge’s high article output and partnerships between companies like LG Chem and global automakers exemplify the impact of these clusters on technological advancement and the broader economy.

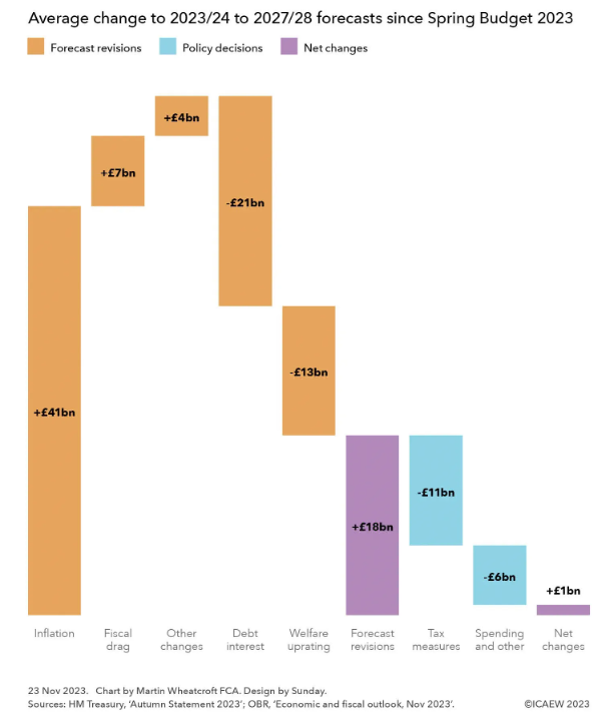

Chart of the Week

Autumn Statement 2023: Balancing Tax Cuts and Fiscal Deficit Reduction

The Autumn Statement 2023 announced significant financial decisions, including a tax cut to national insurance and making full expensing of business capital expenditure permanent. The deficit forecasts over the next five years show an average annual improvement of £18bn, benefitting from £41bn in higher inflation receipts, £7bn from additional fiscal drag, and £4bn in other revisions. However, these are offset by £21bn in higher debt interest and £13bn due to inflation-driven uprating of state pensions and welfare benefits. The Chancellor's decision to reduce public spending and focus on tax measures and business growth initiatives results in an average net change of just £1bn a year over five years. Key tax changes include reducing national insurance for employees and the self-employed, costing an average of £9bn over five years, and making full expensing permanent, averaging just over £4bn. Despite these measures, the Office for Budget Responsibility (OBR) revised the forecast for public sector net debt as of 31 March 2028 up by £94bn to £3,004bn, raising concerns about the sustainability of public service quality without additional investment in technology and efficiencies.

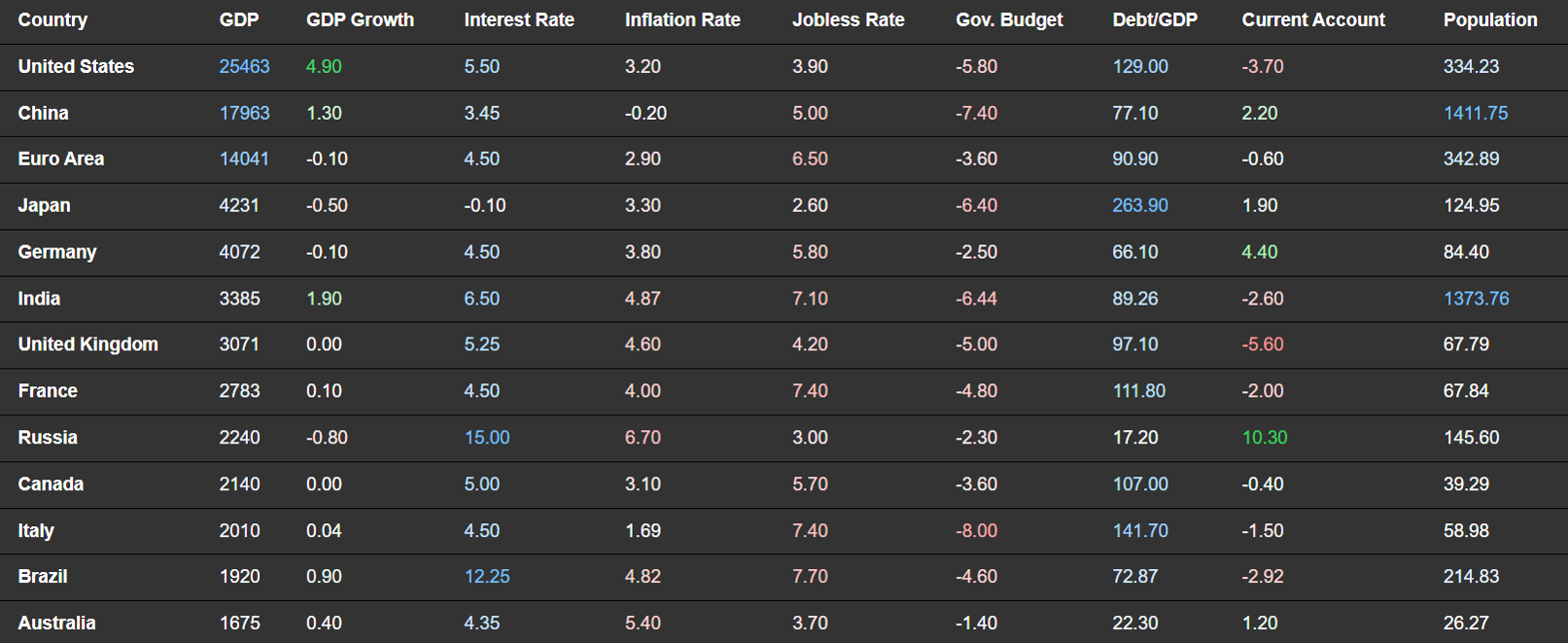

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie