Home > Wednesday Wisdoms: Newsletter > Blueprint to your success in A-Level Economics

Jump to Section:

Blueprint to your success in A-Level Economics

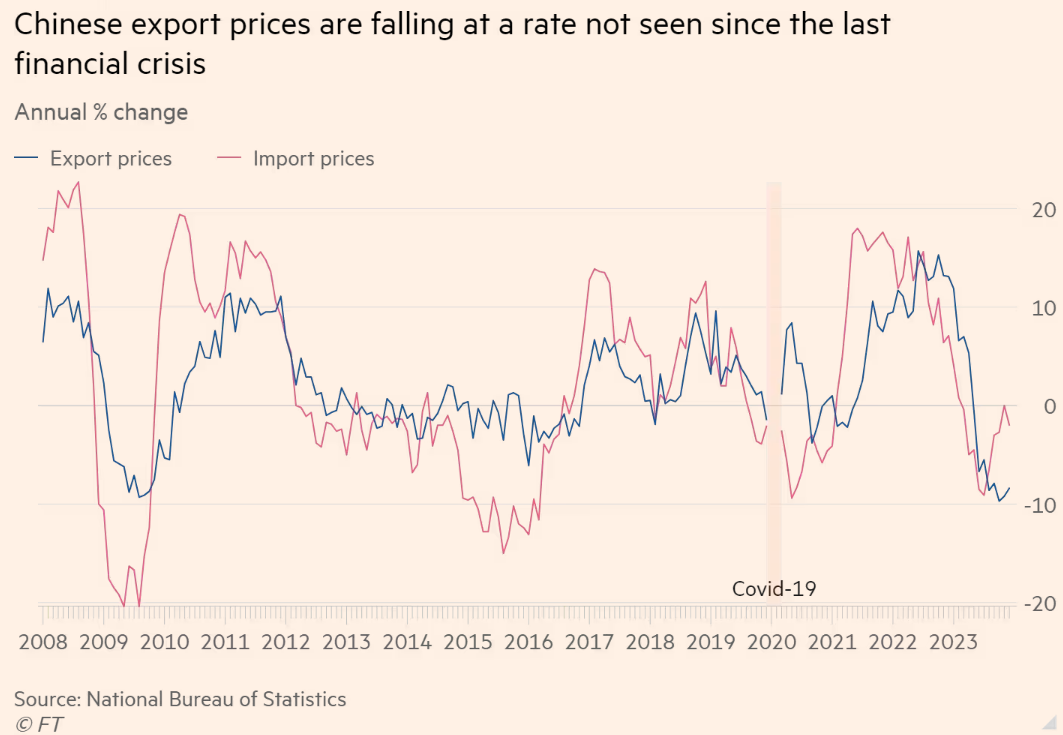

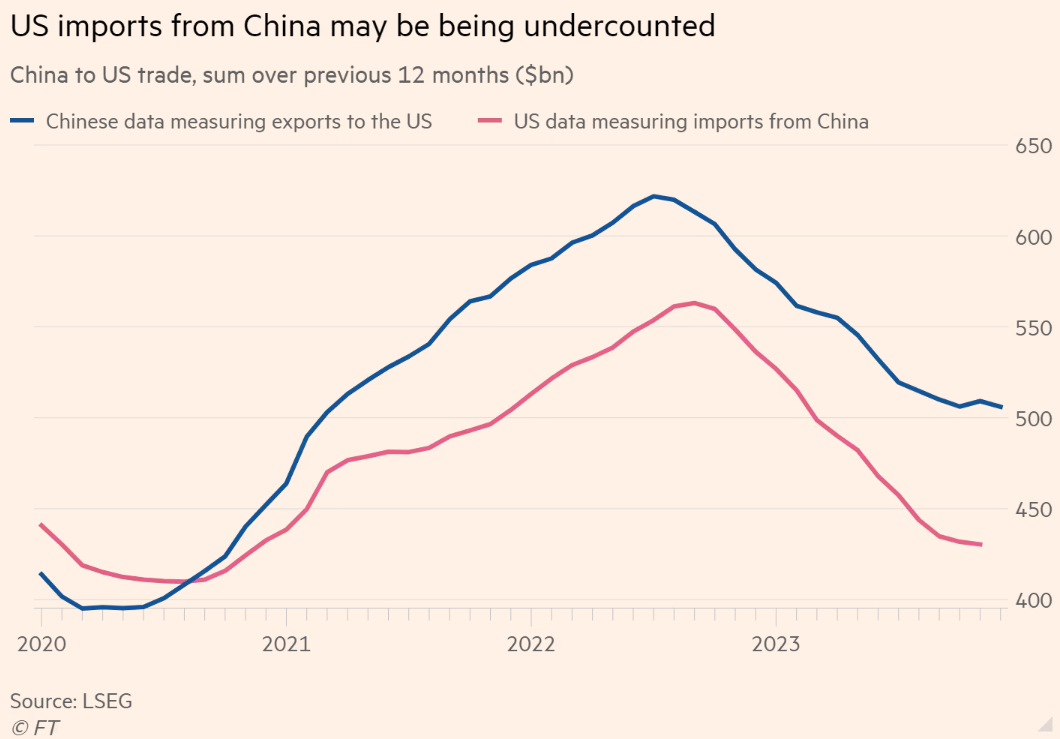

China to export deflation to the world as economy stumbles

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

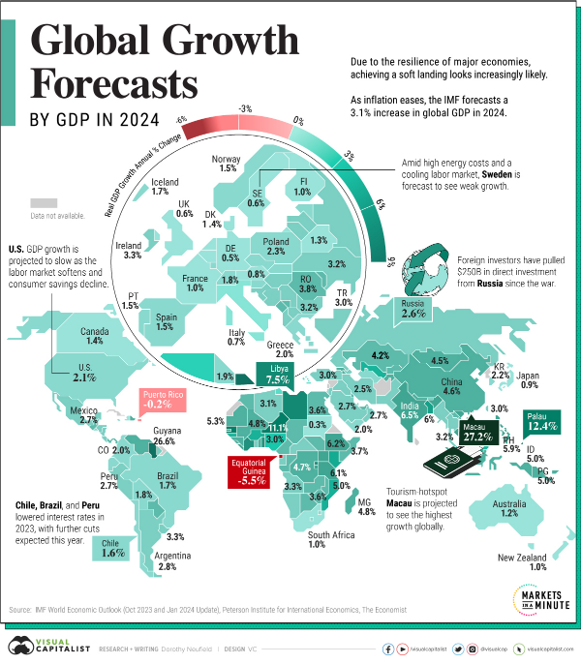

Navigating Economic Currents: Global GDP Growth Projections for 2024

The global economic forecast for 2024 paints a picture of cautious optimism, with the IMF projecting a modest 3.1% rise in real GDP growth, signaling resilience amidst a landscape peppered with financial uncertainties. As countries grapple with varied challenges like potential inflationary rebounds, increasing debt burdens, and diminishing consumer savings, the U.S. stands on the brink of potential rate cuts, though the Federal Reserve maintains a vigilant stance against premature easing. This global outlook underscores a tapestry of regional narratives, where economic prospects diverge, reflecting the unique interplay of domestic and international factors influencing each nation's growth trajectory in a year that hints at recovery but demands strategic navigation.

Chart of the Week

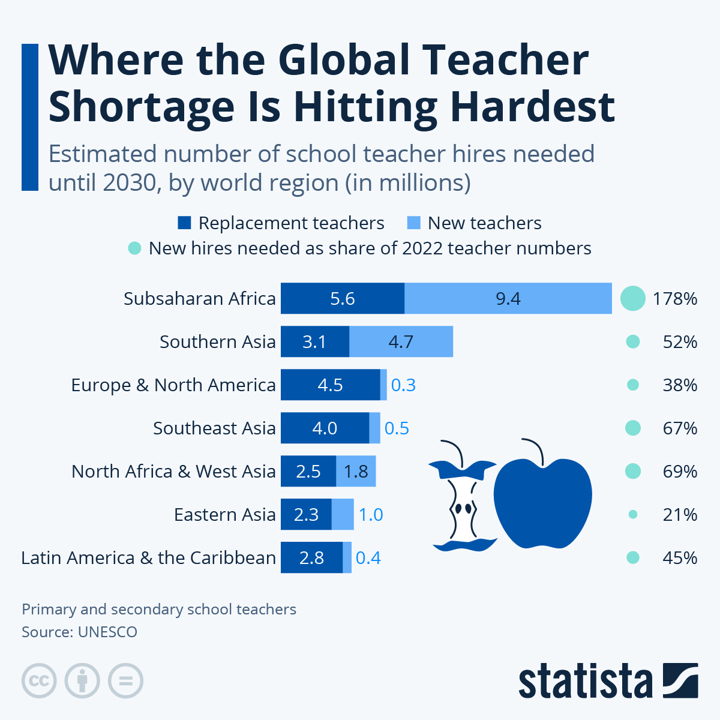

The Looming Educational Crisis: A Snapshot of Global Teacher Shortages

By 2030, an educational crisis looms as UNESCO reports a stark global teacher shortage, with Subsaharan Africa at the forefront, requiring hires equivalent to 178% of its current teacher stock. This region, alongside Southern Asia, faces a unique challenge due to their population growth, demanding an unprecedented number of new teaching roles that outstrip existing numbers. Contrastingly, Europe, North America, and Southeast Asia grapple primarily with replacing retirees, accounting for 38% of their existing workforce. Eastern Asia appears least affected, anticipating new hires at just 21% of current figures. To meet these urgent needs, particularly in the developing world, enhancements in the teaching profession's appeal are crucial, although Subsaharan Africa may still fall short of its 2030 targets, underscoring the need for immediate and innovative educational strategies.

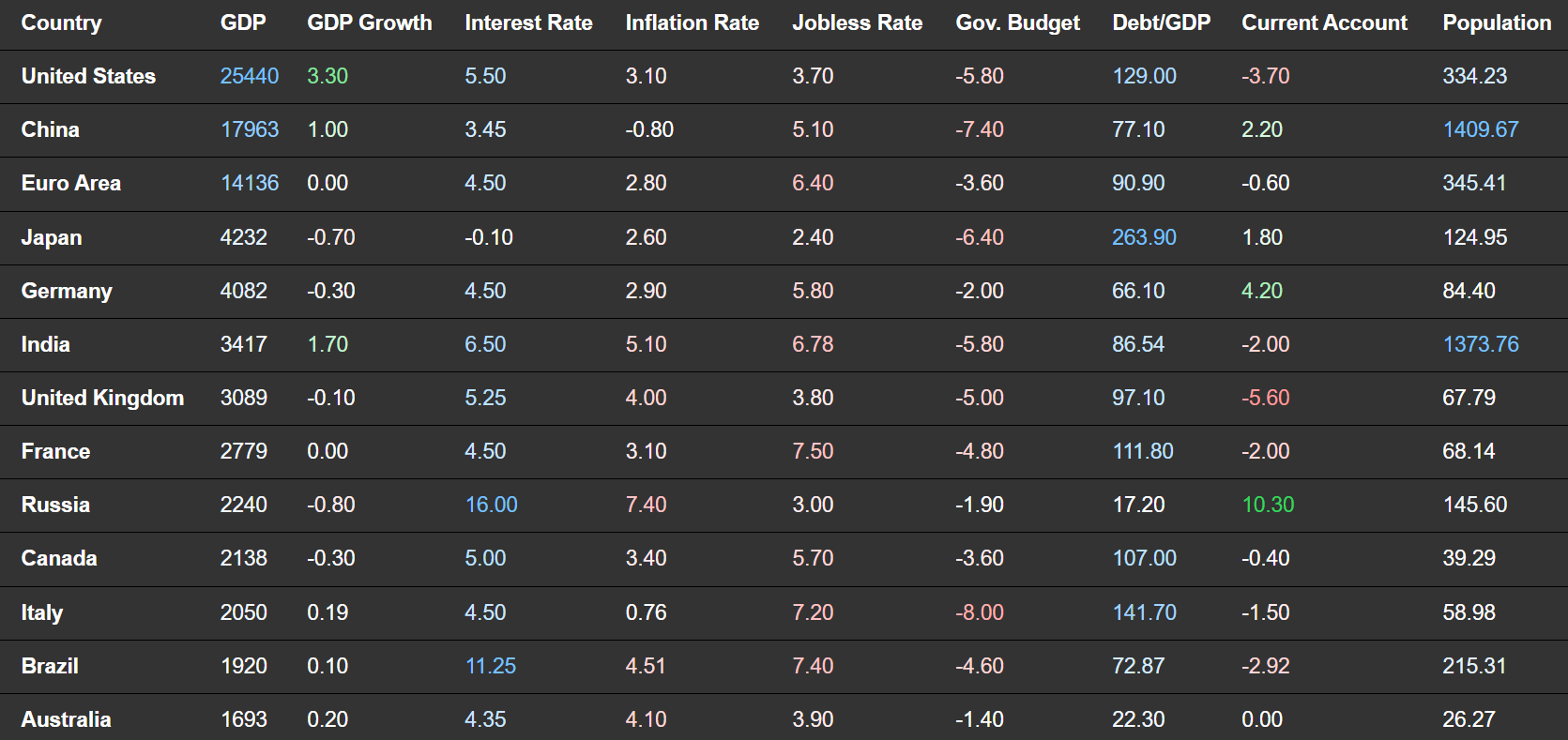

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie