Home > Wednesday Wisdoms: Newsletter >Breaking Boundaries: Your Journey from Comfort to Growth in A-Level Economics

Jump to Section:

Breaking Boundaries: Your Journey from Comfort to Growth in A-Level Economics

Will the ‘sick man of Europe’ label stick to Germany this time around?

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

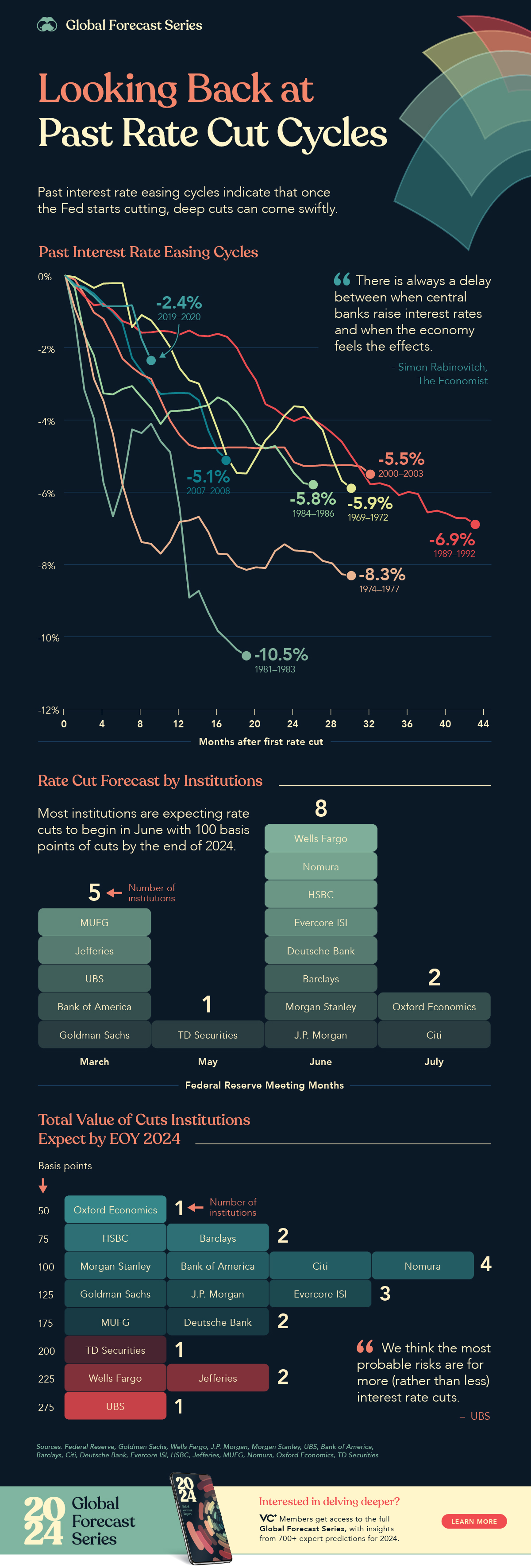

Navigating the Monetary Tightrope: The Fed's 2024 Rate Cut Dilemma

As the U.S. economy teeters on the brink of a potential soft landing or recession following aggressive rate hikes in 2022, all eyes are on the Federal Reserve's next move in the 2024 interest rate cycle. Historical data reveals that past rate cut cycles have often been a precursor to recessions, initiating only after clear signs of an economic slowdown and easing inflationary pressures, with cuts ranging from 2.35% to 10.53% over periods as brief as 10 months to as long as 44 months. In 2024, top financial institutions like J.P. Morgan, Deutsche Bank, and Morgan Stanley converge on a mid-year forecast for the initial rate cut, while others like UBS and Goldman Sachs predict an earlier start in March, expecting total cuts to tally between 100 to 125 basis points. Despite the historic trend linking rate cuts to recessions, Federal Reserve Chair Jerome Powell remains cautiously optimistic, hoping for a unique outcome where inflation cools without significant job losses, an economic tightrope walk against the backdrop of one of the most rapid rate hike environments in history.

Chart of the Week

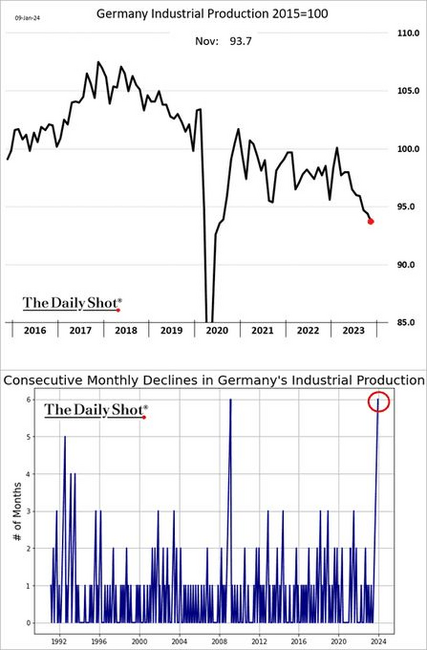

Germany's Industrial Output Dips: A Trend or a Warning Sign?

The graphics depict a worrying decline in Germany's industrial production, with the index plummeting from a baseline of 100 in 2015 to 93.7 in November. The downturn isn't a sudden jolt but part of a consistent slide over recent years, accentuated by a stark plunge post-2020, likely due to pandemic-related disruptions. Moreover, the lower chart illuminates an alarming pattern of consecutive monthly drops in industrial output, a scenario not frequently seen since the 1990s. The circled section in 2024 highlights a recent stretch of declines, signaling potential systemic challenges within Germany's industrial sectors that could have far-reaching implications for its economy.

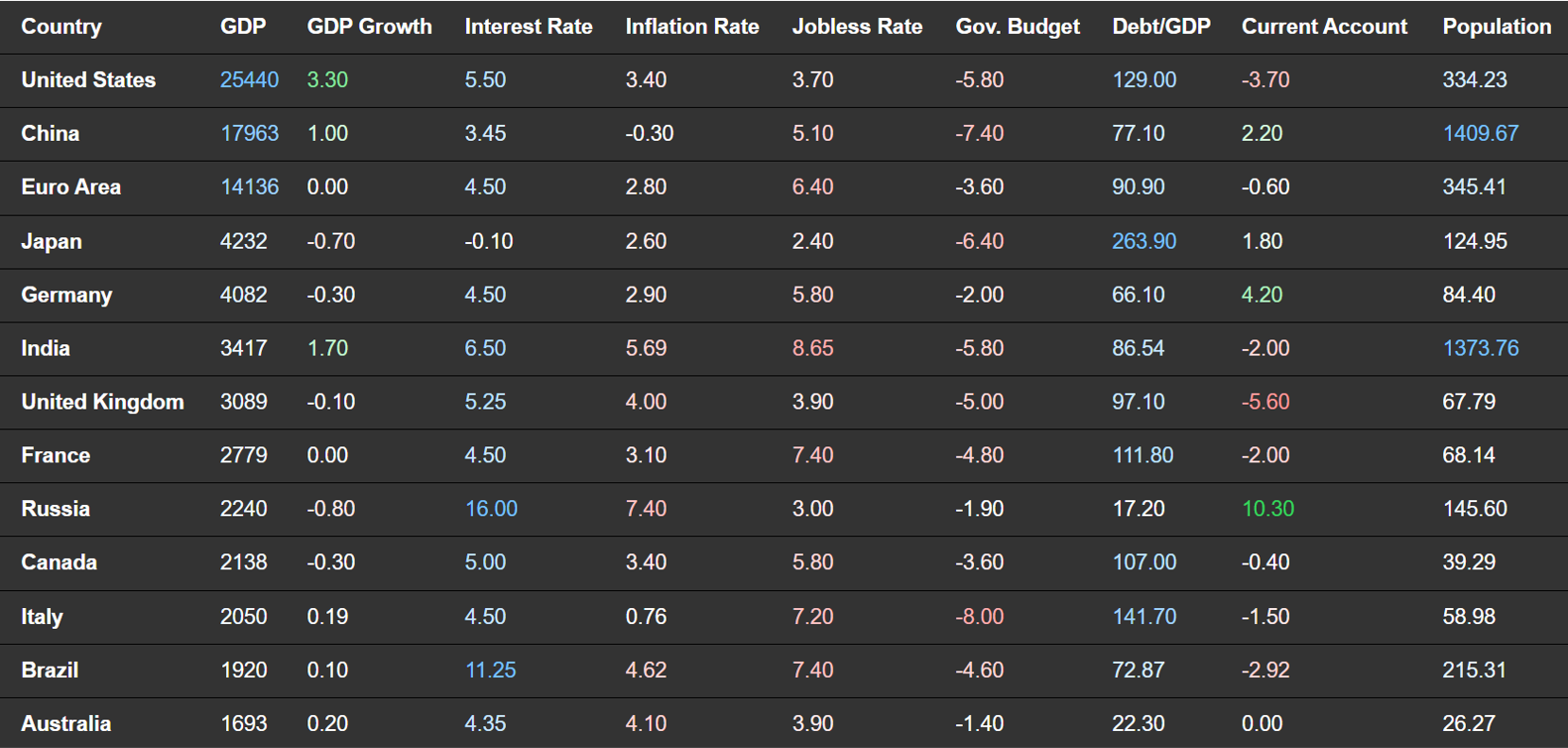

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie