Home > Edgenie Sunday Schroll: Newsletter > Can’t Think of Evaluation Points? Just Ask This One Question 🙋

Jump to Section:

One Quick Trick to Nail Your Evaluation Every Time

Infographic of the Week

Global Debt Reaches Record High in Q1 2024

Global debt surged to a record $315 trillion in Q1 2024, rising by $1.3 trillion compared to the previous quarter. Mature markets accounted for $209.7 trillion, or two-thirds of the total, while emerging markets reached $105.4 trillion, a significant increase over the past decade. Non-financial corporates held the largest share of emerging market debt, at $44 trillion. Although most sectors in mature markets experienced minimal debt growth, government debt saw a sharp rise of 4.5%. The Institute of International Finance (IIF) warned that inflation, trade tensions, and geopolitical risks could elevate global funding costs later in 2024.

Chart of the Week

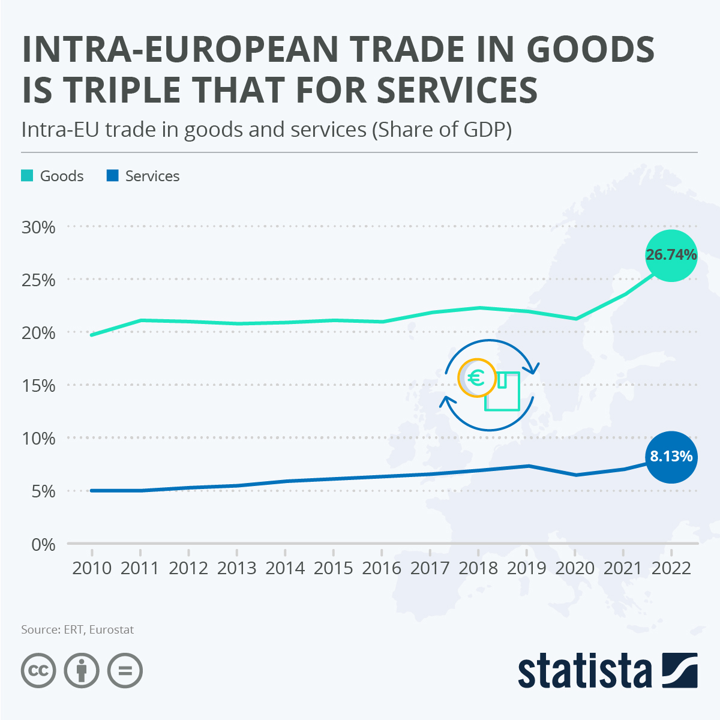

Intra-European Trade in Goods Far Outpaces Services

Intra-European trade within the EU, benefiting from reduced trade barriers, has seen steady growth over the years. However, trade in goods significantly outpaces services, with goods representing 26.74% of GDP in 2022, compared to only 8.13% for services. Despite challenges in fully removing all trade barriers, intra-EU trade in both sectors has consistently grown, reflecting the benefits of the EU's trade freedoms for member states.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie