Home > Wednesday Wisdoms: Newsletter > Does Increasing Taxes for the wealthy really bring down Inequality?

Jump to Section:

Bridging the Wealth Gap: A Closer Look at Proposed Policies and Alternative Strategies❓

A Critical Analysis of the Proposed Strategies

Towards More Sustainable Solutions: Three Supply-Side Policies

Conclusion

UK’s biggest pub group to charge 20p more a pint at busy times under surge pricing

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

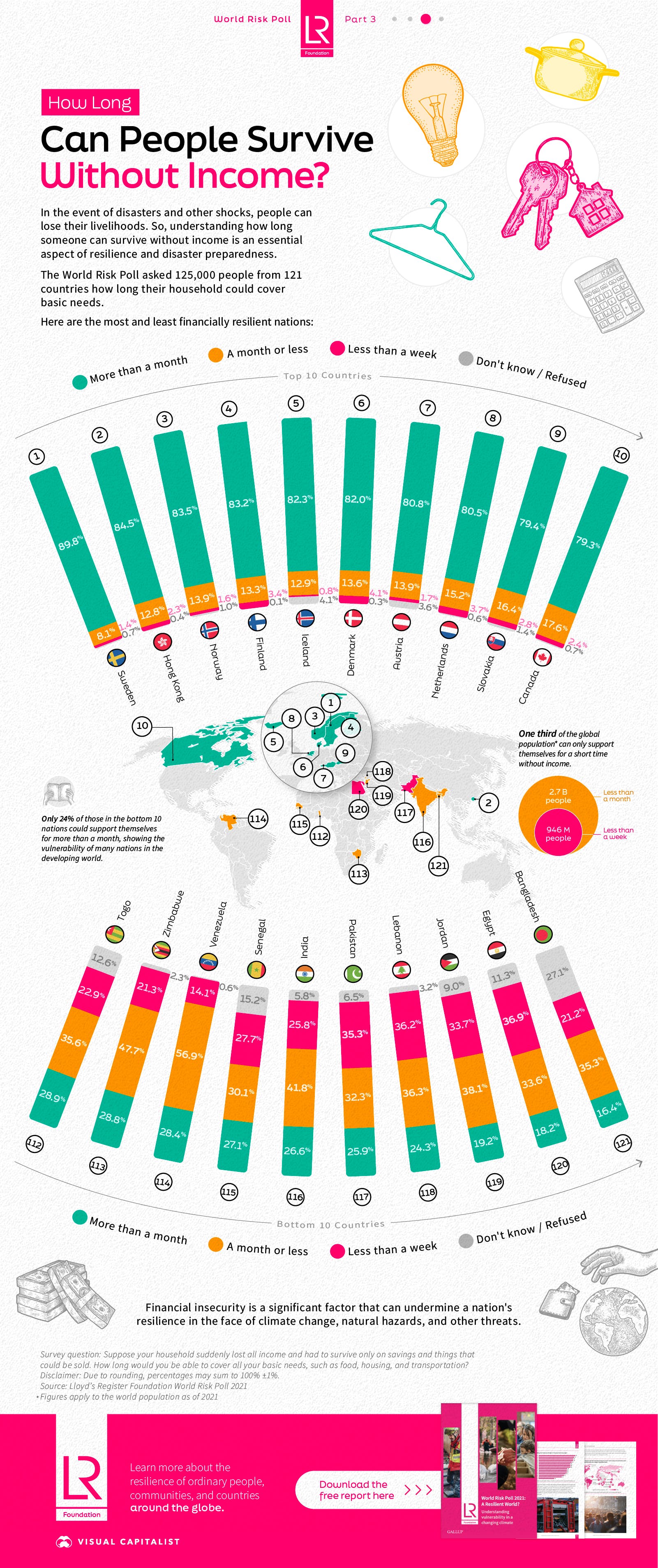

Infographic of the Week

Can People Survive Without Income?

In a 2021 survey sponsored by Lloyd’s Register Foundation, 125,000 people from 121 countries were polled about their financial resilience, revealing stark disparities between developed and developing economies. Notably, countries like Sweden, Hong Kong, and Norway had the majority of their populations able to sustain themselves for over a month without income. In contrast, countries such as Bangladesh, Egypt, and Jordan had a significant number struggling to meet basic needs after just a week without income. Alarmingly, globally, 2.7 billion people could cover their basic needs for only a month or less without an income, with 946 million of them surviving just a week, highlighting the urgent need for measures to bolster financial security, especially amidst global challenges like climate change and pandemics.

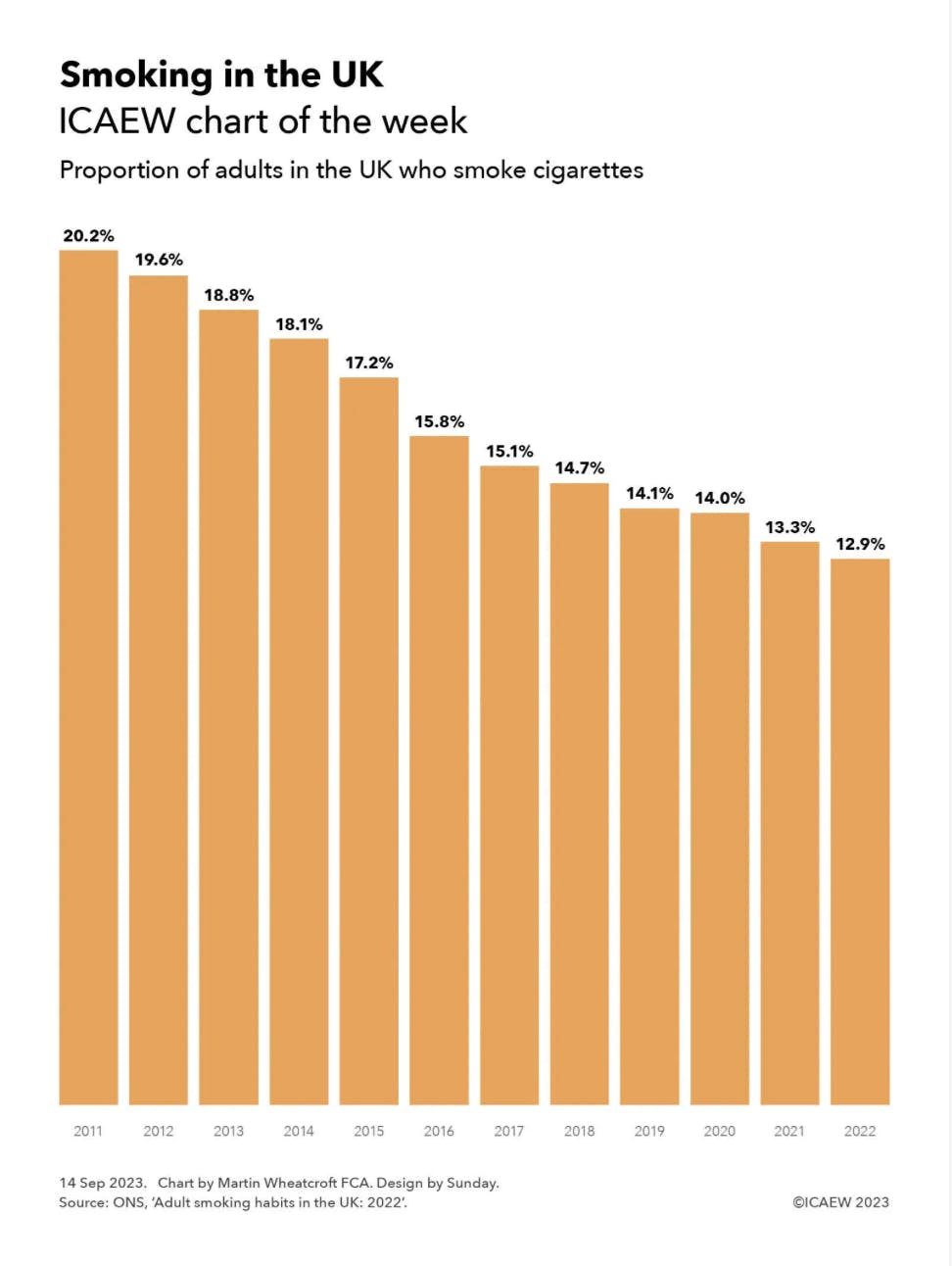

Chart of the Week

Decline in Smoking

The Office for National Statistics (ONS) reports a significant decrease in adult smoking habits in the UK over the past decade, with the proportion of smokers declining from 20.2% in 2011 to 12.9% in 2022. This reduction is observed across all age groups, with men and women's smoking rates dropping from 22.4% and 18.2% respectively in 2011 to 14.6% and 11.2% in 2022. Conversely, vaping has seen an uptick, particularly among younger age groups, with daily or occasional e-cigarette use rising from 6.4% in 2020 to 8.7% in 2022. Despite a 70% increase in tobacco duty rates from 2011 to 2022, tobacco duty revenue fell from £9.9bn in 2011/12 to £9.4bn in 2022/23, marking a 5% cash and 26% real-term decline.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie