Home > Wednesday Wisdoms: Newsletter > A Level Economics: Doing the same thing, expecting a different result, does not work!

Jump to Section:

Doing the same thing, expecting a different result, does not work!

Are electric cars too expensive to tempt motorists away from petrol and diesel vehicles?

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

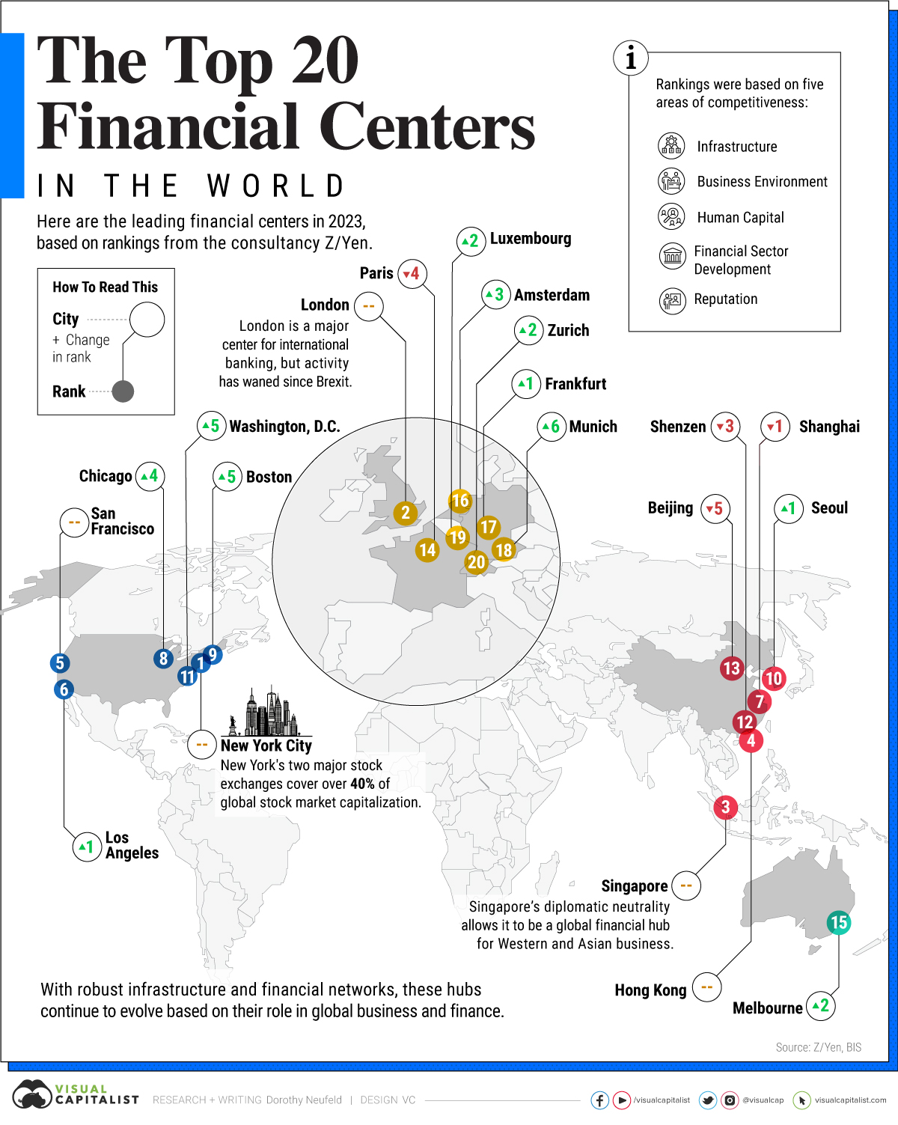

The Global Financial Powerhouses of 2023: New York Leads, Asia Rises

In 2023, New York reigns as the world's premier financial center, maintaining its position with a $46 trillion stock market capitalization, which constitutes 40% of the global total. London, retaining its second rank, faces challenges post-Brexit as its dominance in international banking diminishes. Singapore and Hong Kong secure the third and fourth positions, respectively, with Singapore's diplomatic neutrality and Hong Kong's deep market liquidity being key factors. San Francisco and Los Angeles also feature prominently. Asian financial hubs, particularly Shanghai, show a mix of rank shifts, with Shanghai holding the seventh position, hosting Asia's largest stock exchange at $6.6 trillion. The Z/Yen report anticipates Seoul, Singapore, and Kigali to grow in prominence as financial centers, with Seoul proposing tax incentives to attract foreign companies. This evolution reflects Asia's growing economic influence, hinting at a potential shift in global financial dynamics.

Chart of the Week

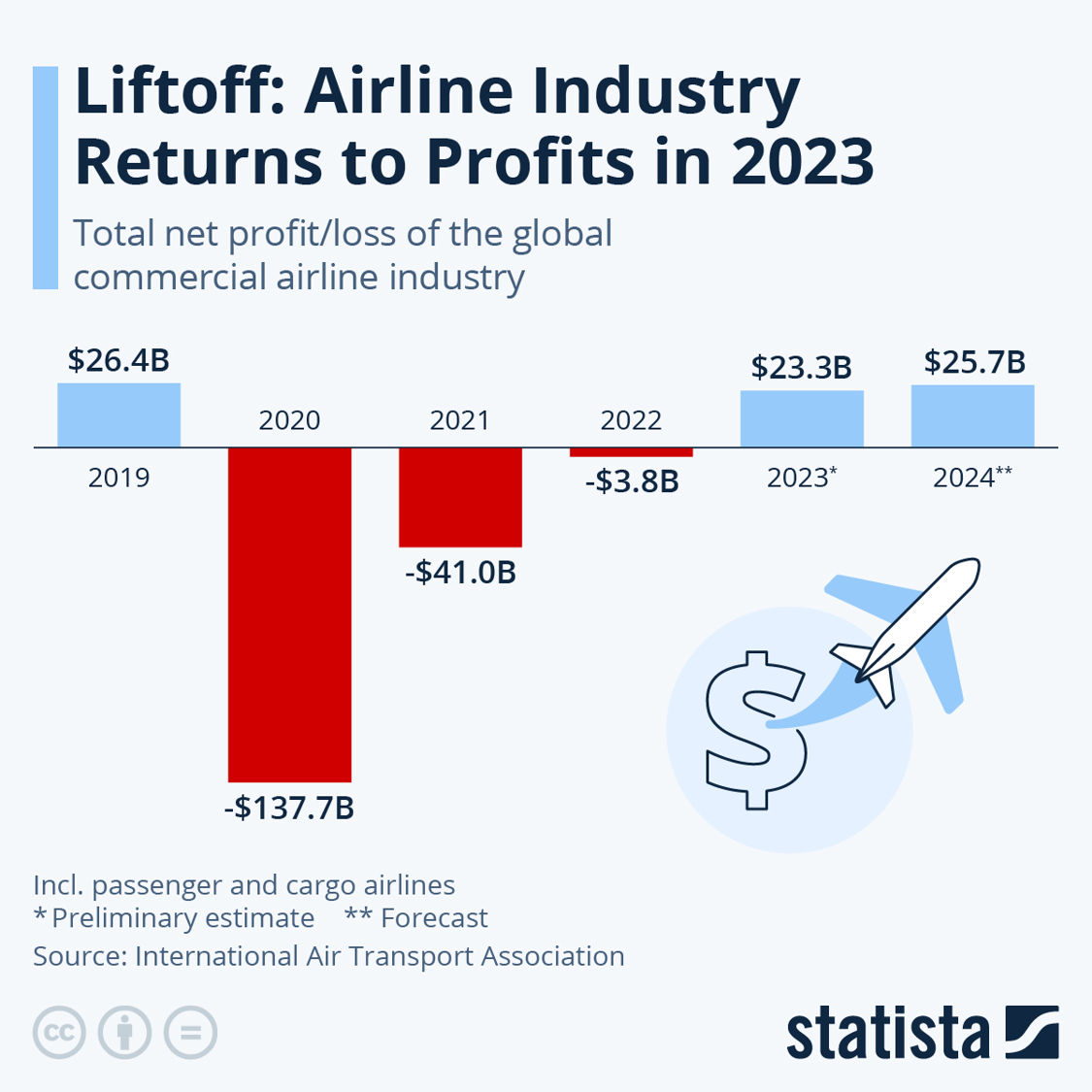

Airline Industry's Resilient Comeback Post-Covid with Modest Profits

The global airline industry, having navigated through the Covid-19 crisis, is set to mark a notable turnaround in 2023. The International Air Transport Association (IATA) reports an expected net profit of $23.3 billion for the year, a significant rebound from the $3.8 billion loss in 2022 and surpassing the initial modest projection of $4.7 billion. Despite this recovery, IATA's Director General Willie Walsh highlights that the industry is still grappling with thin profit margins, averaging just $5.45 per passenger – barely enough to cover a basic coffee in London. The industry is anticipated to reach an all-time high with revenues of $964 billion in 2024, including an 18% increase in passenger revenue over 2019 figures, attributed to more flights and improved passenger yields. However, challenges persist due to stringent regulations, high costs, and a monopolistic supply chain, even as the industry plays a crucial role in supporting over 3 million jobs globally.

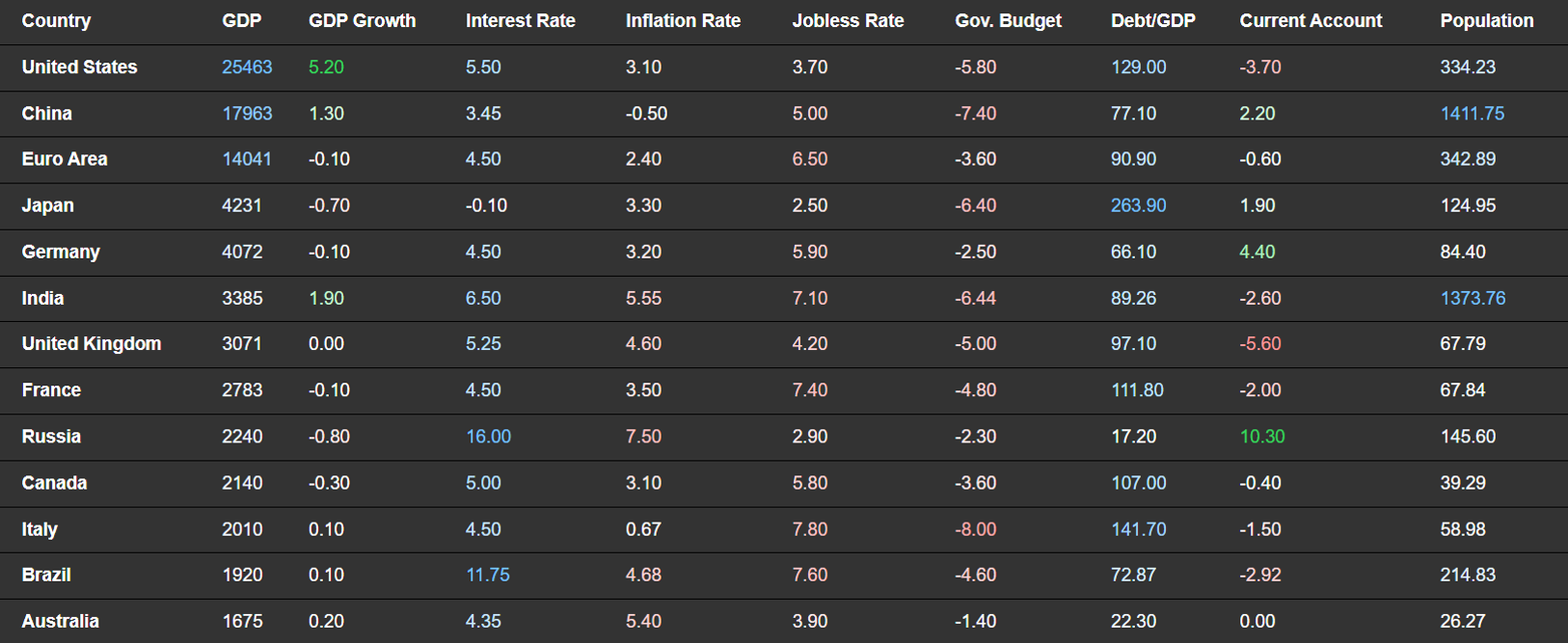

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie