Home > Edgenie Sunday Schroll: Newsletter > Don’t Wait Until Mocks to Realise You Need Help 🎯

Jump to Section:

Don’t Wait Until Mocks to Realise You Need Help 🎯

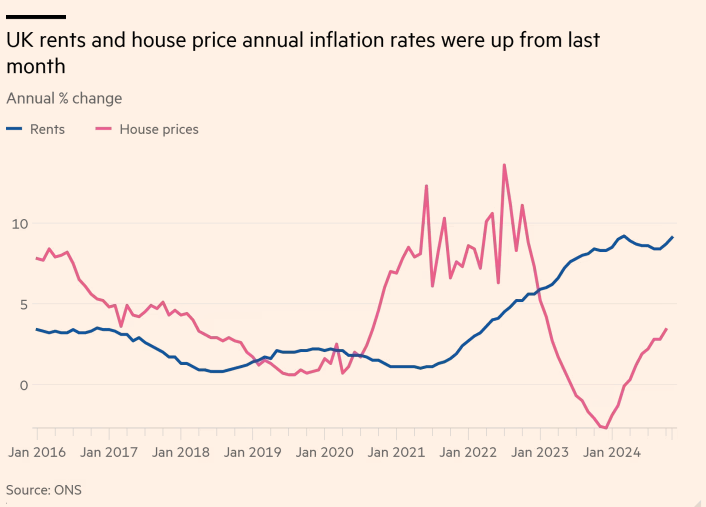

London rents rise at record 11.6%

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

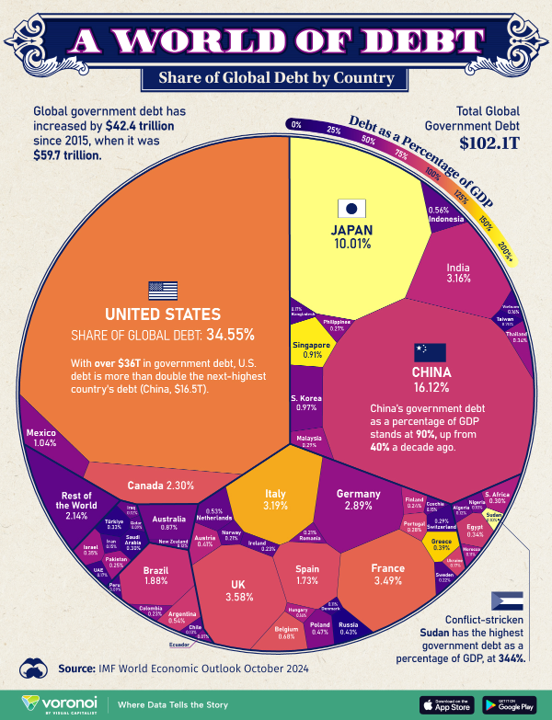

Rising Global Debt: A Looming Fiscal Challenge

Global public debt is forecast to reach $102 trillion in 2024, with the United States and China contributing significantly to this rise. The US alone accounts for 34.6% of the total, with its debt reaching $36.1 trillion by December 2024, while China holds 16.1%, with its debt-to-GDP ratio projected to rise sharply. Factors such as ageing populations, escalating healthcare costs, geopolitical tensions, and stimulus spending are driving debt levels globally, with North America expected to have the highest debt-to-GDP ratio at 125% by 2029. Europe’s debt is also growing, led by the UK’s 101.8% debt-to-GDP ratio, while India demonstrates gradual improvement due to strong fiscal policies. The IMF warns that without major spending cuts or tax hikes, global debt could exceed 100% of output by 2029, posing severe risks to fiscal sustainability.

Chart of the Week

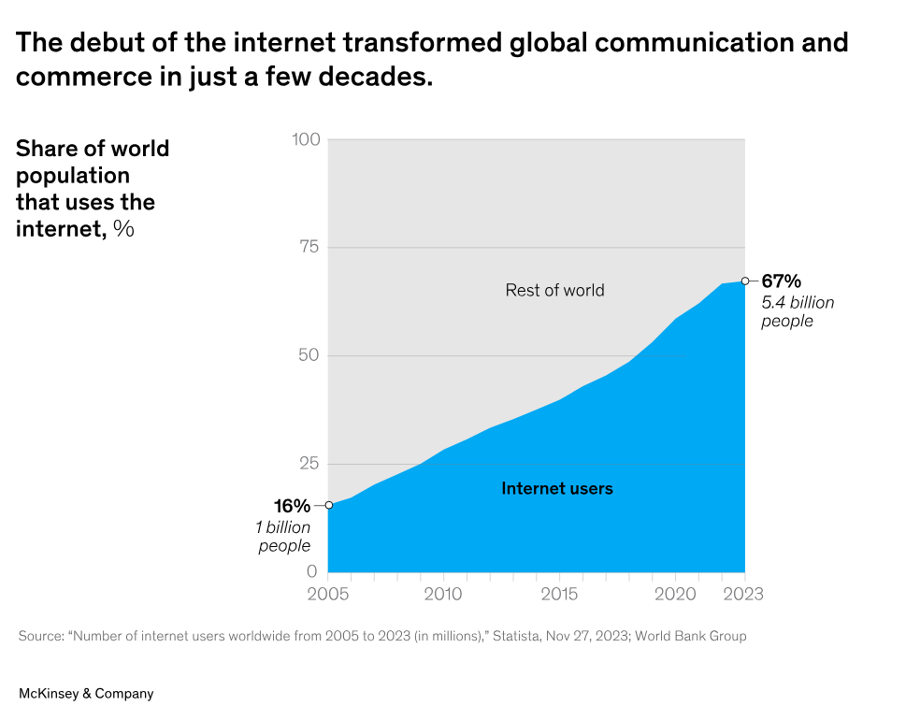

The Growth of the Internet: A Global Transformation

Since its inception in 1991, the internet has revolutionised communication and commerce worldwide. Usage has skyrocketed, growing from just 16% of the global population in 2005 (around 1 billion users) to 67% by 2023 (approximately 5.4 billion users). This exponential increase highlights the internet's profound impact on connectivity, accessibility, and business. Marking its 60th anniversary, McKinsey Quarterly delves into 25 pivotal technological breakthroughs, including the internet, which have reshaped industries—from early computing in the 1960s to the dawn of commercial space exploration. These advancements underline the transformative power of digital technology in shaping modern economies and societies.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie