Home > Edgenie Sunday Schroll: Newsletter > Every Economics Question is Scenario-Based (Are You Ready?)

Jump to Section:

Every Economics Question is Scenario-Based (Are You Ready?)

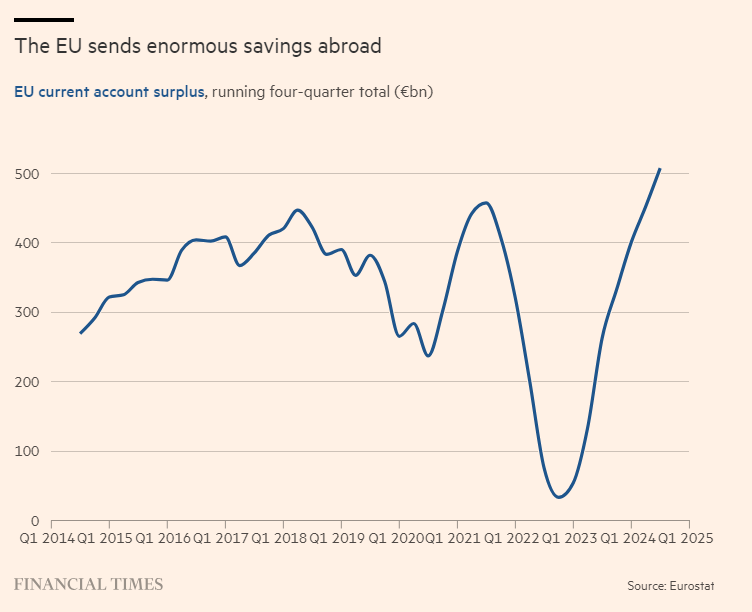

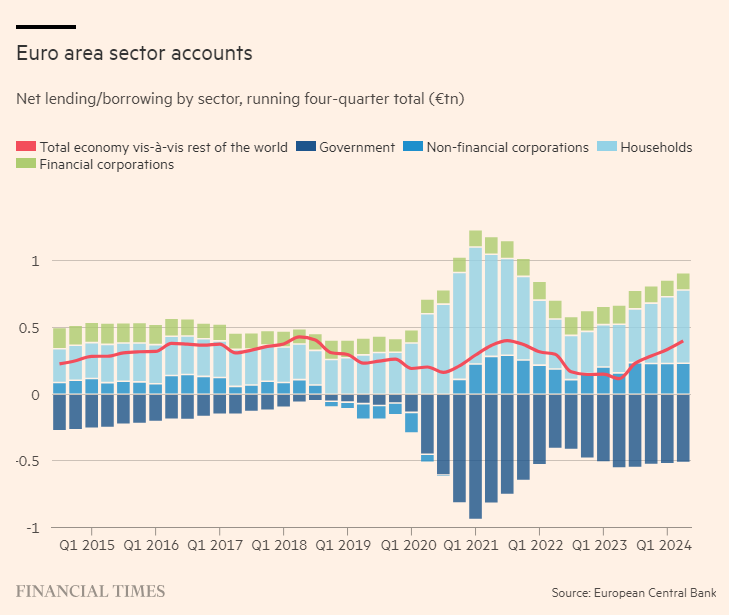

How to put Europe’s savings to work

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

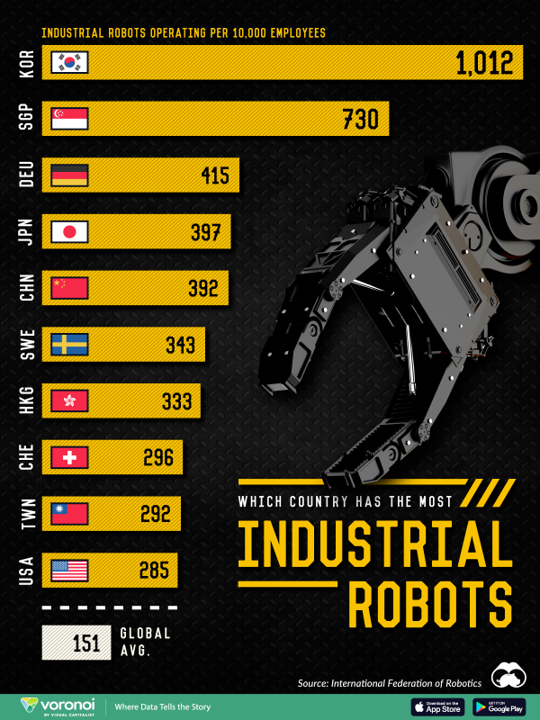

Infographic of the Week

Global Surge in Industrial Robots: Asia Leads the Way

The global automation landscape reached a record 3.9 million operational industrial robots in 2022, with robot density doubling over the past six years. According to the International Federation of Robotics, South Korea leads with 1,012 robots per 10,000 employees, over six times the global average of 151, driven by its strong electronics and automotive sectors. Asia dominates the rankings, with South Korea, Singapore, Japan, China, Hong Kong, and Taiwan among the top 10, reflecting significant investments in advanced manufacturing. Singapore, second with 730 robots per 10,000 employees, underscores how technologically advanced nations with smaller populations adopt robotics to enhance productivity. Globally, 30% of robots are used in automotive manufacturing and 26% in electronics, highlighting the strategic role of automation in these industries.

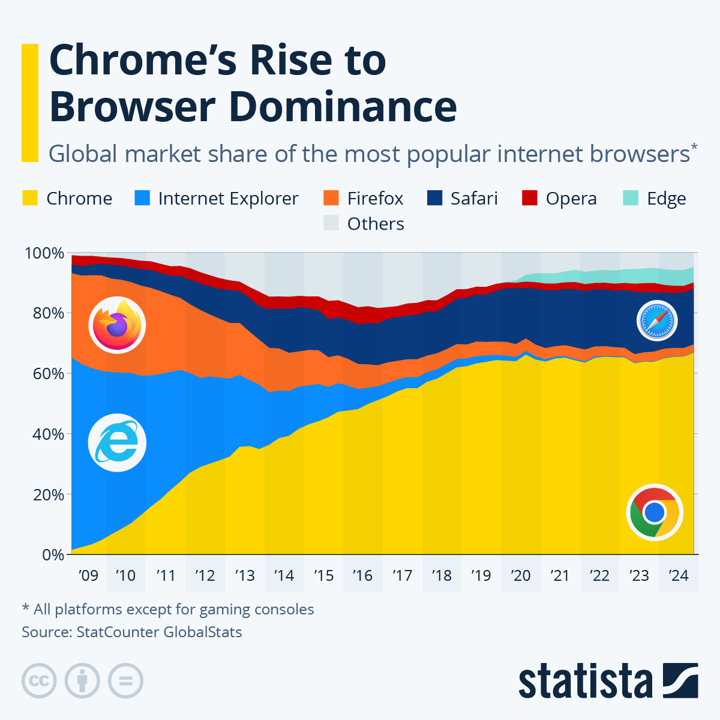

Chart of the Week

Chrome’s Journey to Browser Supremacy Faces Antitrust Scrutiny

Since its launch in 2008, Google Chrome has risen to dominate the web browser market, holding a 65% global market share—over three times that of its nearest competitor, Safari. Originally envisioned as a way to complement Google Search, Chrome's success quickly surpassed expectations, dethroning Microsoft's Internet Explorer within five years. However, a recent antitrust ruling against Google’s search monopoly has brought Chrome under fire, with the U.S. Department of Justice proposing its divestiture to promote competition. Google, labelling the proposal as “staggering” and “extreme,” has vowed to contest the decision, setting the stage for a major legal showdown over Chrome’s future.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie