Home > Edgenie Sunday Schroll: Newsletter > Every Single Thing You Do Counts 📚⏳ (+ or – You Decide)

Jump to Section:

Every Single Thing You Do Counts 📚⏳ (+ or – You Decide)

UK growth forecasts hit by Trump’s tariffs

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

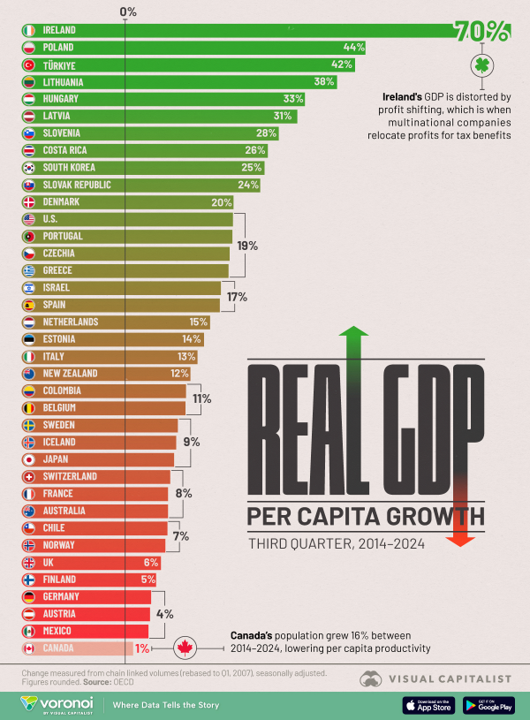

📉 Stagnation and Surges: A Decade of Diverging GDP Per Capita Growth

In 2023, China led the world with the largest trade surplus, reaching $593.9 billion—more than the combined surpluses of the next three countries—driven by its booming export sector amidst sluggish domestic demand. Germany followed in second place, with a $249.9 billion surplus largely attributed to its automotive exports, particularly to the United States. Ireland, Singapore, and Saudi Arabia also featured prominently in the top rankings, with the latter bolstered by its crude oil exports. Notably, five of the top ten surplus nations were European, highlighting the continent’s strong export presence. The data, sourced from the World Bank, reflects shifting global trade patterns amid rising geopolitical tensions and potential trade barriers, particularly between the U.S., China, and the EU.

Chart of the Week

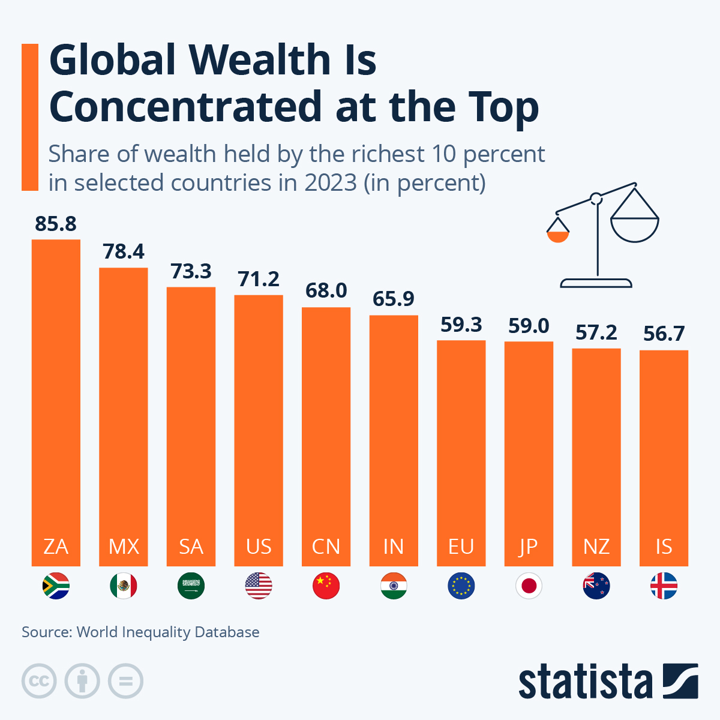

🌍 Global Wealth Inequality: The 10% Dominance

Wealth inequality remains entrenched worldwide, with the top 10% of earners holding over half of all personal wealth in nearly every country. In 2023, the top 10% in the United States owned 71.2% of wealth—higher than in the EU, where the figure stood at 59.3%. This disparity may worsen under proposed Republican budget plans that extend major tax cuts for the wealthy while slashing social programmes like Medicaid and SNAP. Globally, inequality levels in North America now rival those of Sub-Saharan Africa and parts of Asia. Europe and Oceania remain the most equitable regions, with countries like the Netherlands and Iceland displaying relatively fairer wealth distributions.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie