Home > Edgenie Sunday Schroll: Newsletter > Here’s Something Controversial For Some Reason (But True) 👀

Jump to Section:

Why Hard Work Shouldn't Be a Dirty Word 😷

Sterling rises after UK business activity grows more than expected

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

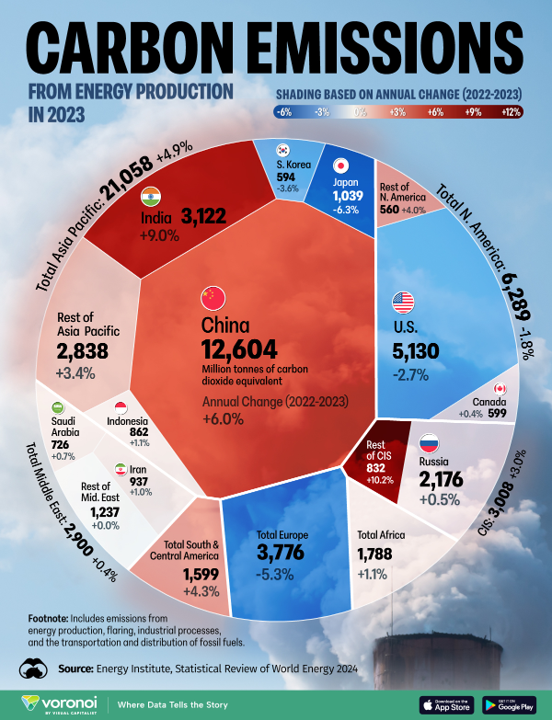

Infographic of the Week

Global Carbon Emissions from Energy Production in 2023

In 2023, China was the predominant contributor to global carbon emissions from energy production, generating 12.6 billion tonnes, which constituted nearly a third of the global total, despite global efforts to increase renewable energy adoption. The United States and India followed, with the latter showing a significant increase of 9.0% in emissions from the previous year. Overall, the Asia Pacific region saw a 4.9% rise in emissions, contrasting with reductions in North America and Europe, which saw decreases of 1.8% and 5.3% respectively. The data, sourced from the Energy Institute’s Statistical Review of World Energy, also highlights the dependence of emerging economies like India on coal, which continues to dominate their energy mix despite global shifts towards greener energy sources.

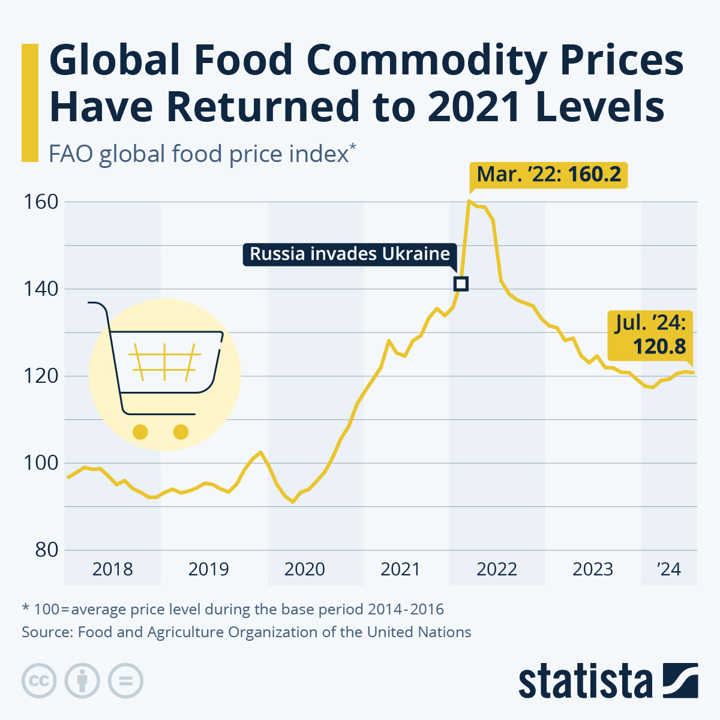

Chart of the Week

Resurgence to Stability: Global Food Prices Realign to Pre-Crisis Levels

In 2023, global food commodity prices stabilised to levels similar to those in 2021, according to the FAO Food Price Index, which indicated a level of 120.8 points in July 2024. This follows a turbulent period in 2022 when prices peaked at 160 points, driven by the compounded effects of the COVID-19 pandemic and geopolitical tensions, notably Russia's invasion of Ukraine. The invasion significantly disrupted Ukraine's export of grains and vegetable oils, crucial to global food supply, causing a sharp increase in prices. However, interventions such as the Black Sea Grain Initiative and the establishment of alternative shipping routes have allowed Ukraine to resume exports, gradually restoring prices to a more typical state seen before the escalation of these crises.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie