Home > Edgenie Sunday Schroll: Newsletter > "How to become a top A-level student 🚀 (simple formula)?🤔"

Jump to Section:

How to become a top A-level student 🚀 (simple formula)

Behind the world’s fragrances sits a shadowy oligopoly

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Oil Reserves Giants: Who Holds the World’s Crude Power?

As of December 2023, Venezuela leads the world with 303 billion barrels of proven oil reserves, followed closely by Saudi Arabia (267bn) and Iran (209bn), all key OPEC members. While Saudi Arabia maintains high output due to low production costs, Venezuela struggles with sanctions and economic collapse despite its vast reserves. Canada, a non-OPEC country, ranks fourth, while the U.S. and Russia also feature among the top 10. The Middle East dominates oil reserves, with the Gulf region holding a third of the global total. Despite geopolitical tensions—especially involving Iran—major disruptions to oil flows have been avoided. However, potential threats like the closure of the Strait of Hormuz could still shake global markets. Overall, the top 10 oil-rich nations collectively hold 1.5 trillion barrels of oil, underscoring their central role in global energy dynamics.

Chart of the Week

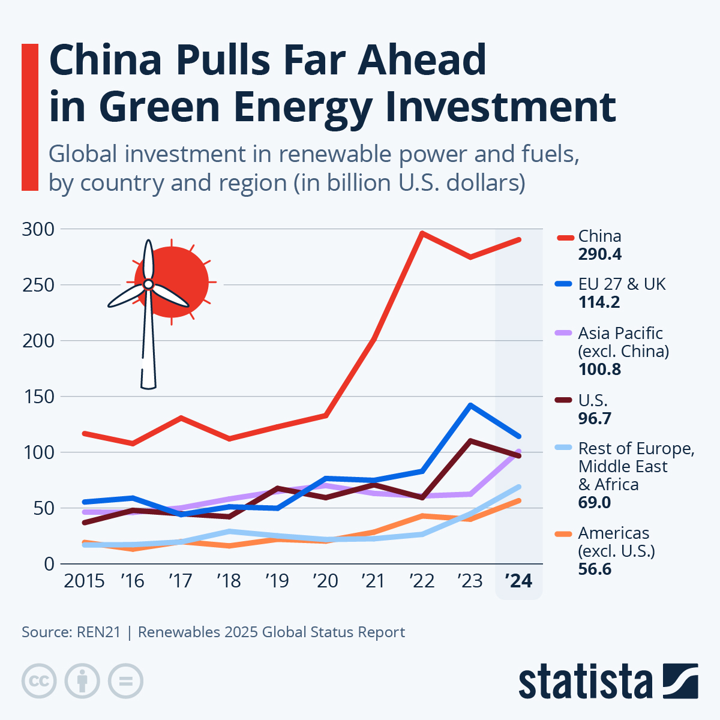

China’s Green Energy Surge Leaves the World Behind

In 2024, China led global green energy investment by a wide margin, funnelling $290.4 billion into renewables—almost three times that of the U.S. ($96.7 billion) and far ahead of the EU & UK ($114.2 billion). While EU investments surged in 2023, they dropped sharply in 2024, highlighting volatility. In contrast, regions like Asia Pacific (excluding China), Africa, and the Middle East showed steady investment growth. Globally, renewable energy investment reached $728 billion, heavily concentrated in solar and EV sectors. Despite this progress, REN21 reports that the world remains well short—only at 48%—of the annual investment needed to stay on track for net zero emissions by 2050.

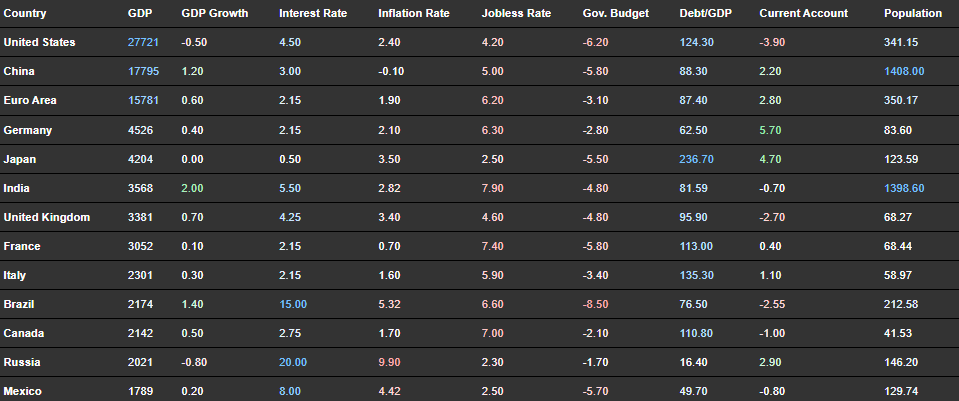

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie

Home > Edgenie Sunday Schroll: Newsletter > "But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Jump to Section:

"But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Asda to invest in price cuts to battle drop in sales and market share

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

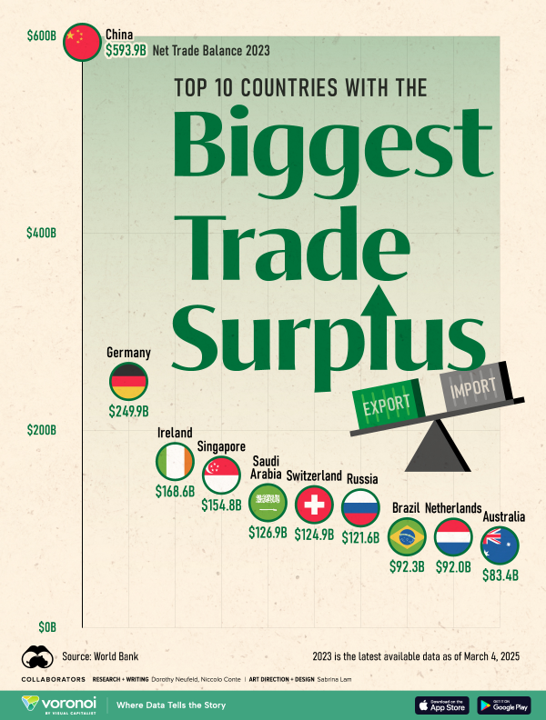

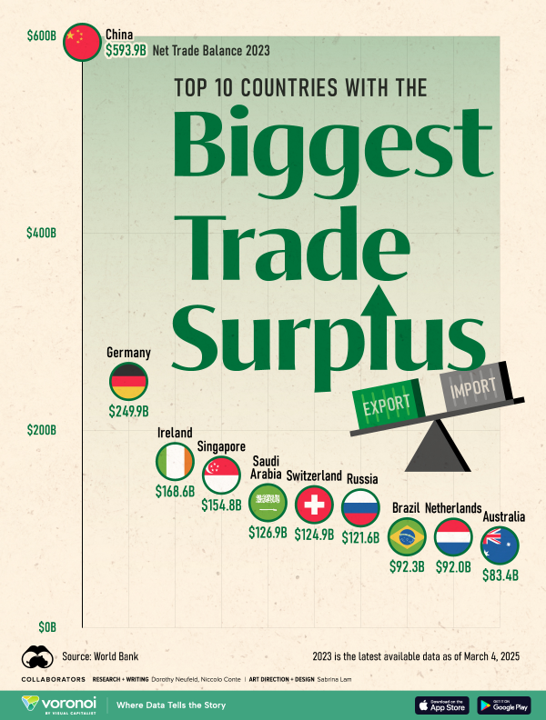

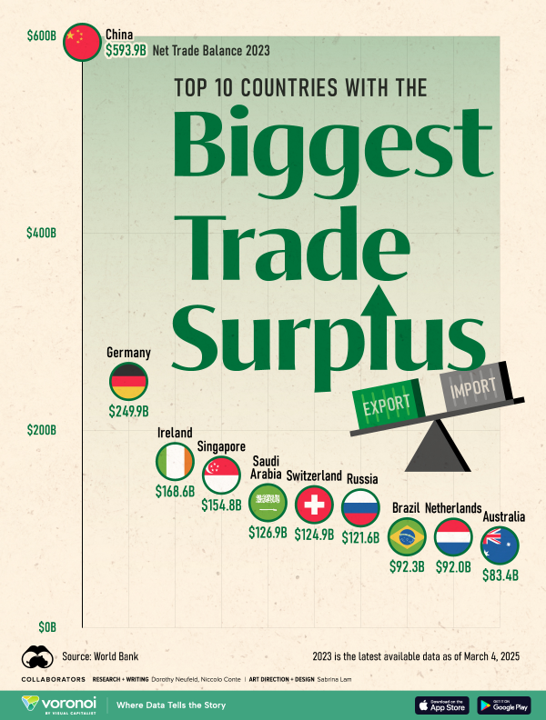

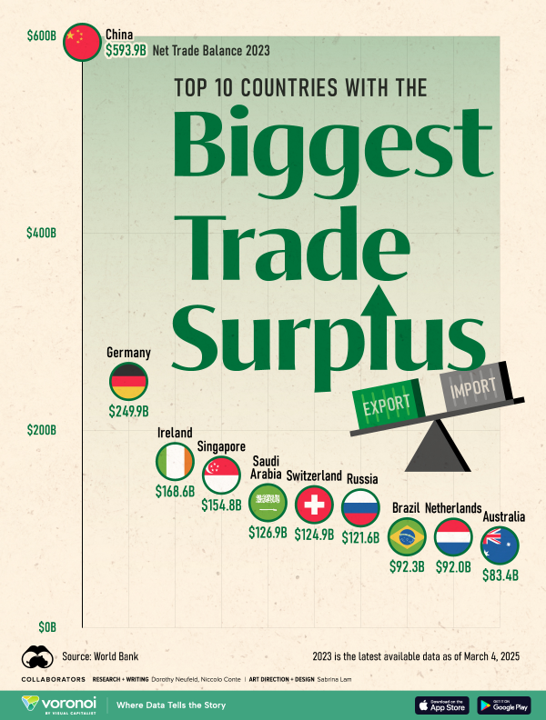

Global Trade Leaders: Countries with the Largest Trade Surpluses

In 2023, China led the world with the largest trade surplus, reaching $593.9 billion—more than the combined surpluses of the next three countries—driven by its booming export sector amidst sluggish domestic demand. Germany followed in second place, with a $249.9 billion surplus largely attributed to its automotive exports, particularly to the United States. Ireland, Singapore, and Saudi Arabia also featured prominently in the top rankings, with the latter bolstered by its crude oil exports. Notably, five of the top ten surplus nations were European, highlighting the continent’s strong export presence. The data, sourced from the World Bank, reflects shifting global trade patterns amid rising geopolitical tensions and potential trade barriers, particularly between the U.S., China, and the EU.

Chart of the Week

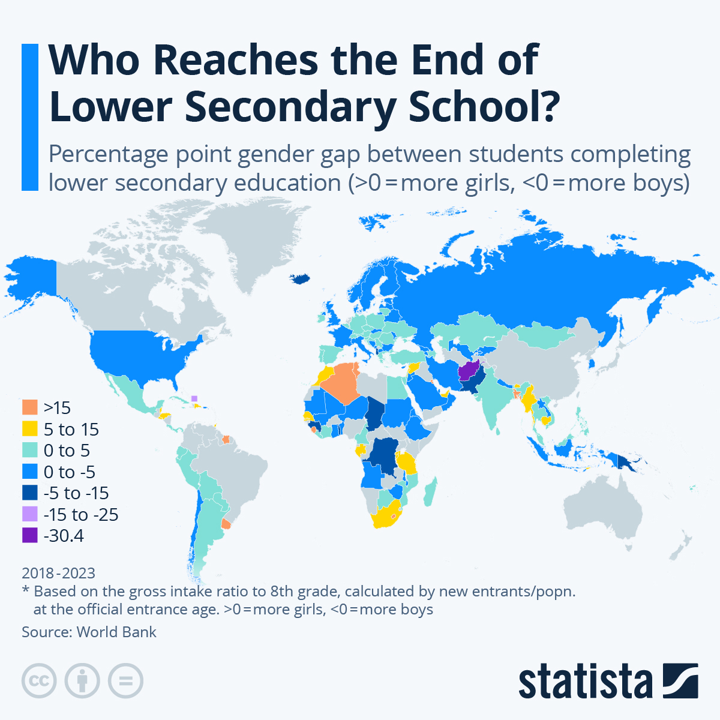

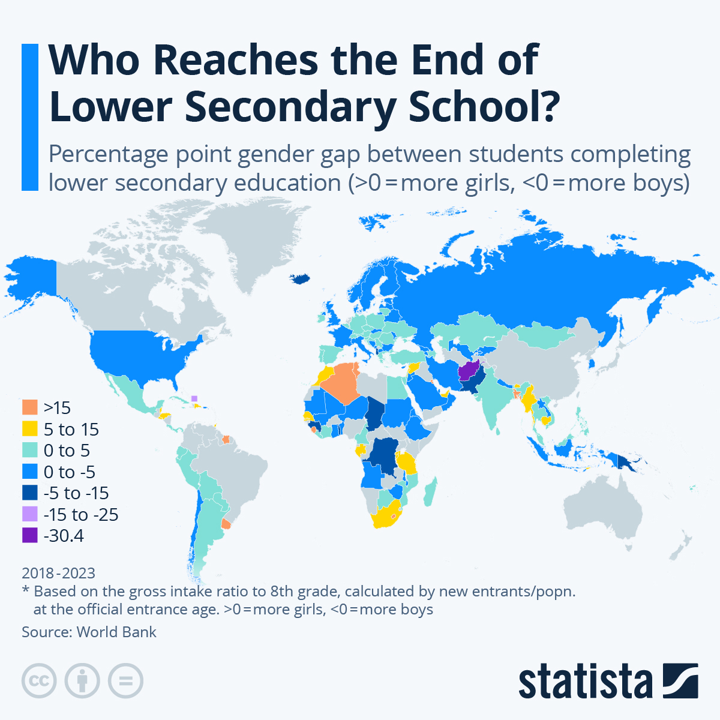

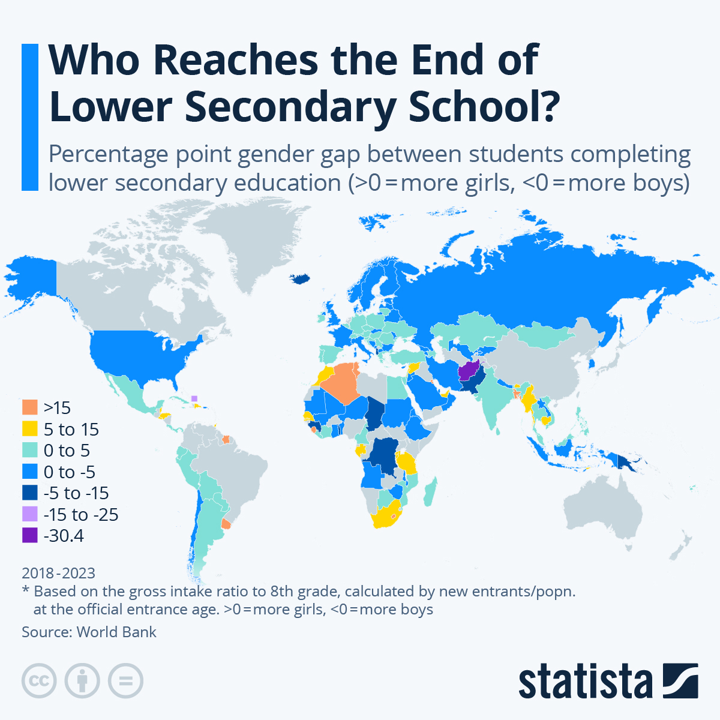

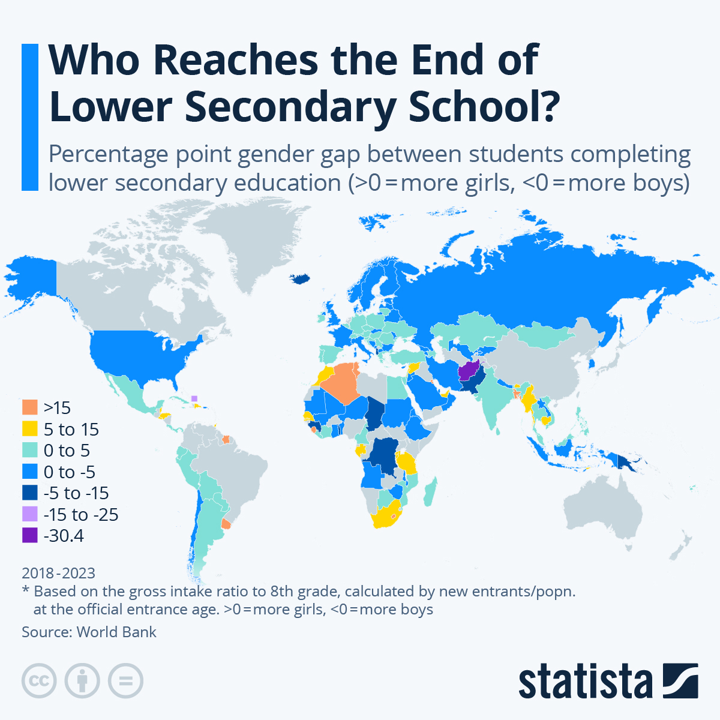

Gender Gaps in Lower Secondary School Completion: A Global Snapshot

Over the last five decades, global education levels have seen remarkable progress, particularly for girls. However, gender disparities in lower secondary school completion still persist across regions. According to World Bank data from 2018 to 2023, some countries still exhibit stark inequalities. In Afghanistan, for instance, girls were significantly underrepresented, with a -30.4 percentage point gap. Other countries such as Iceland, Albania, Mauritius, and the Democratic Republic of Congo also showed fewer girls completing eighth grade. Conversely, several countries reveal a reverse gender gap, where boys are underrepresented—most notably in the Cayman Islands (34.5 p.p. gap), Tuvalu, Sierra Leone, Palau, and Suriname. Encouragingly, 22 economies, including Turkey and Peru, reported near parity. Yet, lagging data and political shifts, like the Taliban's impact on girls’ education in Afghanistan, underscore the ongoing need for focused policy efforts to ensure equal educational access for all children, regardless of gender.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie

Home > Edgenie Sunday Schroll: Newsletter > "But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Jump to Section:

"But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Asda to invest in price cuts to battle drop in sales and market share

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Global Trade Leaders: Countries with the Largest Trade Surpluses

In 2023, China led the world with the largest trade surplus, reaching $593.9 billion—more than the combined surpluses of the next three countries—driven by its booming export sector amidst sluggish domestic demand. Germany followed in second place, with a $249.9 billion surplus largely attributed to its automotive exports, particularly to the United States. Ireland, Singapore, and Saudi Arabia also featured prominently in the top rankings, with the latter bolstered by its crude oil exports. Notably, five of the top ten surplus nations were European, highlighting the continent’s strong export presence. The data, sourced from the World Bank, reflects shifting global trade patterns amid rising geopolitical tensions and potential trade barriers, particularly between the U.S., China, and the EU.

Chart of the Week

Gender Gaps in Lower Secondary School Completion: A Global Snapshot

Over the last five decades, global education levels have seen remarkable progress, particularly for girls. However, gender disparities in lower secondary school completion still persist across regions. According to World Bank data from 2018 to 2023, some countries still exhibit stark inequalities. In Afghanistan, for instance, girls were significantly underrepresented, with a -30.4 percentage point gap. Other countries such as Iceland, Albania, Mauritius, and the Democratic Republic of Congo also showed fewer girls completing eighth grade. Conversely, several countries reveal a reverse gender gap, where boys are underrepresented—most notably in the Cayman Islands (34.5 p.p. gap), Tuvalu, Sierra Leone, Palau, and Suriname. Encouragingly, 22 economies, including Turkey and Peru, reported near parity. Yet, lagging data and political shifts, like the Taliban's impact on girls’ education in Afghanistan, underscore the ongoing need for focused policy efforts to ensure equal educational access for all children, regardless of gender.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie

Home > Edgenie Sunday Schroll: Newsletter > "But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Jump to Section:

"But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Asda to invest in price cuts to battle drop in sales and market share

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Global Trade Leaders: Countries with the Largest Trade Surpluses

In 2023, China led the world with the largest trade surplus, reaching $593.9 billion—more than the combined surpluses of the next three countries—driven by its booming export sector amidst sluggish domestic demand. Germany followed in second place, with a $249.9 billion surplus largely attributed to its automotive exports, particularly to the United States. Ireland, Singapore, and Saudi Arabia also featured prominently in the top rankings, with the latter bolstered by its crude oil exports. Notably, five of the top ten surplus nations were European, highlighting the continent’s strong export presence. The data, sourced from the World Bank, reflects shifting global trade patterns amid rising geopolitical tensions and potential trade barriers, particularly between the U.S., China, and the EU.

Chart of the Week

Gender Gaps in Lower Secondary School Completion: A Global Snapshot

Over the last five decades, global education levels have seen remarkable progress, particularly for girls. However, gender disparities in lower secondary school completion still persist across regions. According to World Bank data from 2018 to 2023, some countries still exhibit stark inequalities. In Afghanistan, for instance, girls were significantly underrepresented, with a -30.4 percentage point gap. Other countries such as Iceland, Albania, Mauritius, and the Democratic Republic of Congo also showed fewer girls completing eighth grade. Conversely, several countries reveal a reverse gender gap, where boys are underrepresented—most notably in the Cayman Islands (34.5 p.p. gap), Tuvalu, Sierra Leone, Palau, and Suriname. Encouragingly, 22 economies, including Turkey and Peru, reported near parity. Yet, lagging data and political shifts, like the Taliban's impact on girls’ education in Afghanistan, underscore the ongoing need for focused policy efforts to ensure equal educational access for all children, regardless of gender.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie

Home > Edgenie Sunday Schroll: Newsletter > "But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Jump to Section:

"But how can I perfect exam technique if I have gaps in my knowledge?🤔"

Asda to invest in price cuts to battle drop in sales and market share

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Global Trade Leaders: Countries with the Largest Trade Surpluses

In 2023, China led the world with the largest trade surplus, reaching $593.9 billion—more than the combined surpluses of the next three countries—driven by its booming export sector amidst sluggish domestic demand. Germany followed in second place, with a $249.9 billion surplus largely attributed to its automotive exports, particularly to the United States. Ireland, Singapore, and Saudi Arabia also featured prominently in the top rankings, with the latter bolstered by its crude oil exports. Notably, five of the top ten surplus nations were European, highlighting the continent’s strong export presence. The data, sourced from the World Bank, reflects shifting global trade patterns amid rising geopolitical tensions and potential trade barriers, particularly between the U.S., China, and the EU.

Chart of the Week

Gender Gaps in Lower Secondary School Completion: A Global Snapshot

Over the last five decades, global education levels have seen remarkable progress, particularly for girls. However, gender disparities in lower secondary school completion still persist across regions. According to World Bank data from 2018 to 2023, some countries still exhibit stark inequalities. In Afghanistan, for instance, girls were significantly underrepresented, with a -30.4 percentage point gap. Other countries such as Iceland, Albania, Mauritius, and the Democratic Republic of Congo also showed fewer girls completing eighth grade. Conversely, several countries reveal a reverse gender gap, where boys are underrepresented—most notably in the Cayman Islands (34.5 p.p. gap), Tuvalu, Sierra Leone, Palau, and Suriname. Encouragingly, 22 economies, including Turkey and Peru, reported near parity. Yet, lagging data and political shifts, like the Taliban's impact on girls’ education in Afghanistan, underscore the ongoing need for focused policy efforts to ensure equal educational access for all children, regardless of gender.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie