Home > Wednesday Wisdoms: Newsletter > 🧞♂️ I recently came across a quote...

Jump to Section:

🧞♂️ I recently came across a quote...

Five charts explaining the UK’s economic prospects in 2024

Summary

Possible A Level Economics 25 Marker Question

Infographic of the Week

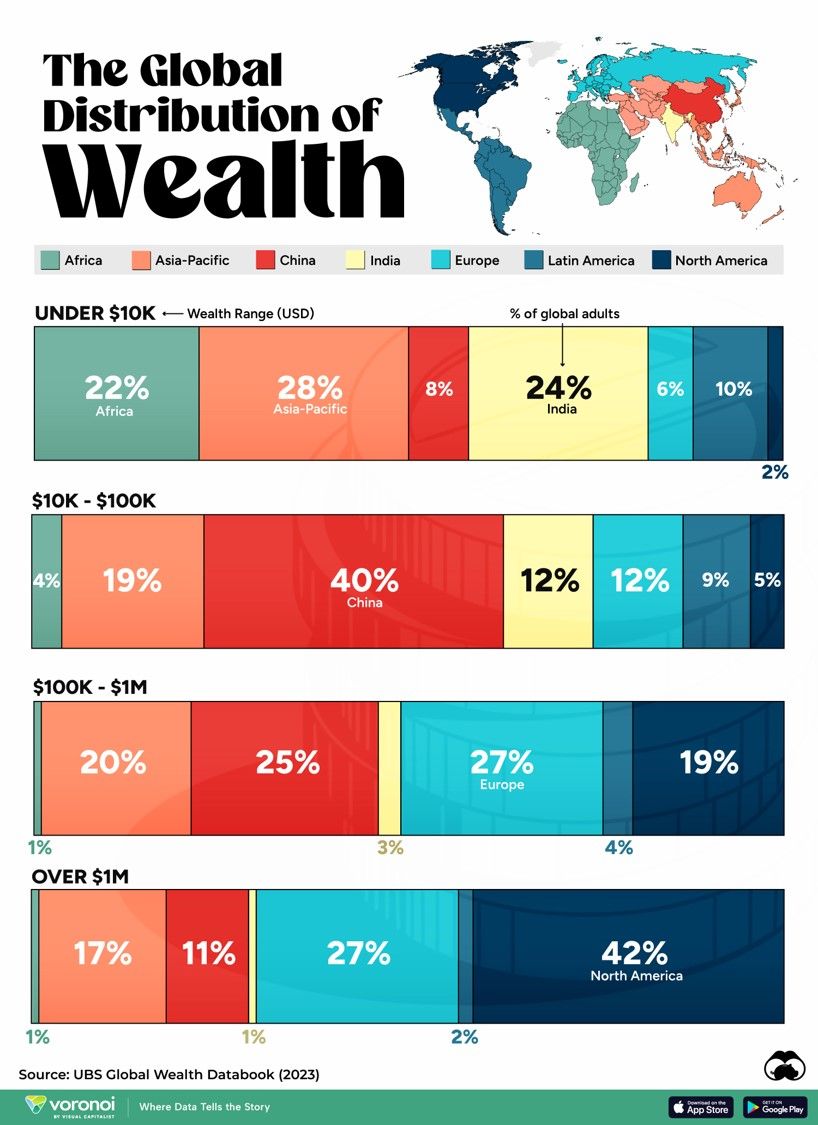

Global Wealth Disparity: A Tale of Continents and Economic Maturity

The global distribution of wealth across various regions provides a clear picture of economic maturity and inequality. In 2023, data from UBS shows significant disparities: North America leads with 42% of adults having wealth over $1 million, reflecting its advanced economy status. Europe closely follows, with an equal 27% in both the $100K - $1M and over $1M wealth ranges. Asia-Pacific and China show a broader distribution across wealth ranges, indicative of their economic transition, particularly China's shift towards a service-oriented economy. Contrastingly, Africa and India have larger proportions of their population in the lower wealth brackets, underlining the challenges in emerging markets. While global median wealth has increased fivefold since 2000, largely thanks to China's economic rise, wealth inequality both within and between countries has grown since the 1980s, highlighting the uneven progress in global economic development.

Chart of the Week

Sterling's Varied Fortunes: A Year of Currency Fluctuations

In 2023, sterling experienced a diverse journey against major global currencies, as reported by the Bank of England. While it saw a modest increase of just over 2% against the euro, from £1:€1.128 to £1:€1.154, its gains were more pronounced against other major currencies. Sterling rose by 6% against the US dollar, 9% against the Chinese yuan renminbi, and an impressive 13% against the Japanese yen. These fluctuations were influenced by various factors, including inflation rates, economic growth, interest rates, and fiscal credibility. The expectation that UK interest rates would remain high played a significant role in sterling's ascent. However, the pound's value is still lower compared to a decade ago, except against the yen, where it now stands 4% higher than the rate in December 2013. This mixed performance underlines the complexity of currency markets and the multiple factors driving exchange rate movements.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie