Home > Wednesday Wisdoms: Newsletter > If your A Level Economics 25 Markers Suck, do this

Jump to Section:

If your A level Economics 25 markers suck. Do This👇

1. Blurting:

2. Pre-planning:

3. Essay Plans:

Final Thoughts

Zombie Britain sees zero growth - and that's the good news

Summary:

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

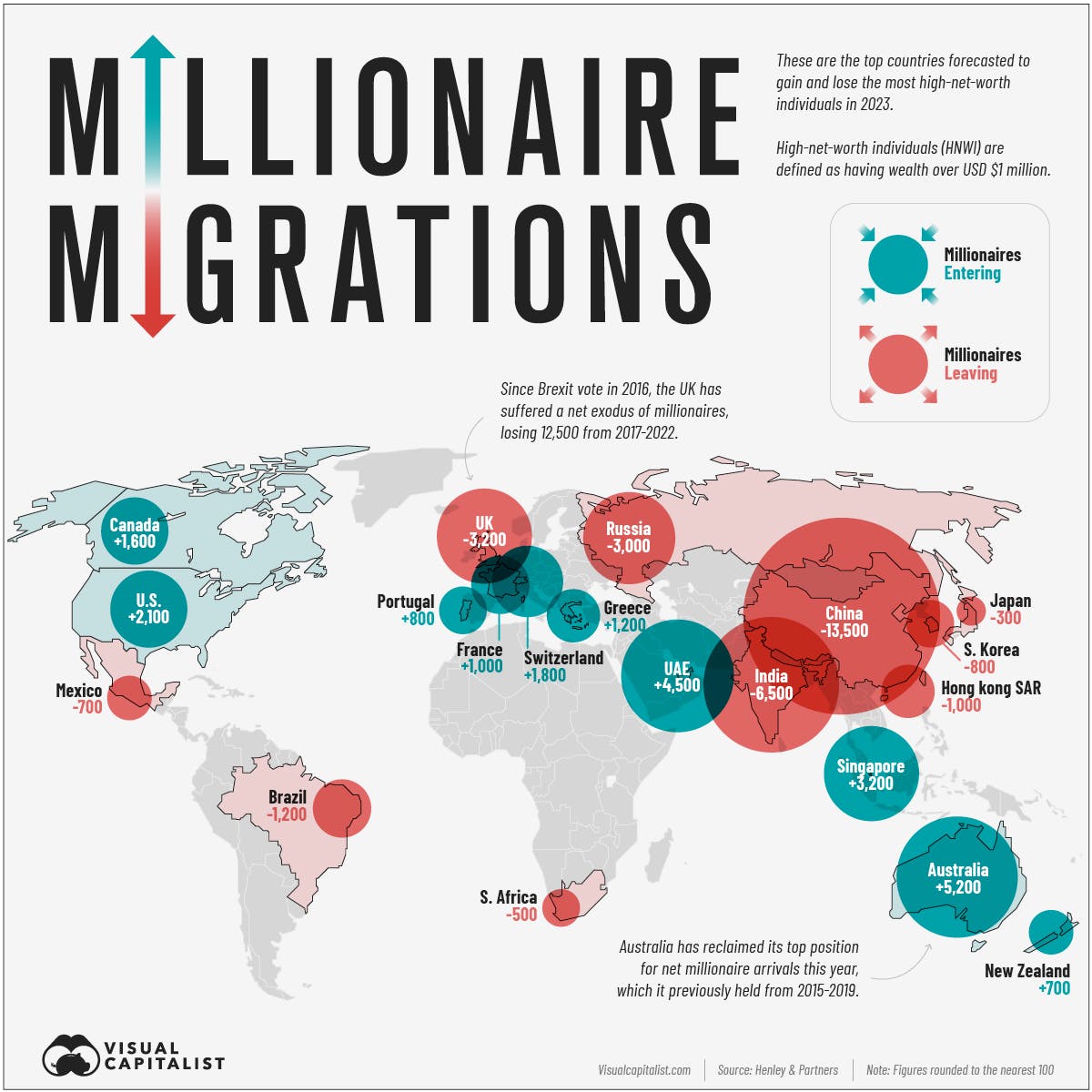

The Migration of High Net Worth Individuals

In 2023, the migration of High Net Worth Individuals (HNWIs)—those with a net worth of at least $1 million USD—is projected to see 122,000 such individuals relocating to new countries, according to Henley & Partners’ Private Wealth Migration Report. Australia is anticipated to welcome the highest number of millionaires, with 5,200 HNWIs, reclaiming its top spot from the UAE. Conversely, China is expected to experience the largest outflow, losing 13,500 HNWIs, attributed to factors like strict regulations and geopolitical tensions. Other notable countries witnessing significant inflows include Singapore and the U.S., while India and the UK are set to see substantial outflows. The trend of HNWI migration has been generally increasing over the past decade, notwithstanding pandemic-related dips.

Chart of the Week

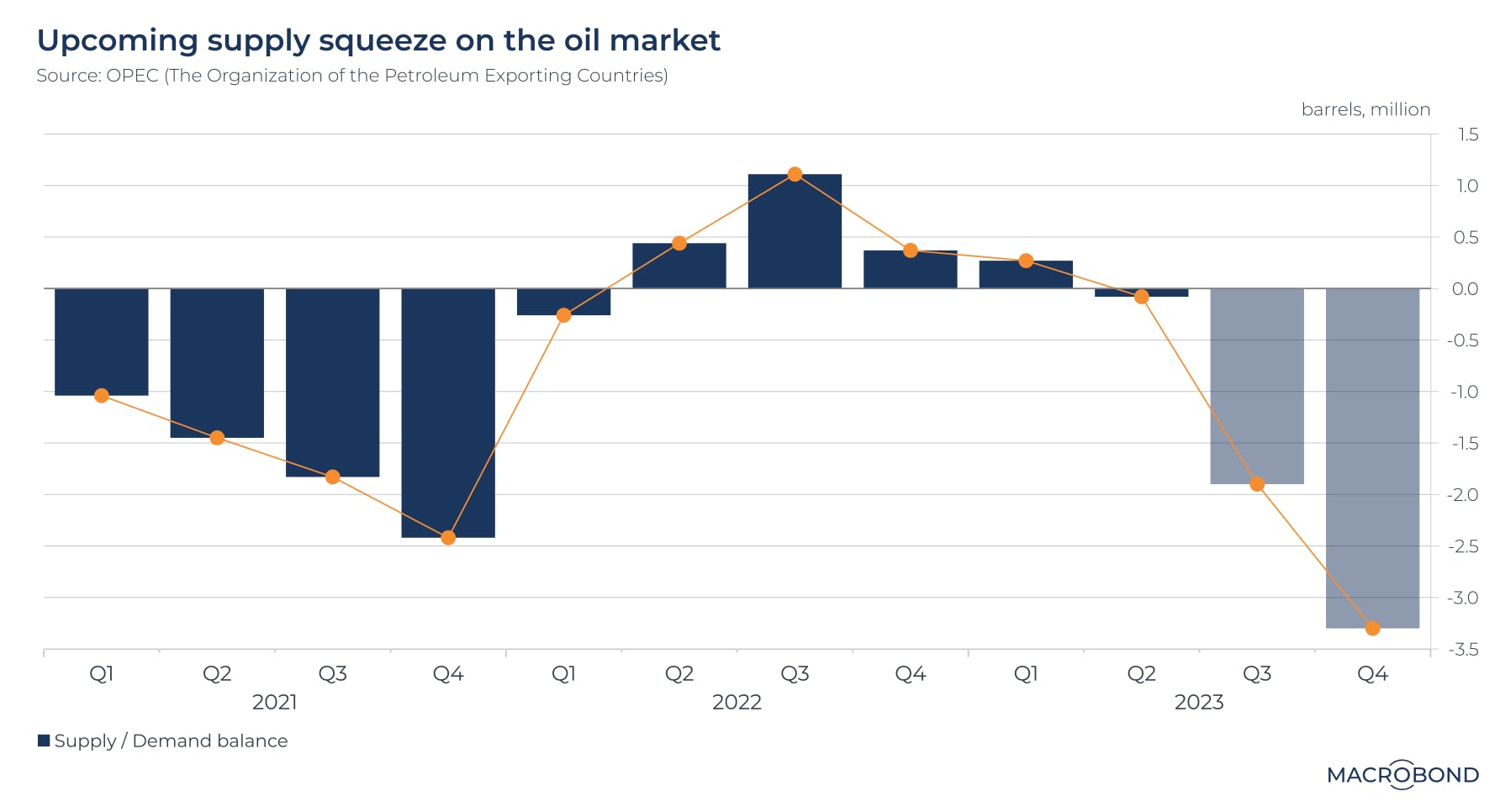

Oil market faces supply squeeze as output is cut

Saudi Arabia has extended its 1 million barrel-a-day output cut through the year's end, and in tandem with Russia's decision to reduce oil exports, the global oil market is poised for a supply shortage. This expected deficit, indicated to reach 3 million barrels by year-end, coupled with rising consumption, is likely to intensify market tensions, compelling consumers to draw from their stockpiles and subsequently driving up oil prices.

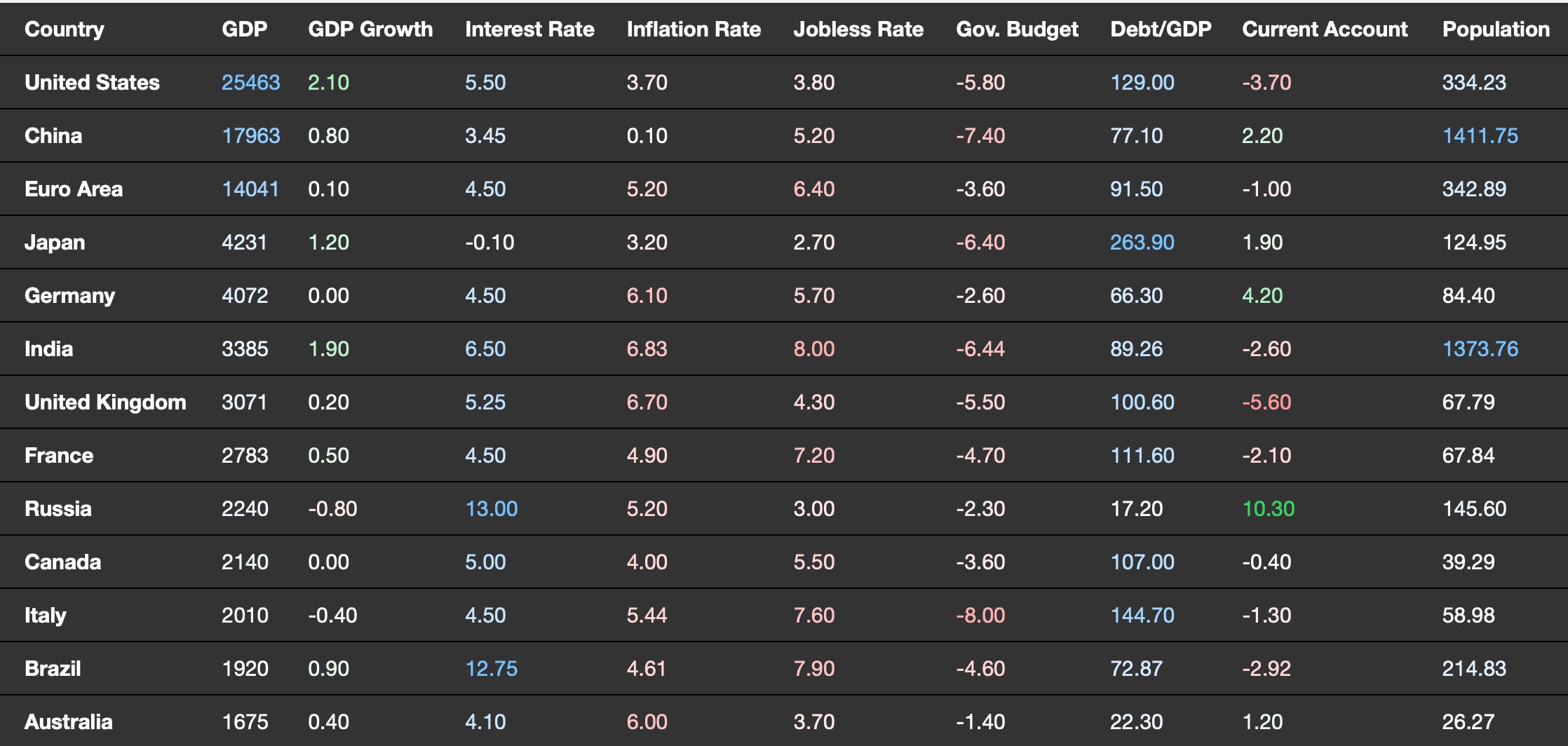

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie