Home > Edgenie Sunday Schroll: Newsletter > Mark Schemes Aren't Enough for A/A* Grades – Here’s Why 👇

Jump to Section:

Mark Schemes Aren't Enough for A/A* Grades – Here’s Why 👇

Ireland’s government has an unusual problem: too much money

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Germany's GDP Growth Stagnation: Economic Hurdles and Implications for the Eurozone

Germany’s real GDP growth has stalled significantly from 1991 to 2024, culminating in near-stagnation post-2019, with only a 0.19% increase since pre-pandemic levels. Factors like declining investment, weak export demand, structural challenges, and competition in core sectors have intensified this slowdown. A Deutsche Bundesbank report in October 2024 suggests that economic activity will “more or less” stagnate in late 2024, though a recession remains unlikely. As Europe’s largest economy, Germany’s lacklustre growth pulls down overall eurozone projections, with predictions by hedge fund manager Ray Dalio estimating Germany’s GDP growth at -0.5% annually over the next decade, tying it with Italy at the bottom among 32 major economies.

Chart of the Week

IMF Projects Slower Yet Resilient Growth in Asia for 2025

The IMF's October World Economic Outlook forecasts a slight slowdown in Asia’s GDP growth, predicting a 4.4% increase for 2025, a 0.2 percentage point drop from 2024, yet still above the global average of 3.2%. While growth in countries like the Philippines, Indonesia, Thailand, and Japan is expected to rise, Japan’s 2025 outlook, buoyed by real wage gains, contrasts with prior deceleration due to supply issues and waning tourism impacts. In China, weakening property investments and consumer confidence weigh on growth, though new fiscal and housing measures may boost recovery in 2025. The IMF warns of risks from subdued global demand, particularly from the U.S., which could impact Asia's export-dependent economies.

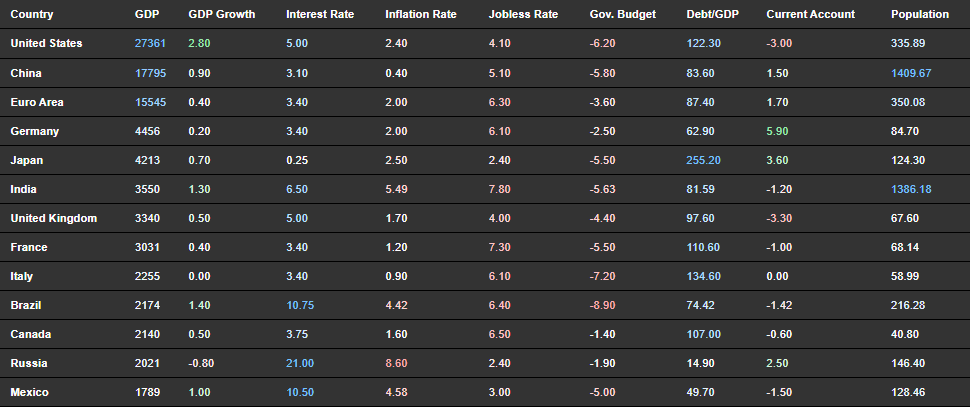

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie