Home > Wednesday Wisdoms: Newsletter > Mastering A-Level Economics Topics From Scratch - Your Step-By-Step Guide! 🚀

Jump to Section:

Mastering A-Level Economics Topics From Scratch - Your Step-By-Step Guide! 🚀

1. Incorporating Visual & Written Learning

Bank of England flags concerns over longer mortgages and rise in credit card use

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

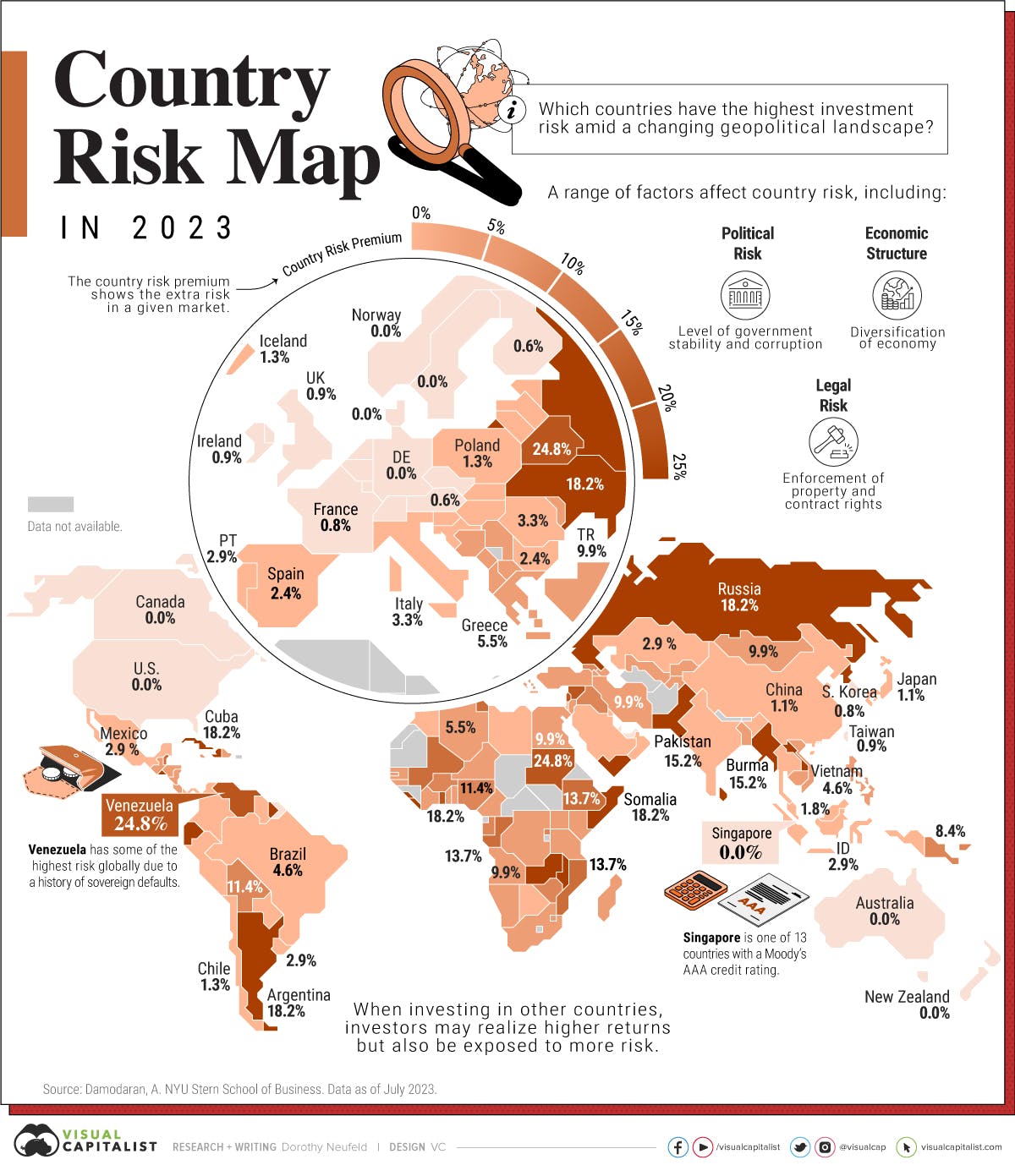

Country Risk Map

In 2023, investment risks across countries differ due to geopolitical, legal, and economic factors. An analysis by Aswath Damodaran of NYU's Stern School of Business reveals that Belarus, Lebanon, Venezuela, Sudan, and Syria have the highest investment risks, with issues ranging from military operations to hyperinflation. In contrast, countries like several European nations, Singapore, and New Zealand exhibit the lowest risks, attributed to strong financial indicators like AAA-rated government bonds and robust property rights. Investors seeking opportunities in emerging economies must weigh these country-specific risks against potential rewards, especially as these risks can significantly impact the performance of various financial assets.

Chart of the Week

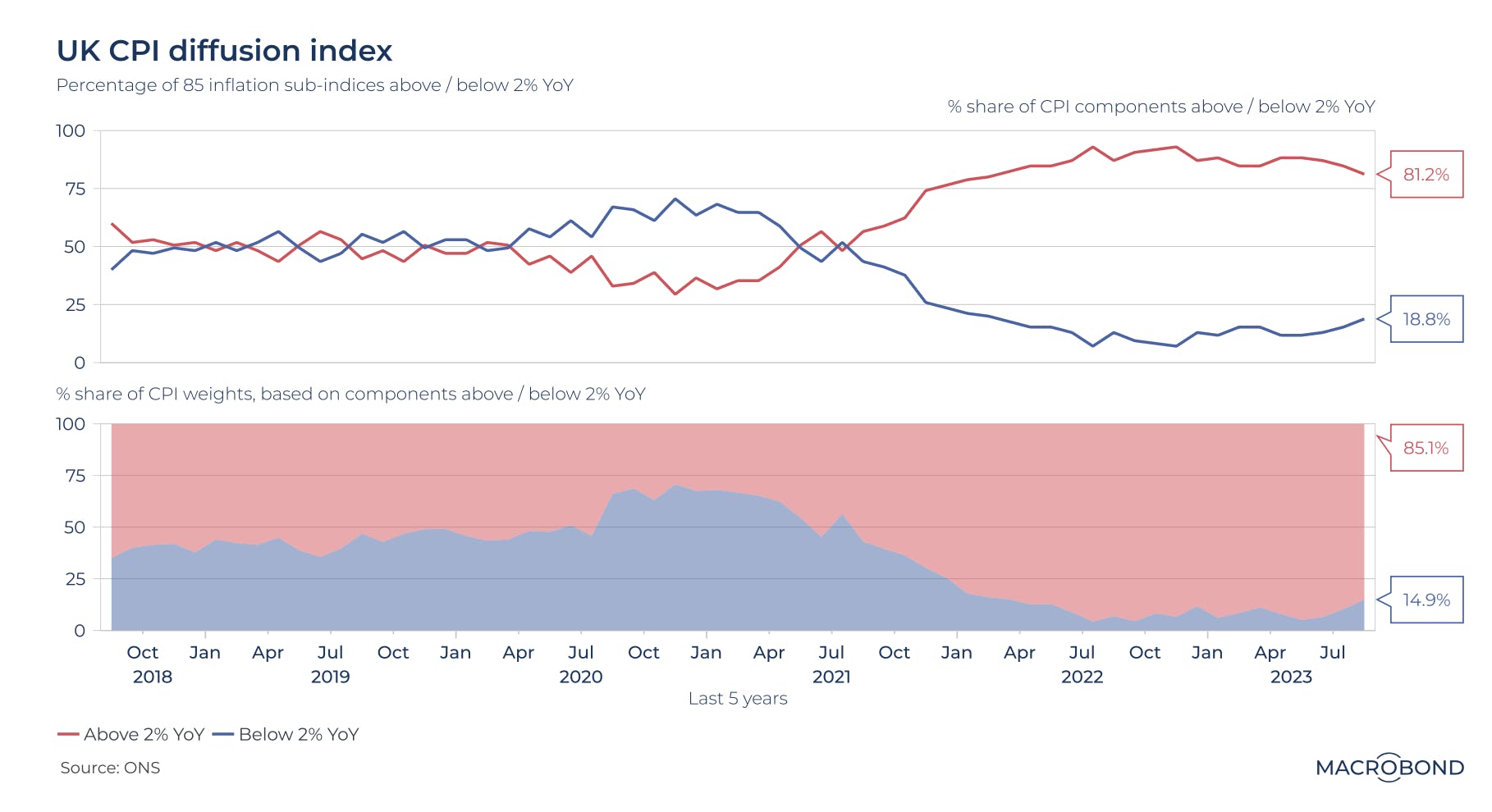

Inflation is sticky for more than 80% of Britain’s CPI basket

Britain is grappling with a persistent inflation issue. A diffusion index, based on 85 distinct sub-indices within the CPI basket monitored by the Office for National Statistics, reveals that a significant portion of this basket has sticky inflation. The chart shows that out of the 85 categories, 69 have experienced price increases exceeding 2% year-on-year. Furthermore, when adjusted for their importance in the overall inflation basket, the data implies an even greater strain on consumers. This shift from the deflationary periods observed during the pandemic is pronounced. Alarmingly, the Bank of England might take note that these proportions have remained nearly constant throughout the past year, suggesting that inflation in Britain is proving hard to curb.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie