Home > Wednesday Wisdoms: Newsletter > Most students have uphill hopes but downhill habits

Jump to Section:

Most students have uphill hopes but downhill habits 🎓📉

Unilever, Nestle, PepsiCo Should Do More to Lower Prices, French Official Says

Summary:

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

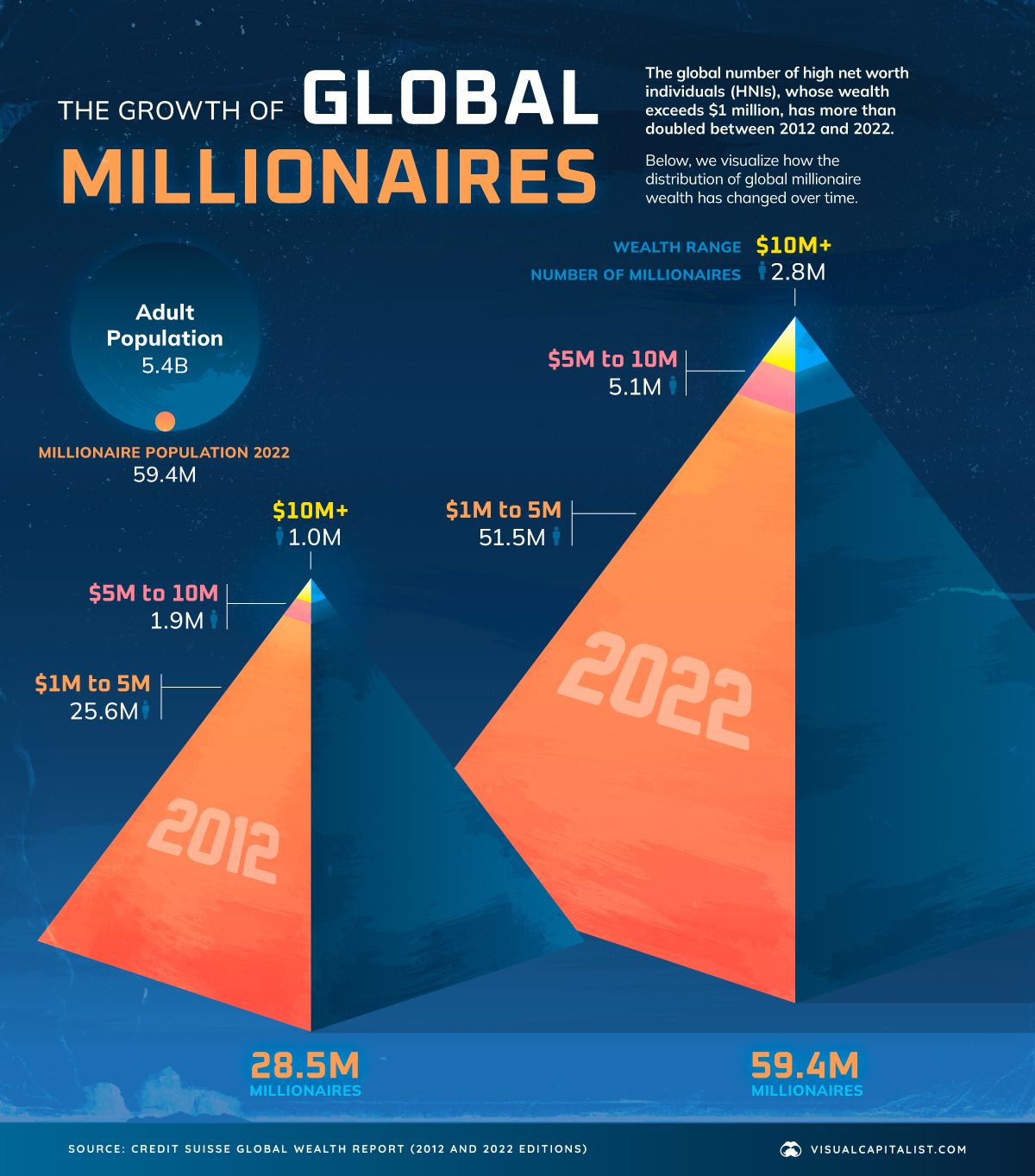

The Growth of Global Millionaires

The significant growth in the global millionaire population over the past decade is highlighted, with 1.1% of the world's adults classified as millionaires in 2022, up from 0.6% in 2012. According to the Global Wealth Report by Credit Suisse, the total wealth held by millionaires in 2022 amounted to $208.3 trillion, representing 45.8% of global wealth and marking a 138% increase from 2011. The number of ultra-high-net-worth individuals has nearly tripled in the last decade. Despite economic challenges such as inflation and interest rates, the millionaire population is expected to reach 86 million by 2027. Meanwhile, wealth inequality, which worsened during the 2020-2021 pandemic period, saw a slight decline in 2022, although over half of the world's adults still hold less than $10,000 in wealth, accounting for just 1.2% of global wealth.

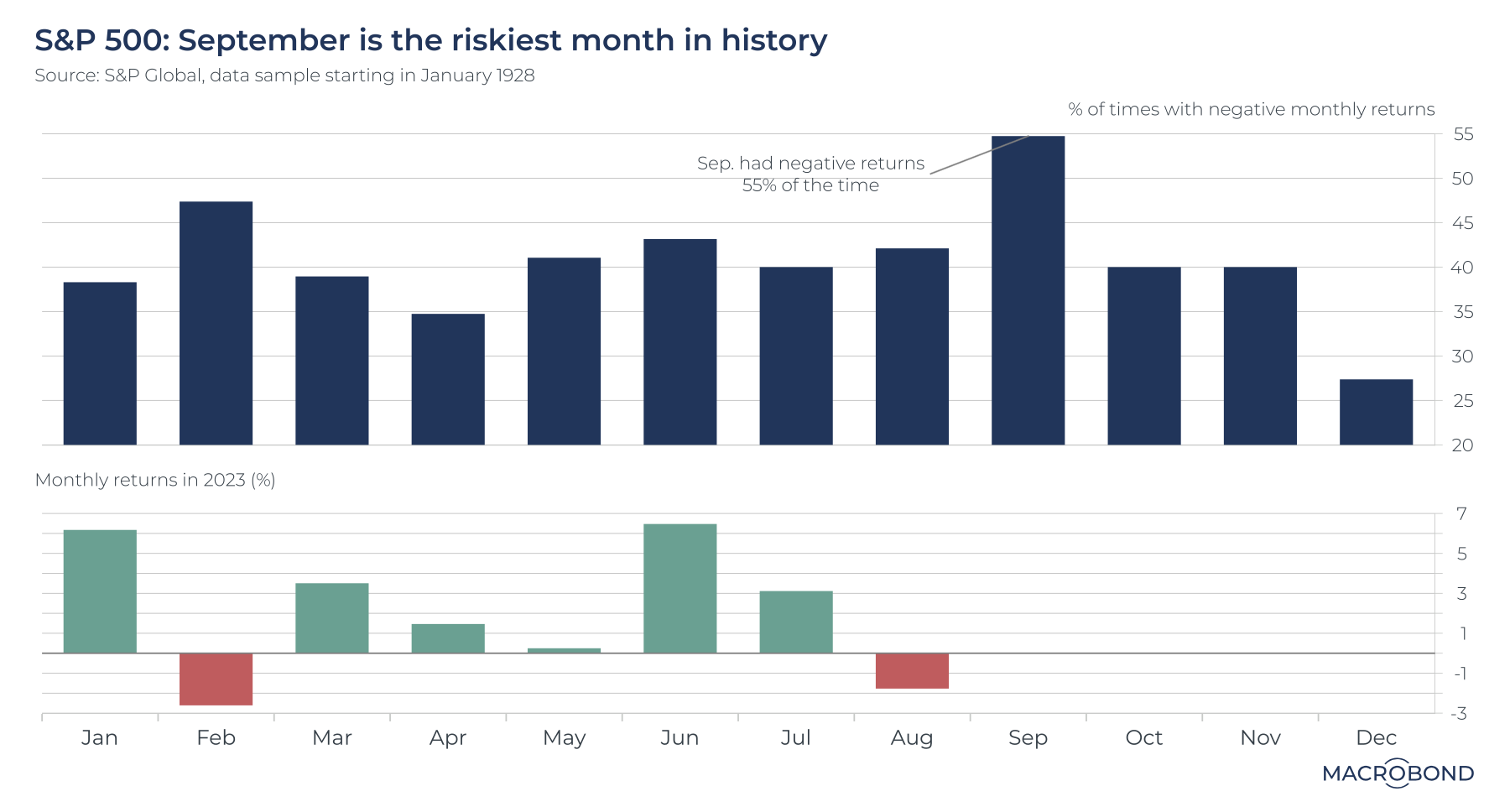

Chart of the Week

August proved to be a challenging month for US equities, with the S&P 500 experiencing a nearly 2% decline. Historical data indicates that September has been the worst-performing month for the index, with declines occurring in 55% of the calendar years since 1928 and an average return of less than 1%. Despite the turbulent trends in October and November, known for historic market crashes, investors have some solace in December, which has historically been the most bullish month with positive returns nearly 70% of the time.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie