Home > Wednesday Wisdoms: Newsletter > Not all 25 markers are the same...

Jump to Section:

Delivery firm Getir to quit UK, Europe and US and focus on Turkey

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

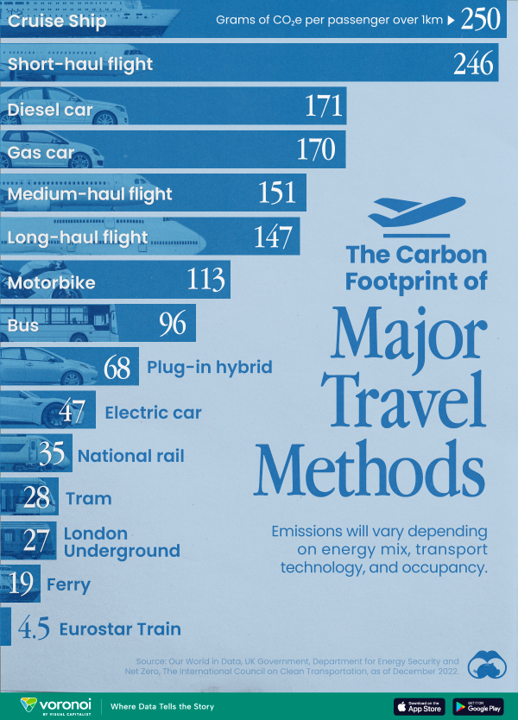

Travel's Carbon Footprint: From Cruise Ships to Electric Cars

Transport is a major contributor to global CO₂ emissions, making up nearly a quarter of all energy-related emissions. A recent comparison highlights the carbon footprints of popular travel methods, showing the amount of carbon dioxide equivalent (CO₂e) released per person per kilometer traveled. Cruise ships emerge as the most carbon-intensive mode of transport due to their heavy fuel oil use and the large amounts of power required for onboard facilities. Similarly, short-haul flights are notably high in carbon output, mainly because of the fuel burned during takeoff and climb. On the other end, the Eurostar and other rail forms prove to be much more carbon-efficient. Electric vehicles (EVs), though potentially greener, still have a carbon footprint that depends heavily on the energy source used for charging, highlighting the complexity of achieving true low-carbon travel. Data from reliable sources like Our World in Data and various government and international bodies support these findings, though they caution that these numbers are approximations influenced by many variables.

Chart of the Week

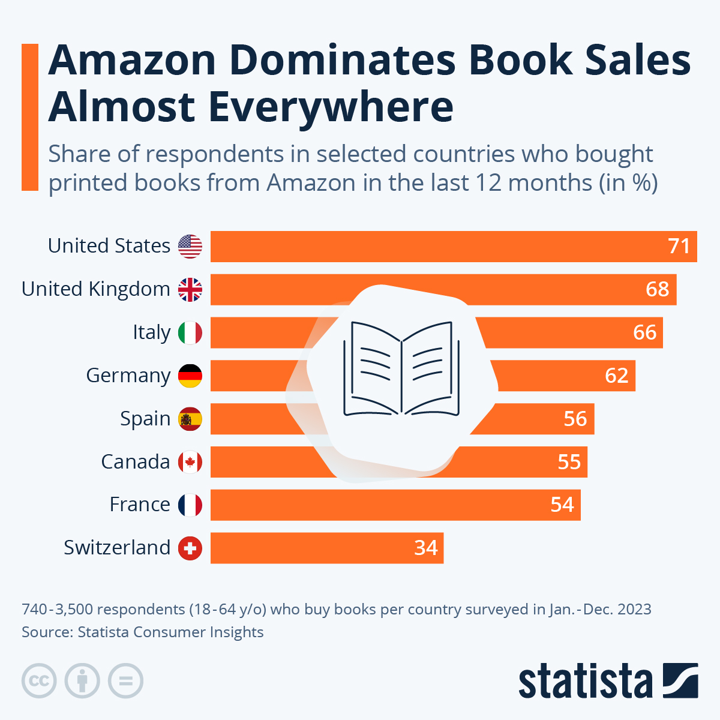

Amazon Leads Global Book Sales: A Look at Recent Trends

Amazon continues to assert its dominance in the global book market, capturing significant market shares in various countries, as indicated by Statista's latest Consumer Insights survey. In the U.S., a striking 71% of adults reported purchasing books from Amazon in the past year, leading the charge in digital book sales. The UK follows closely with 68%, and other European nations like Italy and Germany show robust figures at 66% and 62% respectively. Despite stiff competition from local European booksellers such as La Feltrinelli in Italy and Fnac in France, Amazon's convenient and often more affordable online platform maintains a strong appeal among book buyers worldwide.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie