Home > Wednesday Wisdoms: Newsletter > Post-Mock Reflections: What should you do?

Jump to Section:

UK economy falls into recession, adding to Sunak's election challenge

Summary

Possible A Level Economics 25 Marker Question

Infographic of the Week

Global Consumer Dynamics: The Shifting Landscape of Consumerism by 2030

Despite the global consumer class being projected to expand by over 100 million in 2024, a striking demographic shift is underway, leading to a reduction in consumer numbers within several key economies by 2030. Data from the World Data Lab in 2023 highlights Japan's significant expected decrease by 3.6 million, attributed to a low birth rate and an aging population, impacting its workforce and consumer base. Italy faces a "national emergency" with consumer numbers expected to fall by 480,000, driven by record-low birth rates. Other European nations, including Germany and Portugal, as well as Taiwan and Bulgaria, are also facing reductions in their consumer class sizes due to aging populations, declining birth rates, and emigration of the working-age population. This demographic shift signals a change in demand towards healthcare, leisure, and retirement services, as the average age of the consumer increases.

Chart of the Week

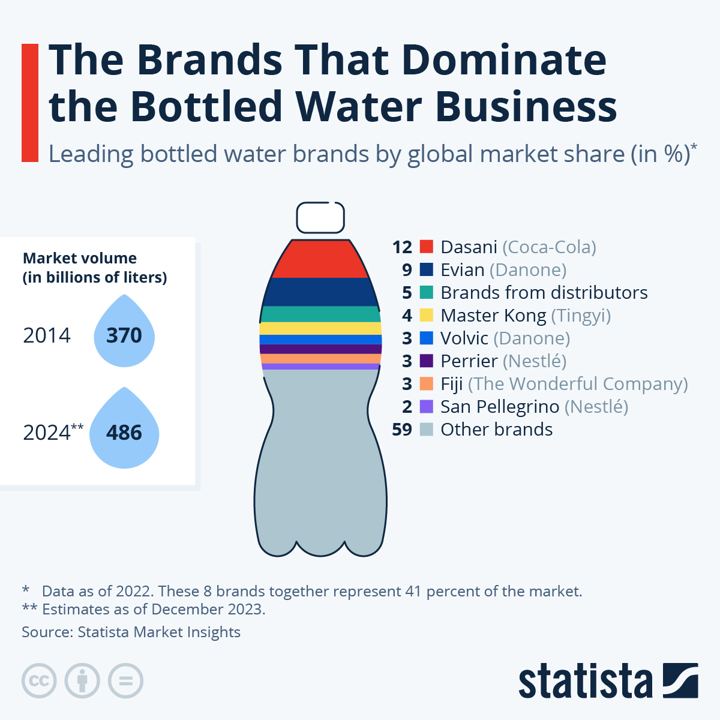

Scrutiny on Bottled Water Giants Amidst Illicit Purification Practices

In a recent exposé by Le Monde and Radio France, it has emerged that major bottled water brands, including Nestlé Waters’ Perrier, Vittel, Hépar, and Contrex, have been employing forbidden purification methods such as ultraviolet and activated carbon filtration. This revelation has surfaced despite stringent French regulations that disallow the disinfection of mineral waters to preserve their natural microbiological integrity. The French government has been cognizant of these breaches since August 2021 but has maintained a low profile in managing the fallout. Amidst this controversy, the global bottled water market continues to flourish, with Coca-Cola’s Dasani and Danone’s Evian leading the sector, contributing to an industry where sales are expected to surge past $360 billion by 2024, marking a significant 60 percent increase over the decade.

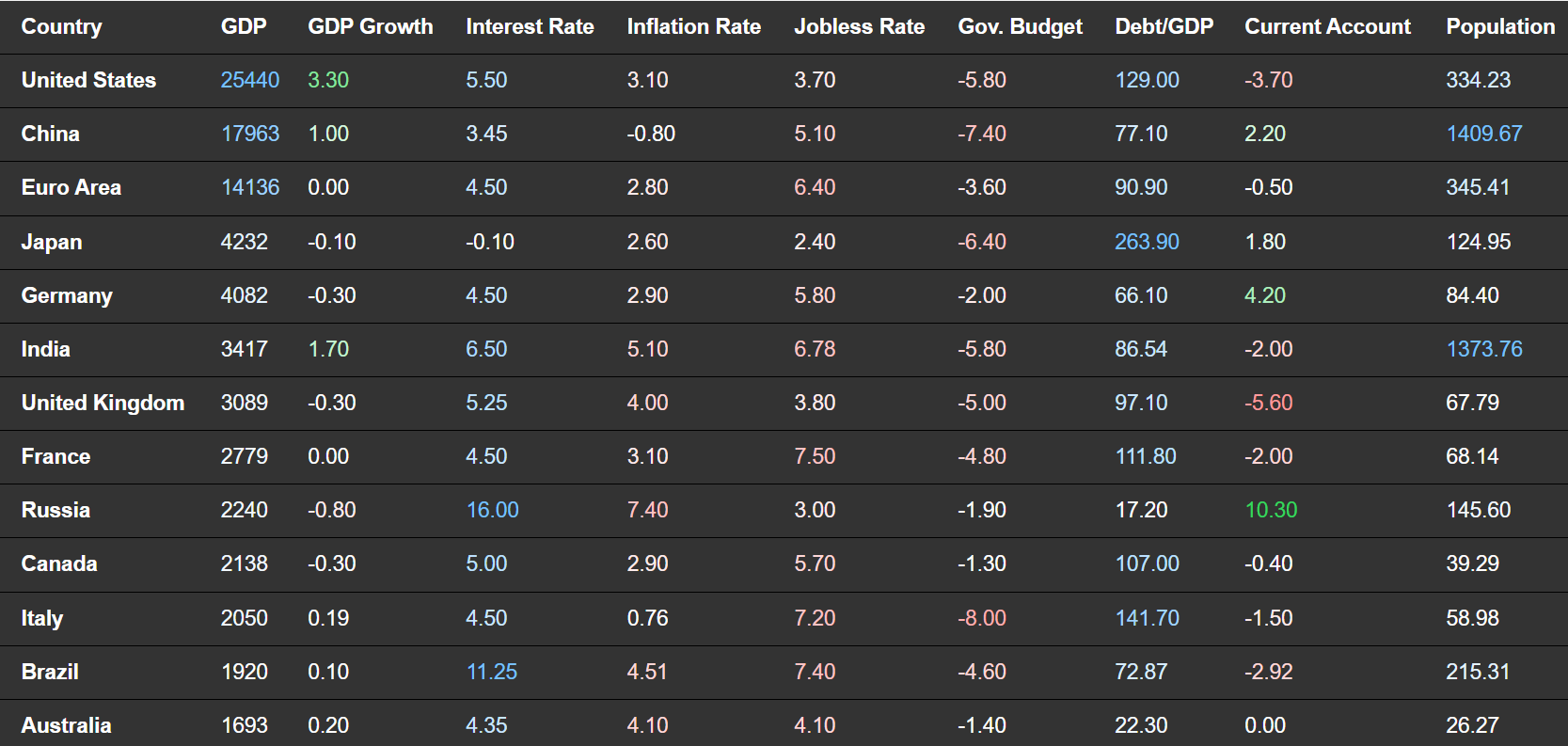

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie