Home > Wednesday Wisdoms: Newsletter > Preparing for A level Economics? This is what I would focus on..

Jump to Section:

Preparing for A level Economics? This is what I would focus on..

Jeremy Hunt’s scope for tax cuts hit by higher-than-expected borrowing

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

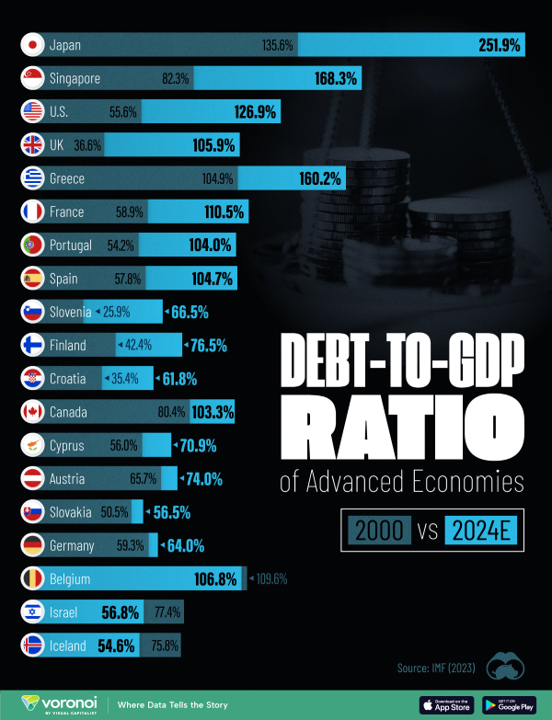

Surge in Global Debt-to-GDP Ratios: A 24-Year Perspective

Since the year 2000, debt-to-GDP ratios have escalated significantly across the world, particularly following the 2008 financial crisis and the COVID-19 pandemic. An analysis based on IMF data reveals stark increases in these ratios for advanced economies from 2000 to 2024, highlighting how much countries owe in relation to their economic size. Japan, Singapore, and the United States have seen the largest increases, with their debt-to-GDP ratios rising by 116.3, 86.0, and 71.3 percentage points, respectively, reflecting growing financial obligations and the potential stress on future budgets due to higher interest payments. Conversely, Belgium, Iceland, and Israel are the rare cases where the debt-to-GDP ratios have decreased, with Iceland's reduction attributed to robust GDP growth and effective debt management. This evolving debt landscape underscores the varying fiscal health and economic strategies of nations over nearly a quarter of a century.

Chart of the Week

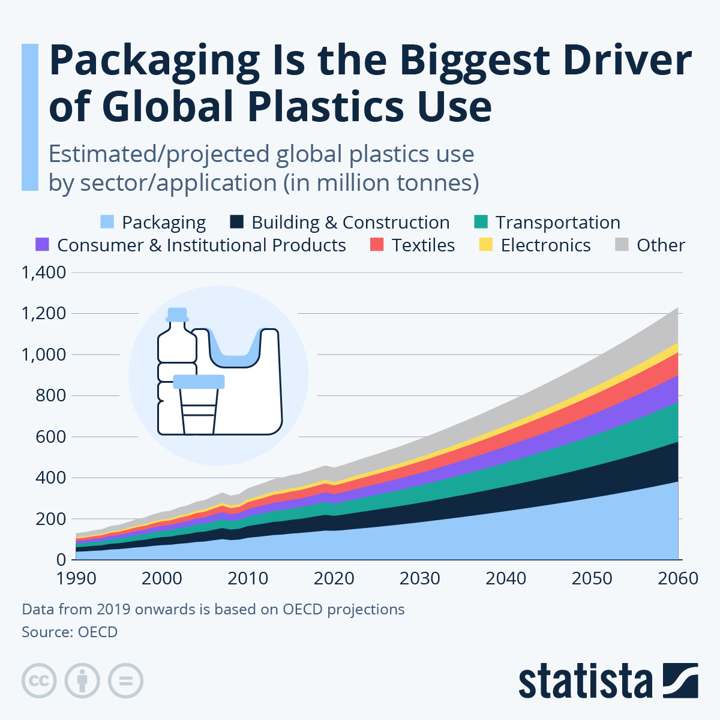

Earth Day 2024: Tackling the Plastics Crisis

Earth Day 2024, themed "Planet vs. Plastics," focuses on combating plastic pollution, a significant environmental issue. Since 1970, Earth Day has mobilized global action towards sustainability. This year, attention is drawn to the rampant increase in plastic use, primarily driven by packaging. From 1990 to 2019, plastic consumption soared by 250% to 460 million tonnes, with projections of further increases. The urgent call is for a 60% reduction in plastic production by 2040, starting with the elimination of single-use plastics by 2030. The day also casts a critical eye on the fast fashion industry, which contributes heavily to the crisis, with the majority of discarded garments ending up in landfills or incinerators.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie