Home > Wednesday Wisdoms: Newsletter > 🌟 Question Practice = The Secret to A/A* Grades!

Jump to Section:

🌟 Question Practice = The Secret to A/A* Grades!

Why UK recession may be deeper than two quarters of falling GDP suggest

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

Global Shifts: Tracing the Path to the World's Lowest Corporate Tax Havens

The global landscape of corporate tax rates in 2023 reveals a strategic positioning by smaller nations to lure multinational corporations and foreign investments with notably low taxation rates. Among these, Barbados emerges as a standout, offering a mere 5.5% corporate tax rate, positioning itself as a prime tax haven where American corporations alone have redirected profits surpassing the nation's GDP. This strategy reflects a broader trend observed across the globe, where countries like the UAE have recently adjusted their tax policies to a 9% rate, marking a significant shift from their previous 0% rate to align with international efforts towards moderate tax increases while diversifying revenue sources beyond the traditional reliance on the energy sector. This snapshot of the contemporary tax havens underscores a stark contrast to the scenario in 1980, where the lowest tax rates were significantly higher, exemplifying the global drift towards lower corporate tax rates, with 91% of jurisdictions now setting their rates below 30%, highlighting a transformative shift in global tax strategies to foster investment and economic growth.

Chart of the Week

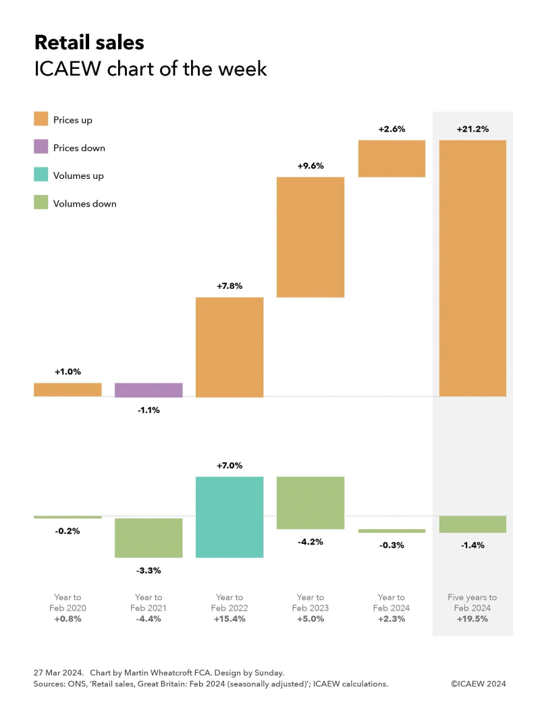

A Five-Year Retail Odyssey: Volume Declines Amidst Price Surges

Over the last half-decade,Great Britain's retail sector has navigated through tumultuous times, marked by a pandemic onset and a subsequent cost-of-living crisis, culminating in a complex retail sales growth of 19.5% up to February 2024, as per the Office for National Statistics. This growth, however, reveals a nuanced picture: a decrease in sales volumes by 1.4%, overshadowed by a significant 21.2% climb in prices, reflecting the changing consumer behaviour and economic challenges faced. Initially, the pre-pandemic year to February 2020 saw a modest retail sales uptick of 0.8%, quickly overturned by a 4.4% slump in the first pandemic year due to reduced spending. A remarkable rebound occurred in the year to February 2022 with a 15.4% surge as consumer confidence returned, only to be dampened by the cost-of-living crisis leading to a 5% increase in sales driven primarily by price hikes in response to inflation. The subsequent year saw a more tempered 2.3% growth, with the tale of the tape over these five years showing an average annual retail sales increase of 3.6%, split between a marginal average annual fall in volumes and a more pronounced average price increase.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie