Home > Edgenie Sunday Schroll: Newsletter >Skipping Steps in Your Analysis? Why It’s Costing You Marks

Jump to Section:

Don't Cut Corners in Your Analysis – Here's Why

UK regulator paves way for £16.5bn Vodafone-Three merger

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

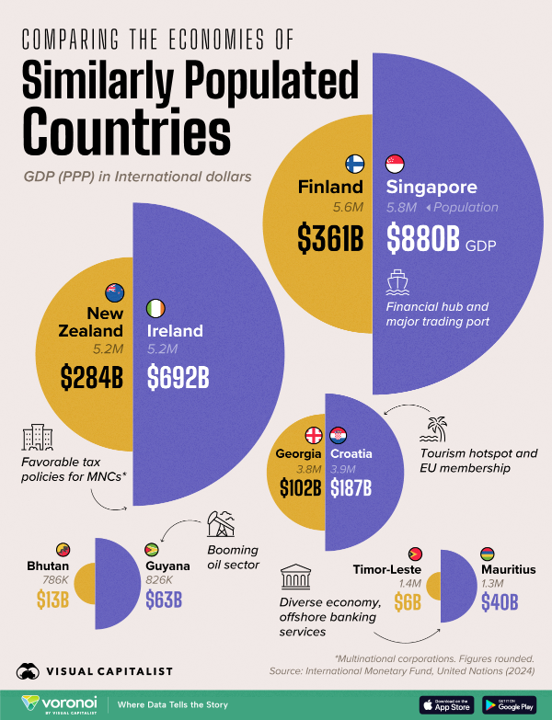

Infographic of the Week

Same Populations, Vastly Different Economies

Germany’s real GDP growth has stalled significantly from 1991 to 2024, culminating in near-stagnation post-2019, with only a 0.19% increase since pre-pandemic levels. Factors like declining investment, weak export demand, structural challenges, and competition in core sectors have intensified this slowdown. A Deutsche Bundesbank report in October 2024 suggests that economic activity will “more or less” stagnate in late 2024, though a recession remains unlikely. As Europe’s largest economy, Germany’s lacklustre growth pulls down overall eurozone projections, with predictions by hedge fund manager Ray Dalio estimating Germany’s GDP growth at -0.5% annually over the next decade, tying it with Italy at the bottom among 32 major economies.

Chart of the Week

Economic Complexity Fuels Productivity

Countries with higher economic complexity scores, reflecting the diversity and sophistication of their exports, tend to exhibit greater labour productivity, suggesting a strong link between economic structure and output. Higher-income G-20 nations, having transitioned from agrarian to industrial and service-oriented economies, achieve elevated complexity and productivity. In contrast, many middle-income countries remain reliant on commodity exports, limiting their economic complexity and overall productivity. This highlights the transformative role of economic diversification in driving development.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie