Home > Wednesday Wisdoms: Newsletter > Stop including your diagrams like this

Jump to Section:

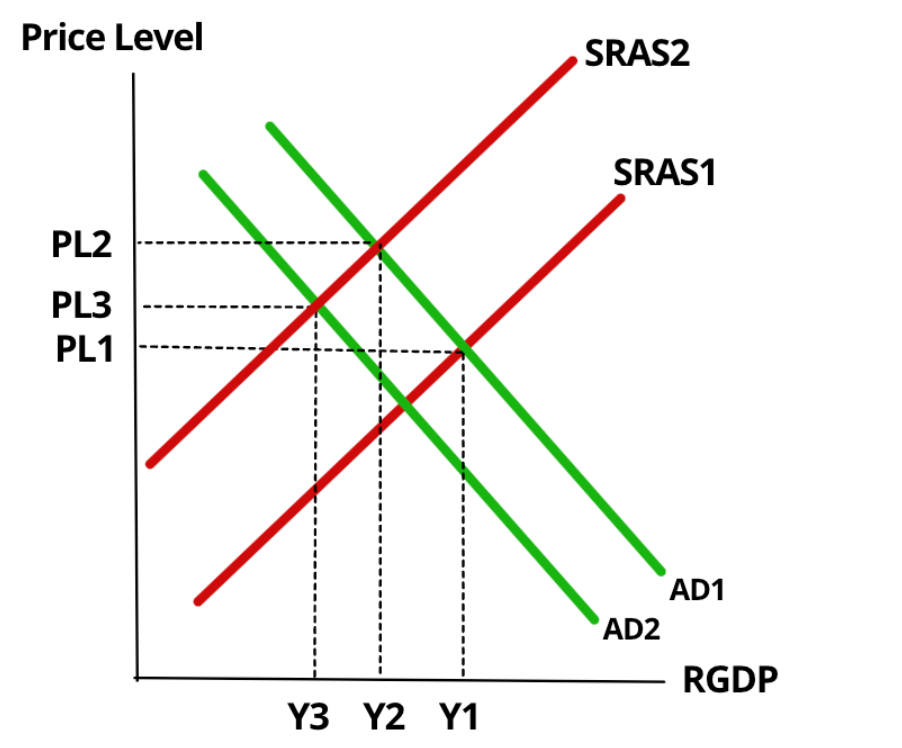

Stop including your diagrams like this

UK’s weak economy is taking a toll on its labour market

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

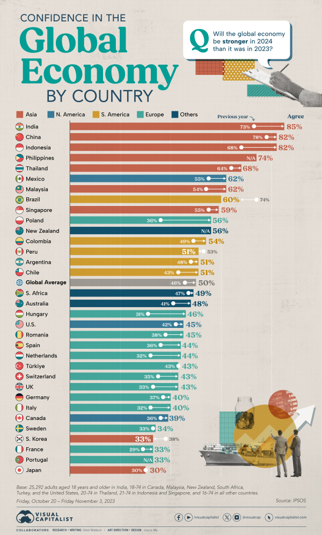

Infographic of the Week

A Global Divide: Economic Confidence Varies Widely from Asia to Europe

Survey data collected between October and November 2023 suggests a split view on the strength of the global economy in 2024, with an average of 50% of respondents across 33 countries expressing confidence, up by 4 percentage points from the previous year. India leads with 85% of respondents feeling positive, closely followed by Indonesia and China at 82%. Asia dominates the top of the optimism rankings, whereas Japan and South Korea show notable skepticism. Brazil reflects the highest optimism in South America, despite a 13-point drop, and Europe remains largely pessimistic, with Poland as the exception. Notably, major European economies like Germany and France are among the least confident, suggesting regional variations in economic expectations for 2024.

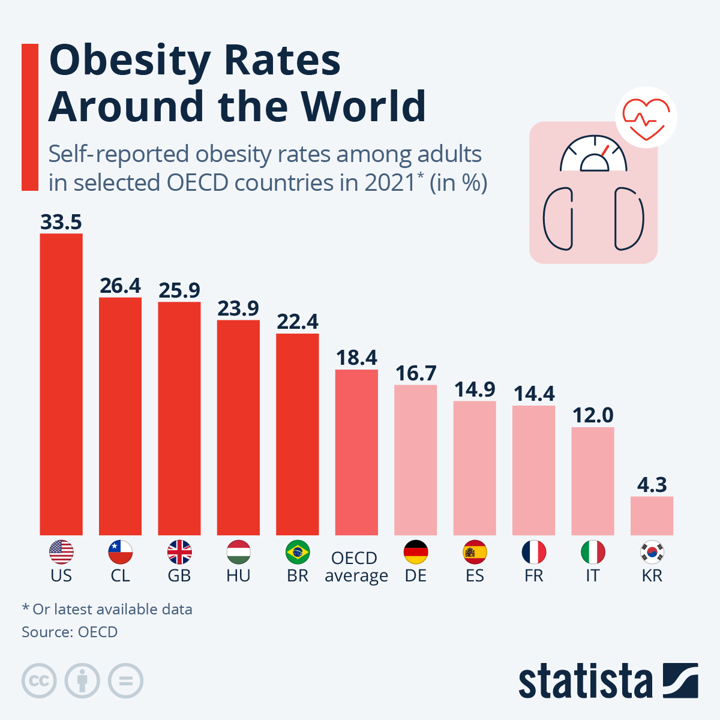

Chart of the Week

Global Weigh-In: Navigating the Obesity Landscape

In 2021, obesity rates were worryingly high across OECD countries, with the US leading at 33.5% and Korea presenting the lowest figure at 4.3%. Over half of the adults in surveyed countries were overweight or obese, with nearly one in five falling into the obese category. The prevalence of obesity was notably high in the US, with a third of respondents classifying themselves as such, followed by over a quarter in Chile and the UK. In contrast, Korea reported a significantly lower percentage. Men were more prone to obesity than women, with a notable 19-20 percentage point gap in countries like Germany, Luxembourg, and the Czech Republic. Misconceptions about obesity prevail, with the condition being more complex than just lifestyle choices, including factors such as genetics and environmental influences. These statistics are pertinent as the world marks World Obesity Day on the 4th of March, drawing attention to a global health challenge that goes beyond individual habits and speaks to broader societal issues.

Macroeconomic Data