Home > Wednesday Wisdoms: Newsletter > Stop Losing Marks: The Right Way to Tackle A-Level Economics Data Responses

Jump to Section:

A Level Economics: Where do your marks come from?

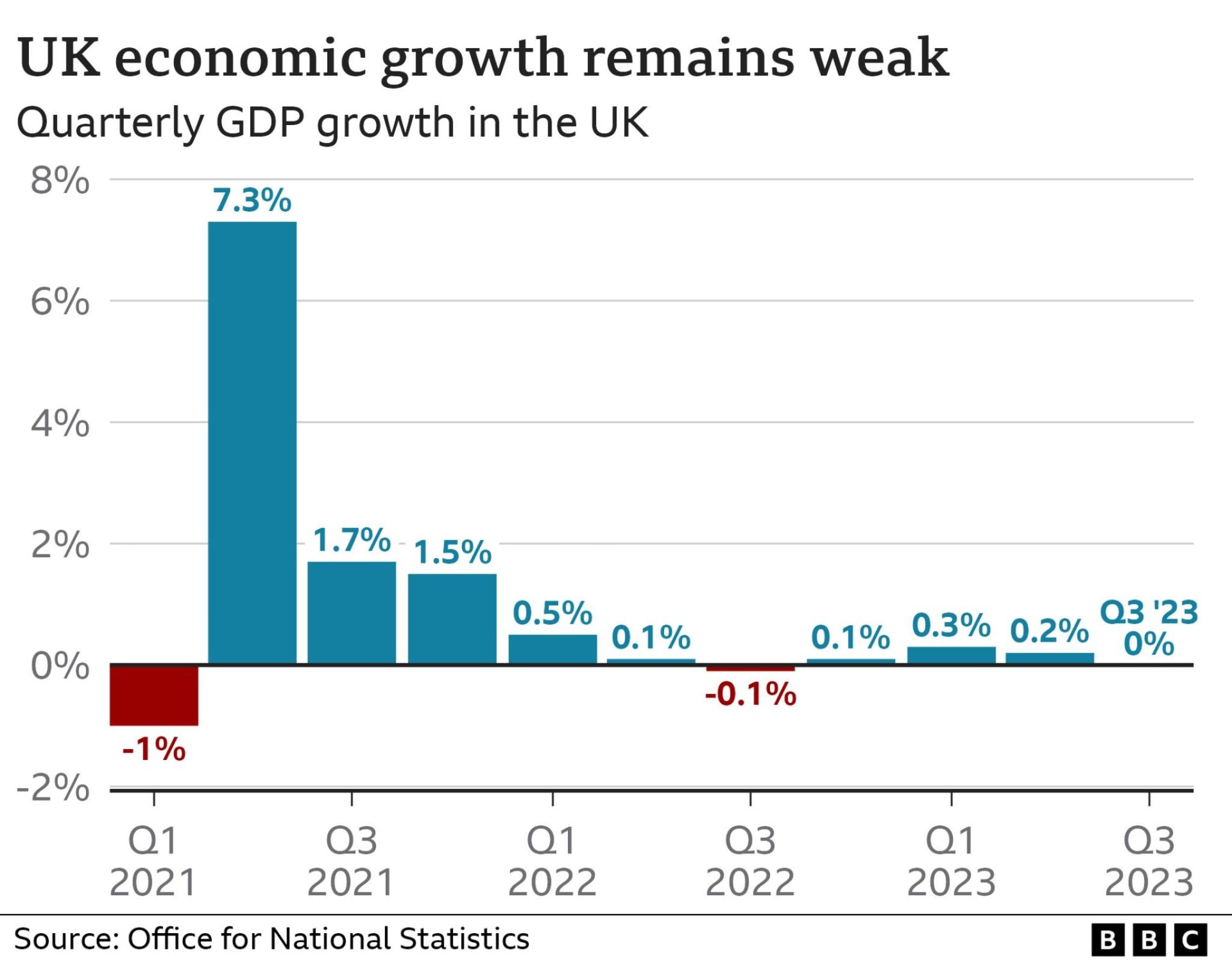

UK economy flatlines as higher interest rates bite

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

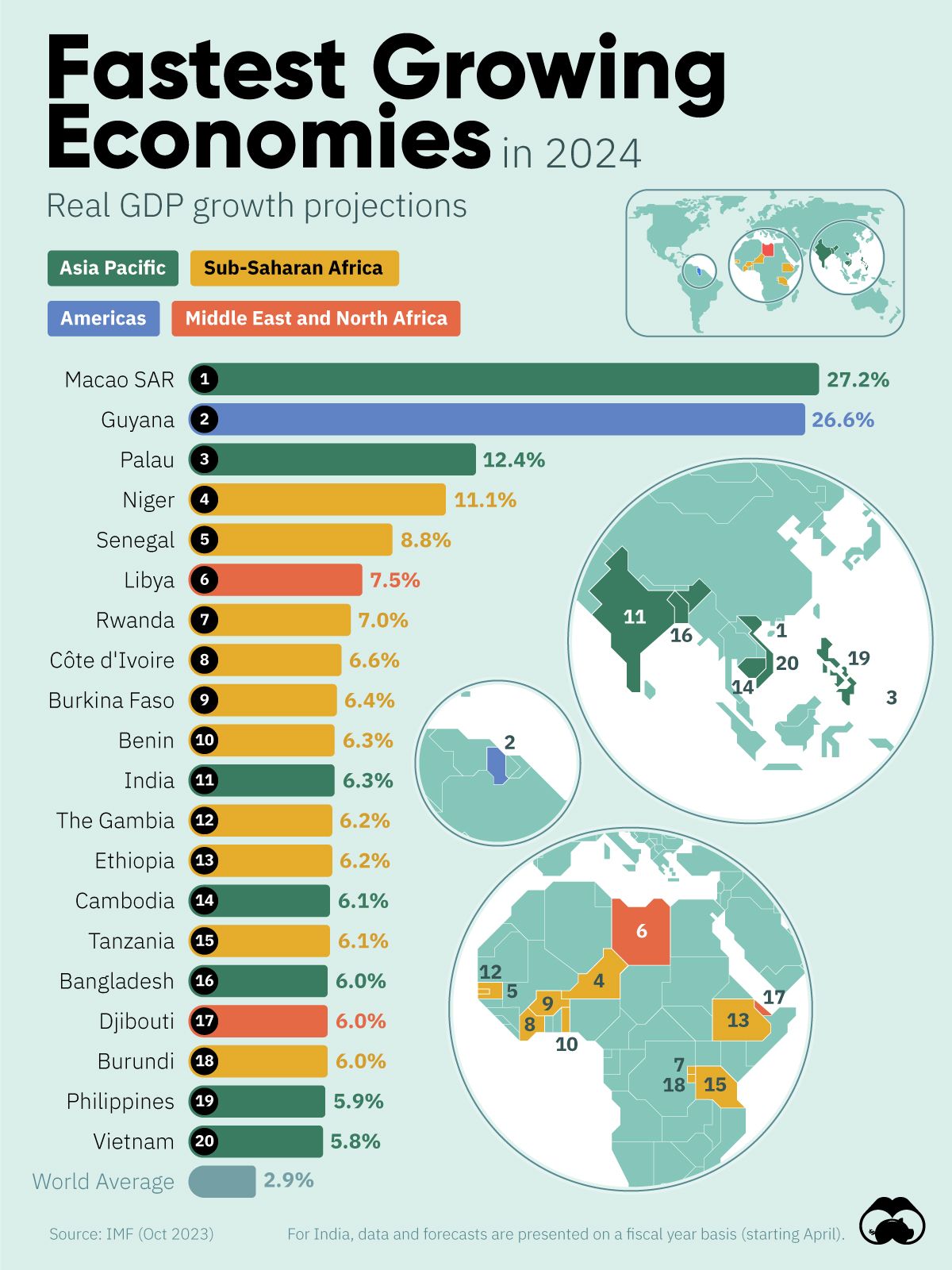

Accelerated Growth in Emerging Economies: IMF’s 2024 Outlook

The IMF's 2024 World Economic Outlook projects significant economic growth in Asia and Sub-Saharan Africa, with Macao SAR and Guyana leading at 27.2% and 26.6%, respectively. Key drivers include Macao's tourism-heavy economy and Guyana's burgeoning oil exports. Sub-Saharan Africa shows strong potential, with Niger and Senegal expected to grow at 11.1% and 8.8%. India's growth is forecasted at 6.3%, buoyed by its massive population, which is on course to peak at 1.7 billion by 2064. The oil industry plays a pivotal role in these economies, particularly in nations like Senegal and Guyana, where oil discoveries and exports are fuelling rapid economic expansion. Overall, the world average growth is estimated at 2.9%, highlighting the robust growth of these emerging markets.

Chart of the Week

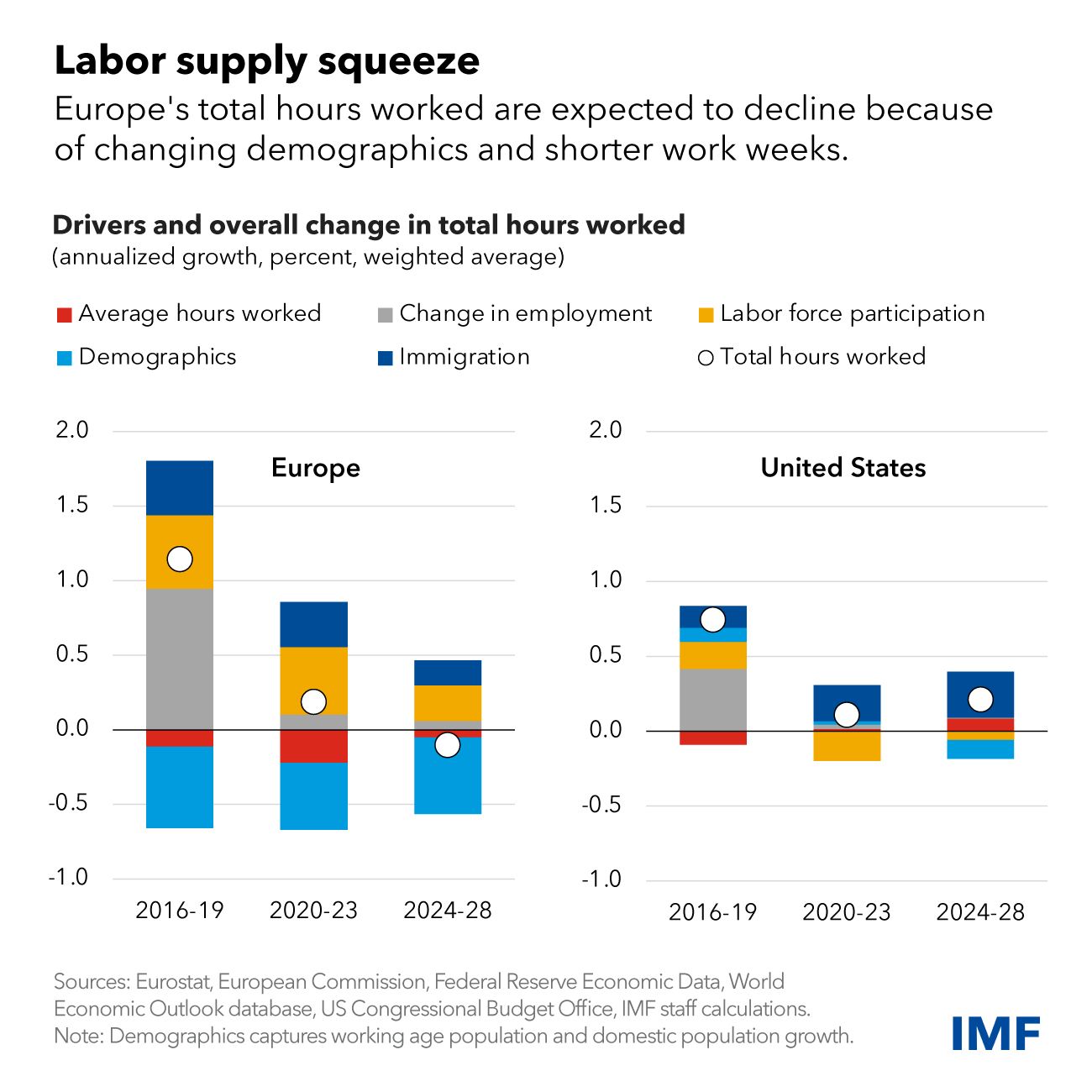

Navigating Europe’s Economic Landscape: Wage Growth Amidst Demographic Challenges

Europe's economic recovery is bolstered by rising wages, with nominal increases of 4.5% in the euro area and over 10% elsewhere in early 2023. This rise in wages, critical after years of diminished purchasing power, helps counter cost-of-living issues and supports economic growth. However, Europe faces demographic headwinds, notably aging populations and a shrinking workforce, which intensify wage pressures and risk stoking inflation. The variation in wage growth across Europe highlights regional disparities: in Western Europe, wages are still catching up with prices, suggesting continued pressure for increases, while Central and Eastern Europe see wages aligned with prices, though weakened productivity could impact competitiveness. The Chart of the Week illustrates the squeeze on labour supply due to demographic trends and shorter working weeks, increasing competition for skilled workers. Policymakers are thus challenged to balance economic recovery and inflation control, with structural reforms aimed at boosting productivity and labour market flexibility becoming increasingly vital.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie