Home > Wednesday Wisdoms: Newsletter > The silent productivity killer you've never heard of...

Jump to Section:

The silent productivity killer you've never heard of...

UK insolvencies rising due to high interest rates, says Begbies Traynor

Summary

Possible A Level Economics 25 Marker Question

Infographic of the Week

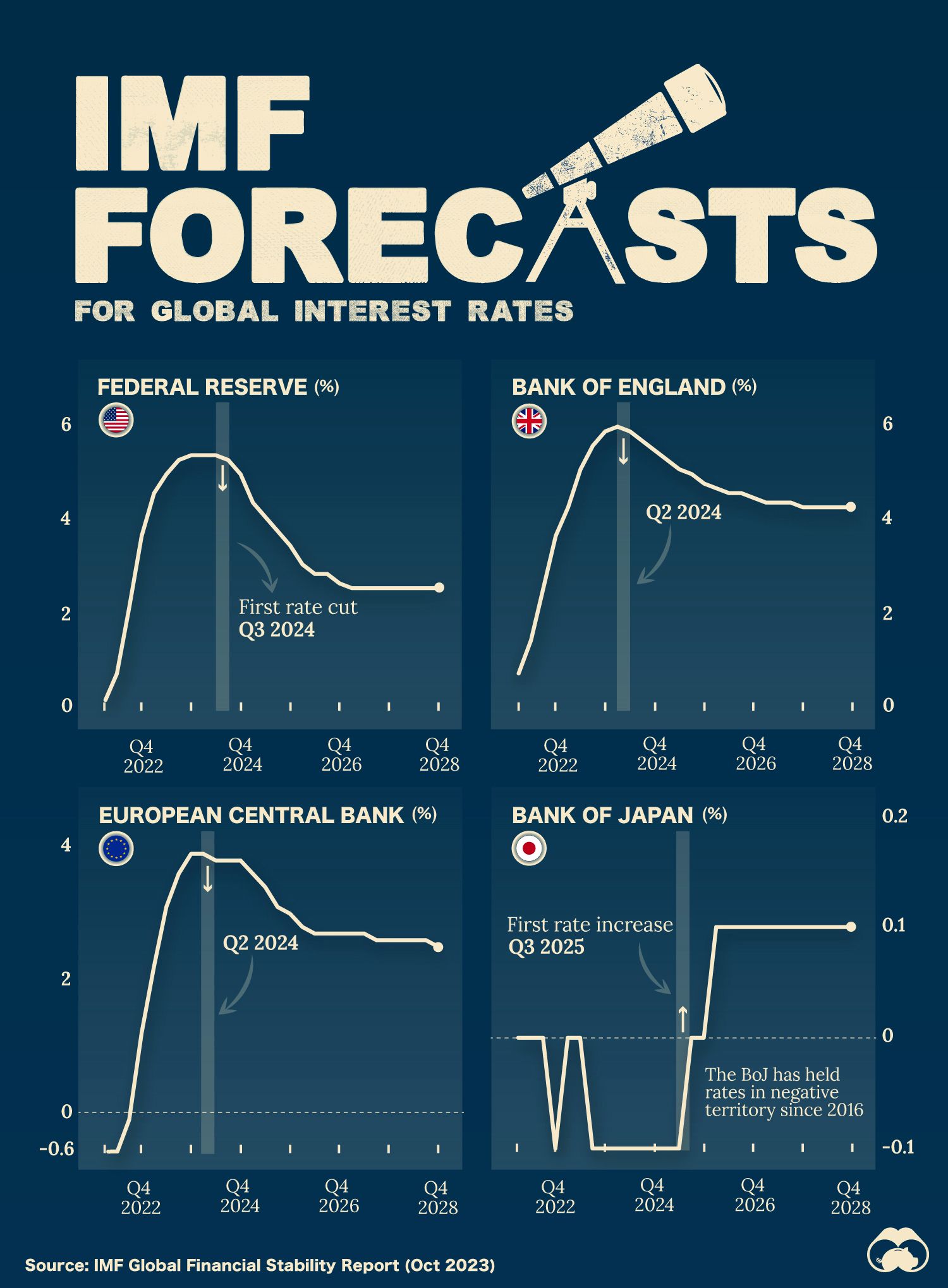

Interest Rate Trajectories: Navigating Through Economic Uncertainty

In response to persistent inflation, central banks across major economies have increased interest rates, with the EU, UK, and U.S. seeing hikes of at least 4 percentage points since 2022. The IMF forecasts that these rates will peak in early 2024, with the U.S. Federal Reserve expected to hit around 5.4% before rate cuts commence in Q3 2024. In contrast, Japan has maintained rates at or below zero since 2016 due to its long-term struggle with weak consumer demand, despite recent inflationary pressures and a falling yen. Looking ahead, the IMF predicts that Japan will witness its first interest rate rise in nine years by 2025. However, these projected rate adjustments remain contingent on the deceleration of inflation and could be influenced by major global events that impact economic conditions and policy decisions.

Chart of the Week

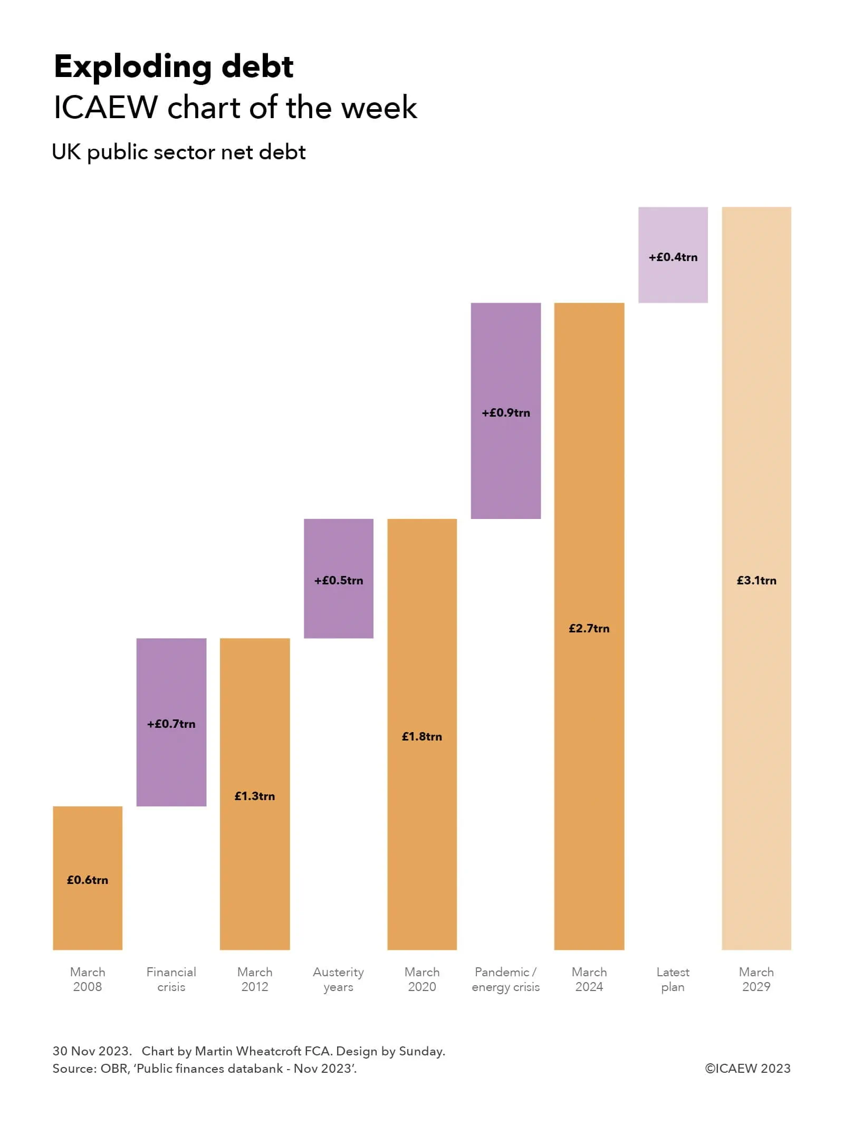

UK's Public Debt Surge: From Financial Crisis to Fiscal Future

Since the financial crisis of 2008, the UK's public debt has witnessed an unprecedented surge, escalating from £0.6 trillion to a forecasted £3.1 trillion by March 2029. The post-crisis years saw government borrowing reach £0.7 trillion, doubling the net debt by March 2012. Despite austerity measures, by March 2020, an additional £0.5 trillion had been borrowed. Pandemic and energy crisis spending are expected to add £0.9 trillion by 2024, with Autumn Statement 2023 outlining £0.4 trillion more in borrowing for the next five years. Commentators speculate that the projected spending cuts may be unattainable, potentially leading to further borrowing unless taxes increase. While the net debt to GDP ratio has spiked, from 35.6% in 2008 to an expected 97.9% in 2024, it's forecasted to decrease slightly to 94.1% by 2029, assuming economic stability prevails without new recessions or crises.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie