Home > Wednesday Wisdoms: Newsletter > What happens next....?

Jump to Section:

What happens next....?

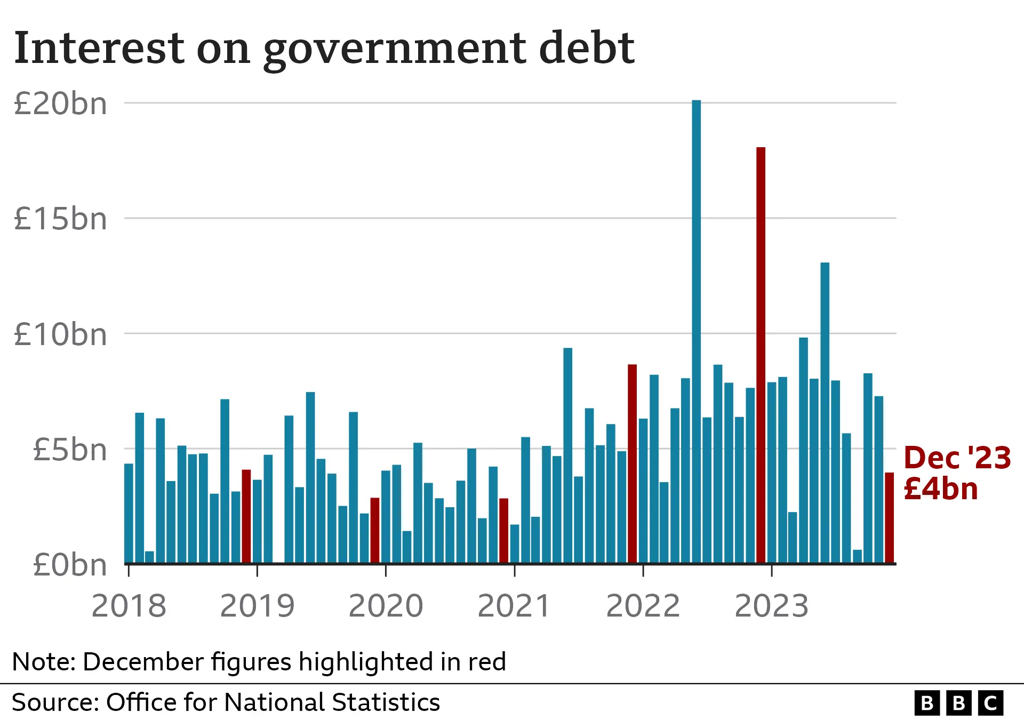

Lower UK government borrowing raises prospects of tax cuts

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

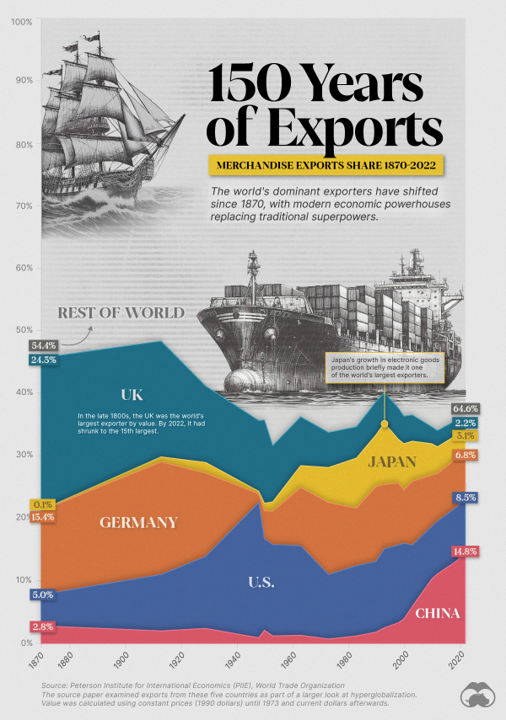

From Empire to Innovation: A 150-Year Journey of Global Trade Dominance

Over the last 150 years, the landscape of global exports has dramatically shifted, reflecting the rise and fall of economic superpowers. In the 19th century, Britain's industrial prowess led the world in merchandise exports, bolstered by its empire and efficient production, with India being a key export destination. Post-World War II, the United States emerged as the new leader in global exports, benefiting from its unscathed industrial base while Europe recovered from the war's devastation. Moving into the late 20th century, Japan's rapid growth, particularly in electronics, marked its ascent as a major player in global trade. Today, China stands at the forefront, commanding nearly 15% of all merchandise exports with its expansive manufacturing sector, producing everything from precision instruments to semiconductors. The journey from British dominance to China's current position underscores the dynamic nature of global trade, where economic power shifts in tandem with industrial and technological advancements, growing from $59 billion in 1948 to a staggering $24.3 trillion in 2022.

Chart of the Week

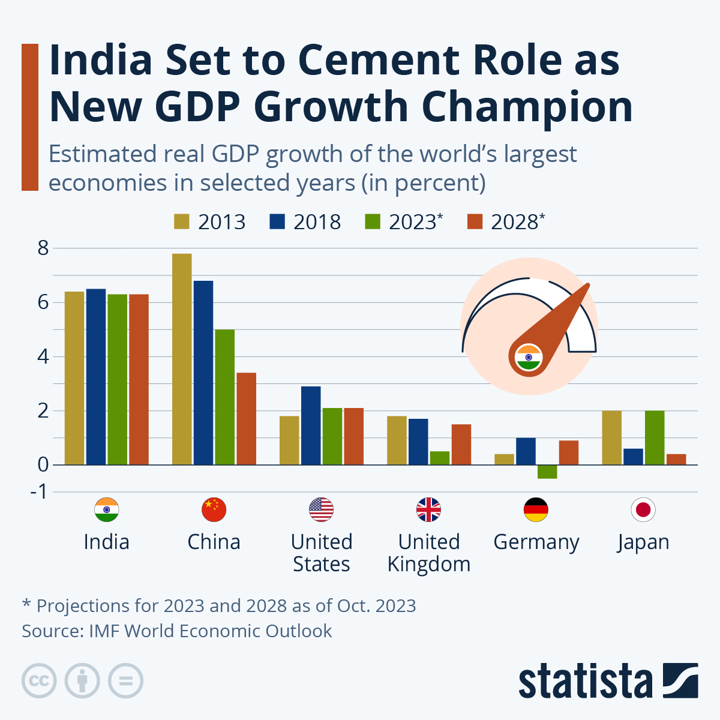

India's Economic Surge: Set to Outshine China in Global GDP Growth Race

The global economic landscape is witnessing a significant shift, with India emerging as a consistent frontrunner in GDP growth, outpacing its regional rival China. As per the IMF's World Economic Outlook from October 2023, India's economy is buoyant, with forecasts showing a robust growth of approximately 6.3% over the next half-decade, riding high on the central bank's revision for 2023/2024 to a stellar 7.3%. This trajectory positions India on the cusp of becoming the world's third-largest economy by 2030. In contrast, China's once-rapid economic expansion is showing signs of cooling, with real GDP growth dipping to 5.2% in 2023 and expected to fall below 4% from 2027, amidst population decline, property crises, and deflationary risks without significant economic stimuli. This diverging economic fortune, however, casts a spotlight on the uneven distribution of prosperity within India, where large corporations thrive on benefits and tax breaks, while smaller businesses and households grapple with rising bureaucratic hurdles and tax burdens financing such corporate incentives.

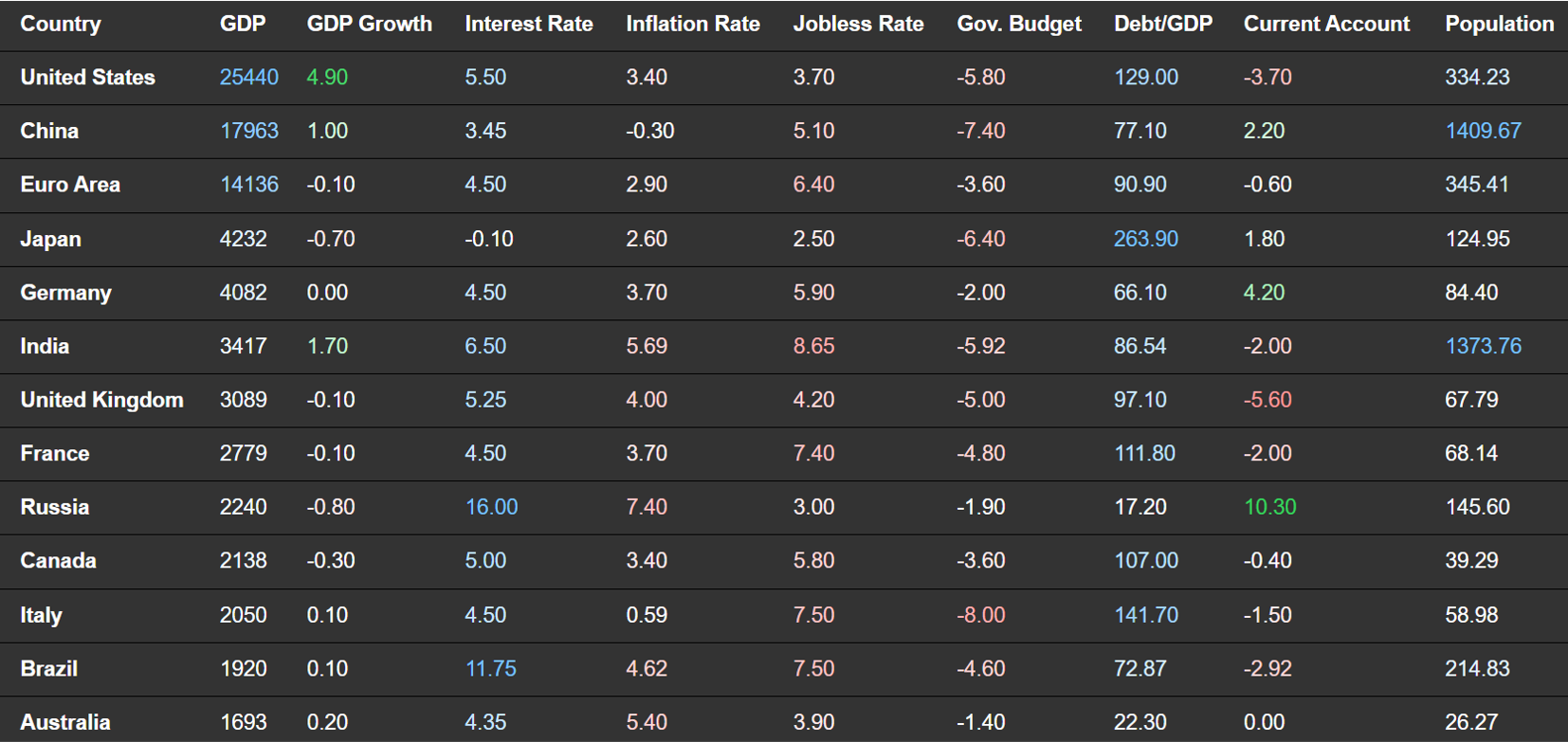

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie