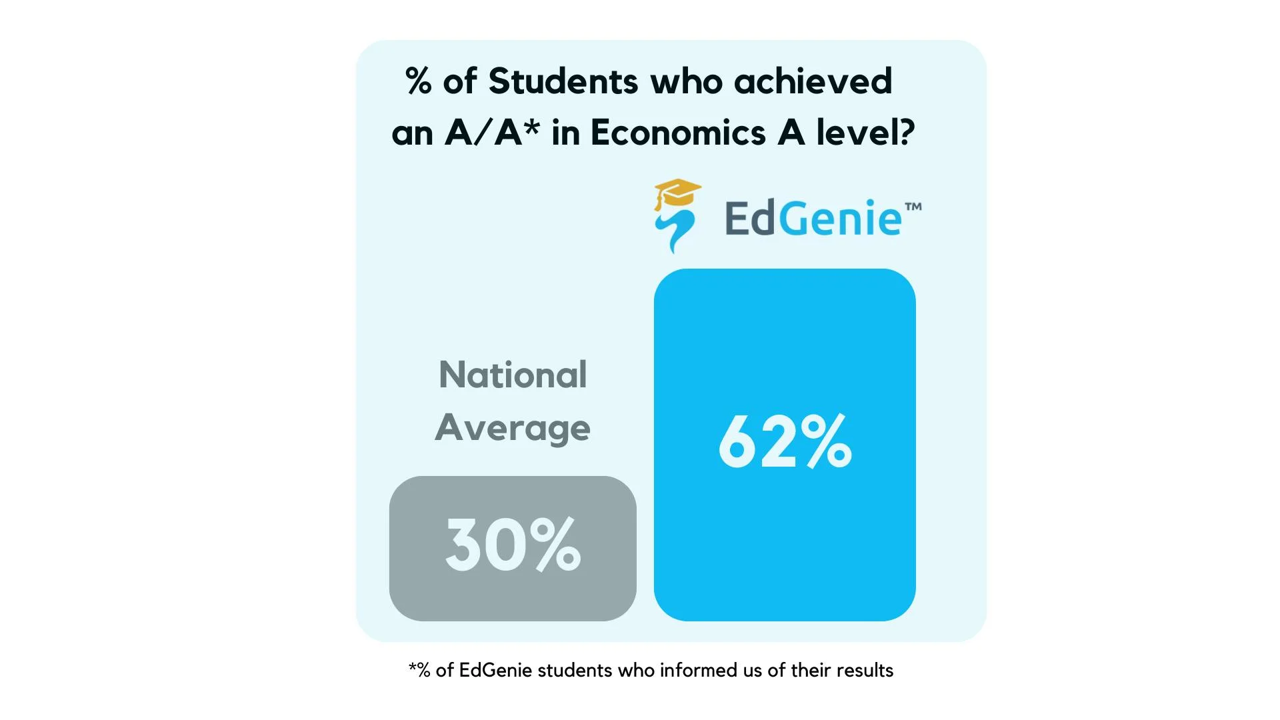

Home > Edgenie Sunday Schroll: Newsletter > Why 62% of Our Students Scored A or A* in A level Economics – Learn Their Secrets 👇

Jump to Section:

What A* Students Do Differently – And How You Can Too 💪

The low-tax countries wooing the world’s wealthy

Summary

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

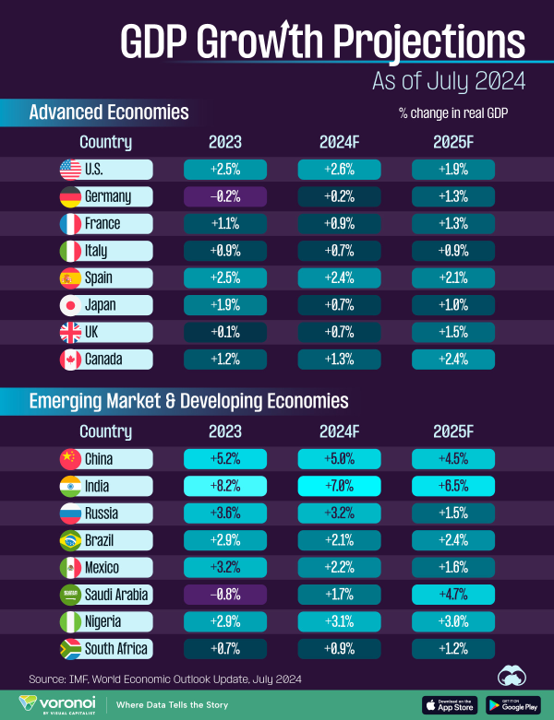

Infographic of the Week

Global GDP Growth Projections: Advanced and Emerging Economies Outlook

As of July 2024, the International Monetary Fund's (IMF) GDP growth projections reveal a varied landscape across advanced and emerging economies. The US is expected to remain one of the strongest performers among advanced economies, with growth peaking at 2.6% in 2024 before tapering to 1.9% in 2025. European economies like Germany and France are predicted to see modest recoveries, with growth improving slightly by 2025 after struggling in 2024. Emerging markets such as India and China continue to lead in growth, though China's economic expansion is anticipated to slow due to demographic challenges. Meanwhile, India's growth is projected to remain robust, driven by strong domestic consumption. In contrast, Russia and Saudi Arabia are expected to experience fluctuations, with Russia's growth decelerating significantly by 2025, while Saudi Arabia's economy is predicted to recover strongly by the same year. Overall, the global economic outlook indicates a period of cautious optimism with divergent growth trajectories across different regions.

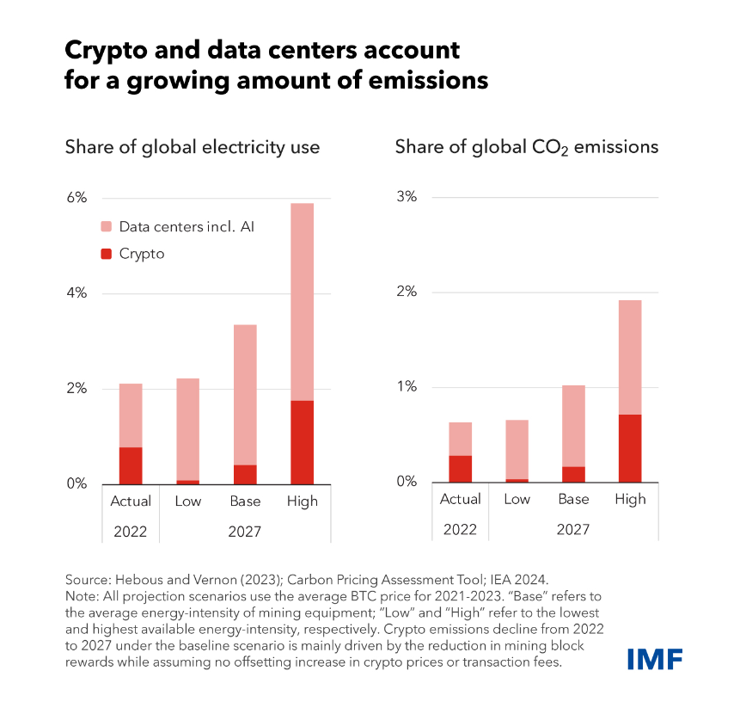

Chart of the Week

Rising Environmental Impact of Crypto and Data Centres

By 2027, the combined energy consumption and carbon emissions from data centres, including AI, and cryptocurrency mining are expected to significantly increase, contributing up to 6% of global electricity use and nearly 3% of global CO2 emissions under high projection scenarios. This trend highlights the growing environmental impact of digital infrastructure, driven by advancements in technology and the rising demand for data processing and cryptocurrencies. Despite a projected reduction in crypto emissions due to improved mining efficiency, the overall environmental footprint of these sectors remains a significant concern for global sustainability efforts.

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie