Home > Wednesday Wisdoms: Newsletter > Worst advice I've heard for A level Economics students 🤦

Jump to Section:

Worst advice I've heard for A level Economics students 🤦

Evidence on Consistency:

Implementing Consistency and making it easy: How?

Final Thoughts 💭

UK Income Tax: How Fiscal Drag Leads to People Falling Into Higher Rates

Summary:

A Level Economics Questions:

Possible A Level Economics 25 Marker Question

Infographic of the Week

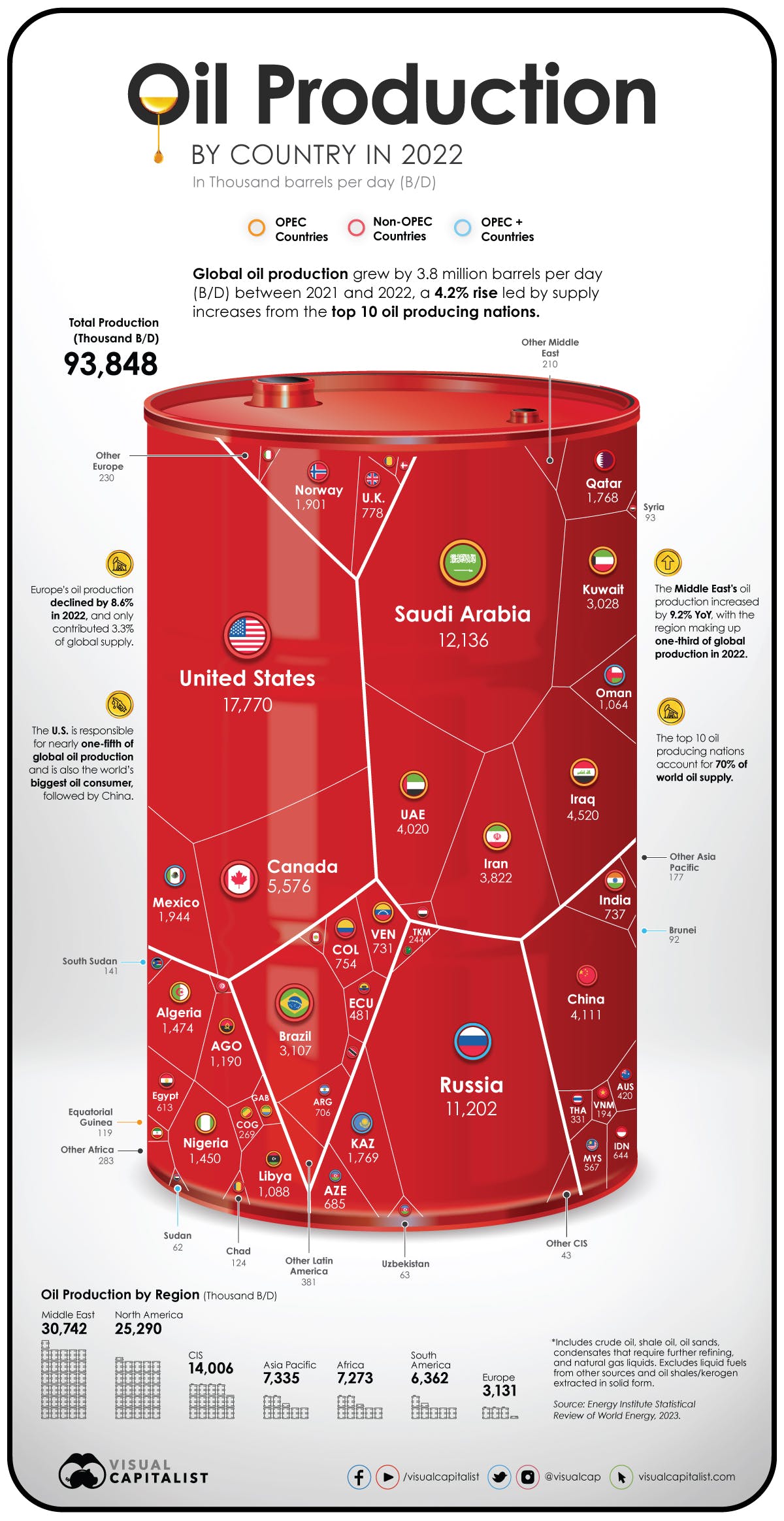

World's Top Oil Producers in 2022

In 2022, the U.S. led global oil production with nearly 18 million B/D, constituting 18.9% of the world's total. Following closely were Saudi Arabia, Russia, Canada, and Iraq. Together, the top five nations provided over half the world's oil supply. Overall, global oil output increased by 4.2% from 2021 to 2022. Regionally, the Middle East produced a third of the global total, while Europe's share declined significantly. Amid these shifts, efforts to transition to renewable energy sources continue, pushing major oil nations to diversify their economies.

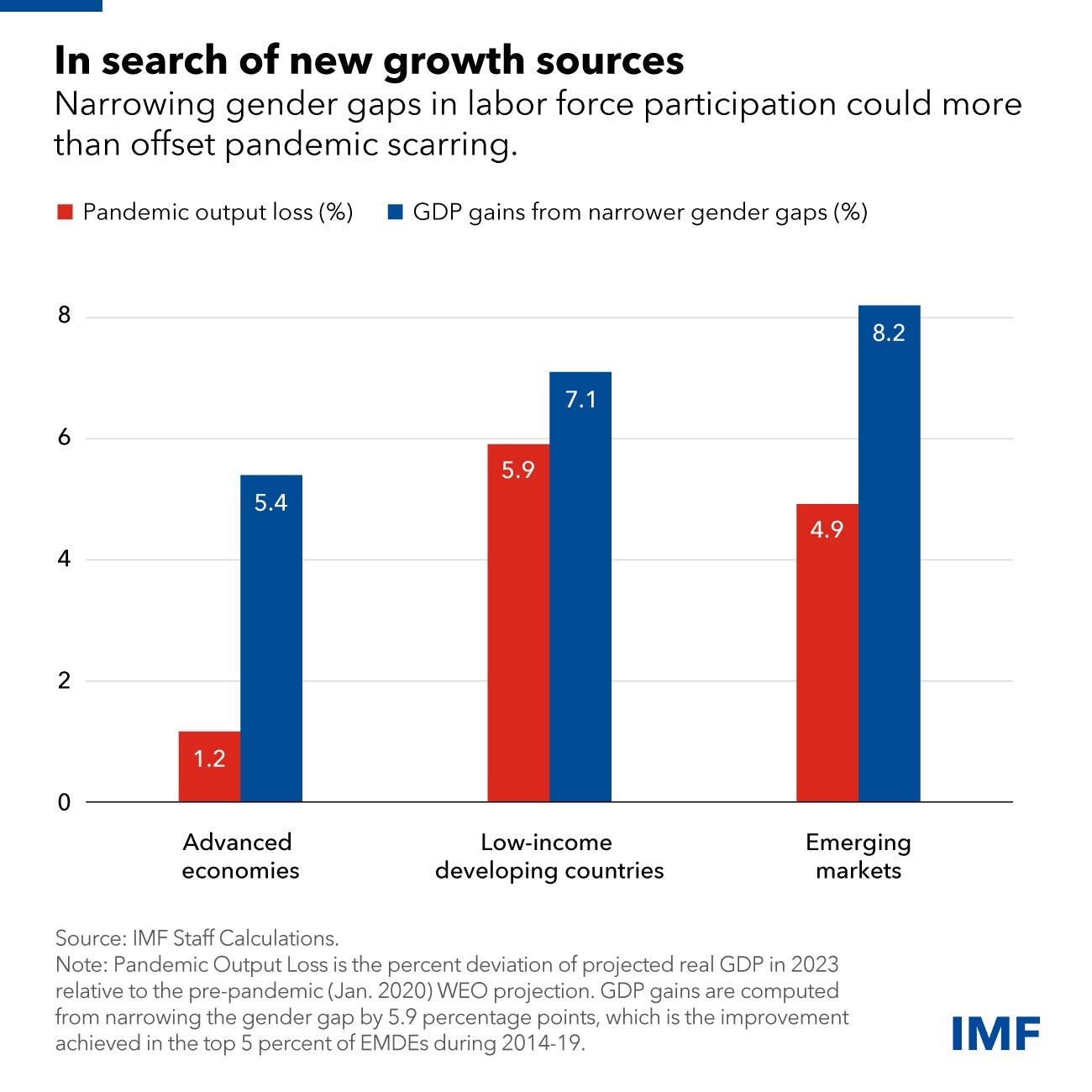

Chart of the Week

Economic Benefits of Closing Gender Gaps

Closing the gender gap in the workforce can provide a significant boost to global economies, especially during the weakest medium-term growth projections in over 30 years. Presently, only 47% of women are active in the labour market, compared to 72% of men. This disparity, caused by discriminatory laws, unequal service access, and biased attitudes, leads to substantial growth potential loss. Research indicates that emerging economies could increase GDP by about 8% in the coming years if female labour force participation rises by just 5.9 percentage points. Although there are many ways to stimulate growth, combining them with gender gap reduction measures can amplify returns significantly. Current policies, however, are insufficient, with the pandemic further exacerbating disparities. To genuinely advance gender equality, countries need to prioritize dismantling barriers hindering women's market participation and consider the impacts of macroeconomic policies on women.

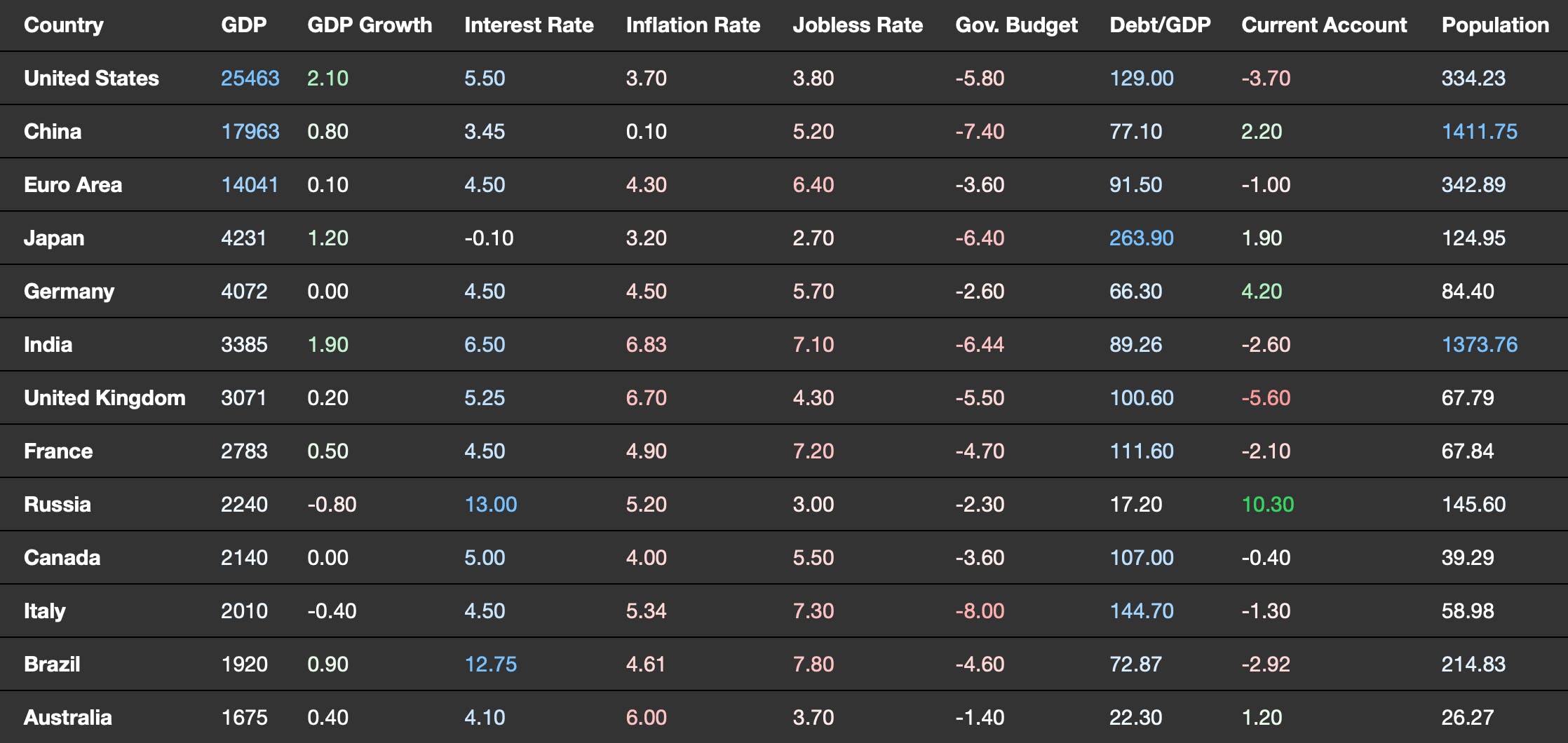

Macroeconomic Data

Whenever you're ready there is one way I can help you.

Emre Aksahin

Chief Learning Officer at Edgenie